Key Takeaways

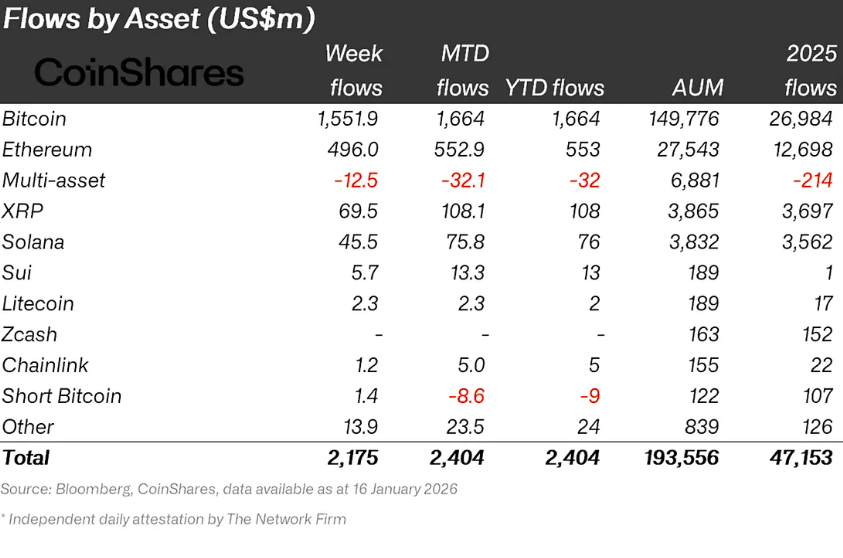

- Digital asset investment products saw almost $2.2 billion in inflows, marking the strongest week since October 2025.

- Bitcoin led with over $1.5 billion in inflows; Ethereum and Solana attracted $496 million and $45 million, respectively.

Investors poured approximately $2.2 billion into digital asset products last week, marking a peak in weekly inflows not seen since October 2025, according to CoinShares.

By assets, Bitcoin dominated with over $1.5 billion in new capital. Ethereum trailed with nearly half a billion dollars, while XRP rounded out the top performers with inflows topping $69 million.

Funds tied to Solana, Sui, Litecoin, and Chainlink also reported gains.

Geographically, the US drove over $2 billion of the total inflows, followed by Germany, Switzerland, Canada, and the Netherlands.

These gains coincided with Bitcoin’s climb to $97,500, its highest level since last November. However, geopolitical friction over Greenland and renewed threats of international tariffs have since weakened the market’s bullish outlook.

Analysts at CoinShares highlight a shift in investor confidence following signals that Kevin Hassett, a leading candidate for Fed Chair, will likely remain in his current role.

At the time of writing, Bitcoin is trading above $93,000, per CoinGecko. While this represents a slight recovery from yesterday’s slump to $91,910, the asset remains down approximately 2% over the last 24 hours.

Source: https://cryptobriefing.com/digital-asset-inflows-billion-record-week/