The altcoin market is gathering strength. This was most clearly visible in the first week of the year, when Bitcoin [BTC] rallied from $87.5k to $94.8k. During this period, Bitcoin’s Dominance fell from 59.58% to 58.7%. The altcoin market cap, excluding Ethereum [ETH], saw a hike of $82.56 billion or 9.97% too.

However, it is nowhere near altcoin season yet. In fact, according to CoinGlass data, the altcoin season index had a reading of 33 at press time.

Yes, the market sentiment is very much muted compared to the same time a year ago. This will affect capital flows into the industry. Even so, traders much preferred going long on altcoins, data revealed.

Source: Alphractal on X

In a post on X, analytics platform Alphractal warned that the long/short ratio of most altcoins was above 1 – Evidence of a crowded long trade.

The platform labeled XRP’s long/short ratio of 3.06 as “unusually high” to demonstrate that major cap assets were vulnerable to price volatility and long-side pressure.

The bullish case for altcoins

Source: TOTAL3 on TradingView

From a technical analysis perspective, TOTAL3 might be in a strong position in the long run. The weekly chart showed a steady uptrend in progress, unbroken since November 2023. Before the November breakout, a 1.5-year-long consolidation occurred.

The altcoin market (excluding Ethereum) looked likely to challenge the all-time high at $1.19 trillion over the next month or two. Experts believe that spot demand may be driving the current Bitcoin rally. If Bitcoin manages to reclaim $107.5k, it would likely dramatically alter the market-wide sentiment.

Traders and investors need to remain vigilant

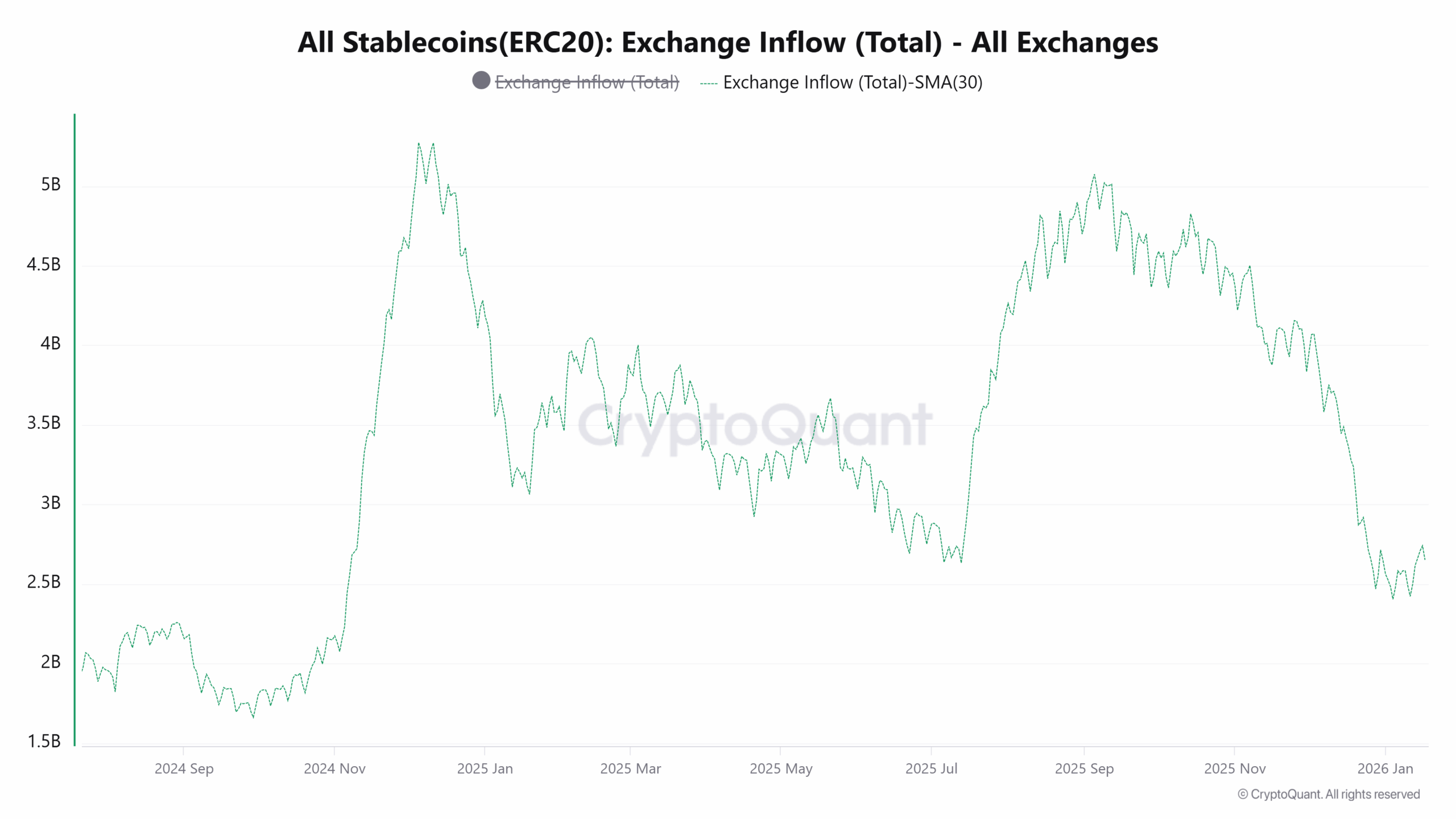

Source: CryptoQuant

A recent AMBCrypto report highlighted that stablecoin inflows to exchanges have dropped sharply since September. The 30-day moving average of stablecoin inflows to exchanges has not recovered to its August-September 2025 levels.

The falling stablecoin exchange reserves since November might be another worrisome trend. Together, the metrics warned of a lack of significant capital inflows to the market as a whole. Rather, it could be capital rotations within the market fueling certain coins’ rallies.

Final Thoughts

- Weekly structure of the altcoin market cap (TOTAL3) was in a great position, and the strong start to January could encourage buyers.

- Buyers should be wary of an altcoin price bounce amid a longer-term downtrend, driven by capital rotation within the market instead of an influx of fresh capital.

Source: https://ambcrypto.com/altcoin-season-odds-some-promise-but-look-out-for-these-volatility-risks/