Privacy-focused narratives gained traction across crypto markets amid intensifying debates around artificial intelligence and data regulation. That shift brought Oasis Network into focus, pushing its token sharply higher.

By mid-January, traders increasingly rotated toward privacy infrastructure with tangible utility rather than speculative momentum.

That raised a key question.

Was ROSE’s rally driven only by narrative strength, or did structural demand support it?

Why did Oasis’ privacy narrative lift ROSE?

By the 20th of January, Oasis Network’s token, ROSE, had climbed more than 105% from mid-December lows. CoinMarketCap data showed rising interest in privacy technology amid tighter global data regulations.

Oasis Network’s confidential computing stack drew attention during that period. Its SemiLiquid staking design and AI-focused ROFL framework positioned the network as a privacy-first infrastructure layer.

That positioning helped reprice ROSE as an infrastructure asset rather than a short-term speculative play. Institutional participation appeared to outweigh retail-driven momentum during the move.

Rising Volume and Open Interest confirmed real bullish demand

According to data from CoinGlass, Oasis [ROSE] Open Interest climbed to $26.23 million, its highest level since September 2025. That increase coincided with price appreciation, indicating fresh long positioning rather than short-covering activity.

Source: CoinGlass

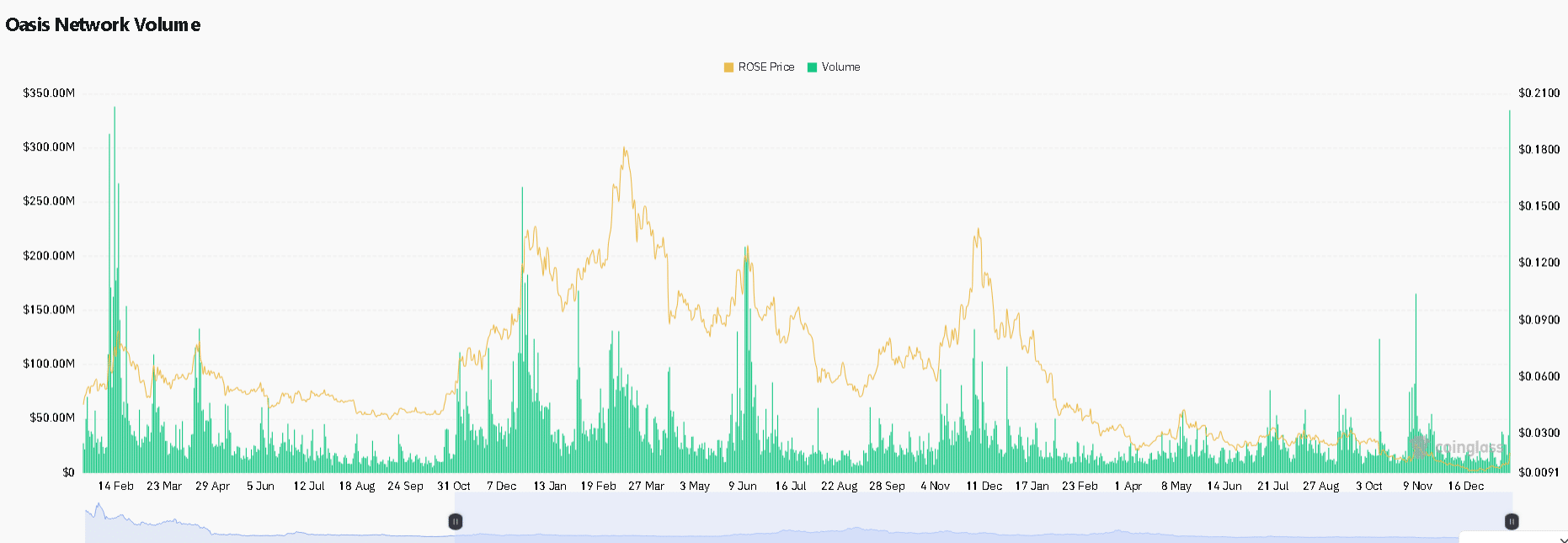

Meanwhile, trading volume surged on the 20th of January, reaching $334.6 million, the highest level since 2023. This drove positive price repricing, reinforcing that bulls, not bears, controlled market participation.

Source: CoinGlass

ROSE neared resistance as momentum tested

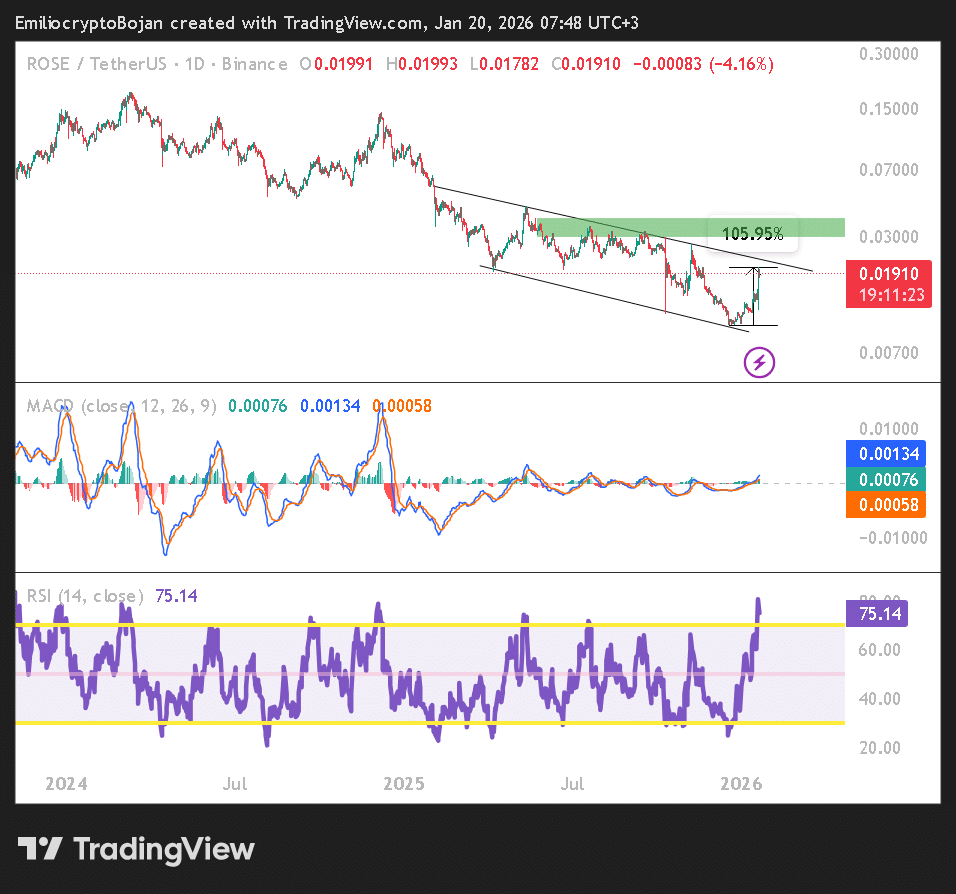

On the daily chart, ROSE’s rally approached the upper boundary of a descending channel pattern. Price tested descending resistance following a sharp rebound from recent lows.

Source: TradingView

A confirmed breakout could open the $0.030 to $0.039 supply zone. Acceptance within that region would be necessary for continuation.

Even so, downside risks remained. ROSE needed to hold the $0.015 support level, despite the MACD remaining bullish during the move.

Final Thoughts

- ROSE’s January surge reflected more than shifting narratives.

- Positioning data suggested traders treated Oasis as infrastructure, not a fleeting theme. Whether that conviction holds may depend on how the price reacts near the overhead supply.

Source: https://ambcrypto.com/oasis-network-rose-climbs-105-are-traders-rotating-toward-privacy-ai/