Crypto traders have further reduced their expectations for Fed rate cuts this year following the release of the U.S. Q3 GDP and initial jobless claims data. Bitcoin also dropped following the release of this data, signaling that the U.S. economy is strong and strengthening the case for holding interest rates steady for now.

Fed Rate Cut Odds Fall After GDP and Jobless Claims Release

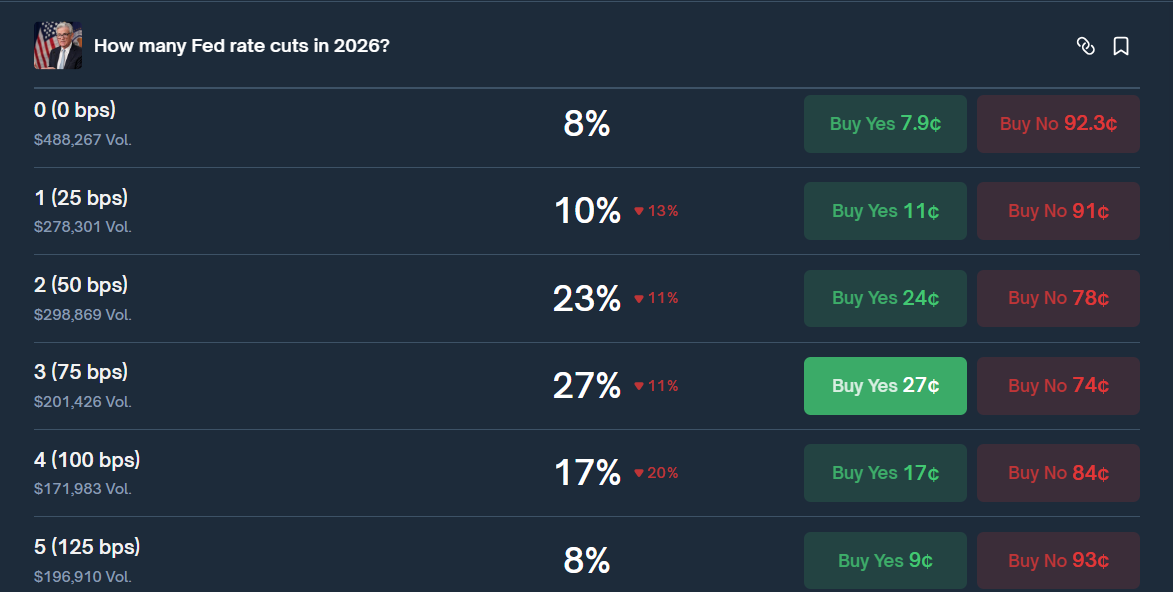

Polymarket data shows that the odds on rate cuts have fallen, with crypto traders reducing their bets on how many cuts the Fed is likely to make this year. The odds of three cuts this year now stand at 27%. There is a 23% chance of two cuts, 17% chance of four cuts, and 10% chance of just one 25 basis points (bps) cut.

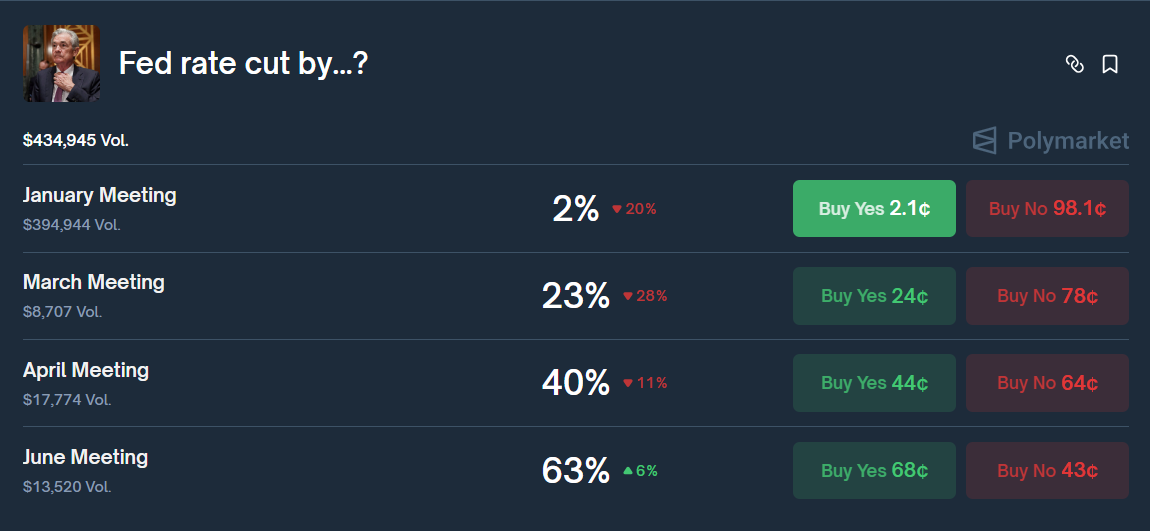

Meanwhile, crypto traders have reduced expectations of a Fed rate cut by the April FOMC meeting. There is only a 40% chance that the committee will lower rates by that meeting. These traders expect the first cut to come at the June FOMC meeting, with a 63% chance of a rate cut.

The drop in expectations of a rate cut comes amid the release of the U.S. GDP and jobless claims data. The Bureau of Economic Analysis (BEA) data shows that GDP increased at an annual rate of 4.4 percent in the third quarter of 2025, above expectations of 4.3 %.

Meanwhile, Department of Labor data shows that the initial jobless claims for the week ending January 17 was 200,000, which was below expectations of 209,000. The figure was up just 1,000 from last week’s jobless claims data of 199,000, which the agency revised from 198,000.

These macro data signal that the U.S. economy is strong, which puts the FOMC in a good position to hold off on further Fed rate cuts. Particularly, the jobless claims data signal that the labor market is rebounding, which was the reason the Fed cut rates three times last year.

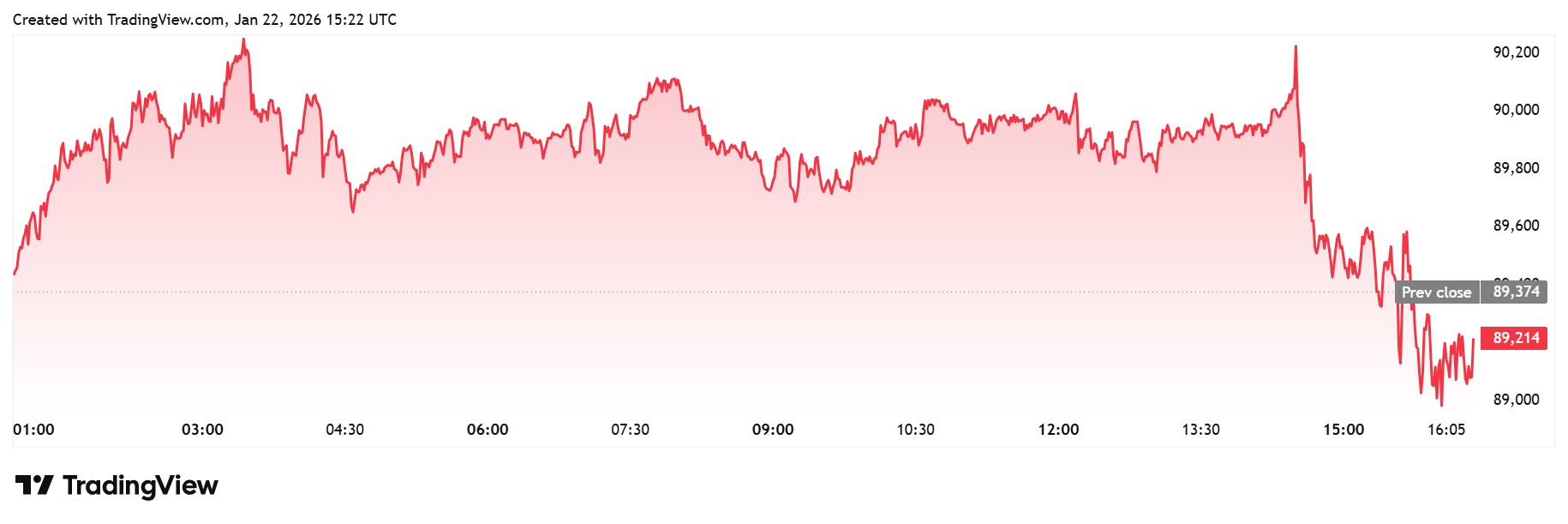

Bitcoin Drops From $90,000

Bitcoin notably dropped from the psychological $90,000 level following the release of the GDP and jobless claims data. The drop in the odds of Fed rate cuts is bearish for the crypto market, as these cuts are believed to inject more liquidity into risk assets.

It is also worth noting that the PCE inflation data, the Fed’s preferred inflation gauge, dropped today, coming in line with expectations. The November PCE and Core both came in at 2.8%, indicating that U.S. inflation remains elevated.

These macro data come just ahead of next week’s FOMC meeting, where the committee is likely to hold rates steady rather than make a fourth consecutive Fed rate cut. There is currently a 95% chance that they hold rates steady, according to CME FedWatch data. Meanwhile, there is only a 5% chance they lower rates by 25 bps.

Source: https://coingape.com/fed-rate-cut-odds-fall-following-strong-u-s-gdp-and-jobless-claims-data/