Cardano (ADA) will be among the crypto assets offered by Germany’s second-largest bank, DZ Bank, after the latter secured regulatory approval to offer crypto trading services. The announcement has sparked bullish bets on ADA, with one analyst predicting the price could rise by 70% as overleveraged shorts likely trigger such gains.

Germany’s DZ Bank to Offer Cardano Trading

DZ Bank, one of the oldest banks in Germany with over 1.2 trillion euros in assets under management, recently disclosed that it has received approval from the country’s regulator, BaFin, to offer digital asset trading through a platform dubbed meinKrypto. The approval was in line with the Markets in Crypto-Assets (MiCA) framework.

Besides Cardano, the other assets available on this platform include Bitcoin, Ethereum, and Litecoin. Per the announcement, the platform will “allow individual institutions to offer their retail customers the opportunity to trade cryptocurrencies.”

The move is a major win for the crypto industry in Germany following a regulatory crackdown. As ZyCrypto reported, the third-largest stablecoin, Ethena-USDE, was kicked out of Germany last year for failing to meet MiCA requirements.

Analyst Eyes 70% ADA Price Rally

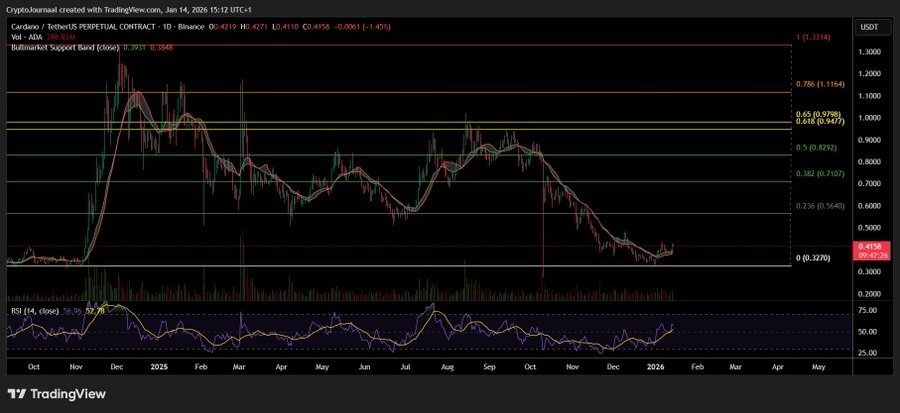

As institutional interest in Cardano begins to emerge, one analyst has stated that the ADA price may be set for an over 70% surge. He noted that for months, the price has been stuck in a corrective phase after failing to flip resistance in the second half of 2025. However, the price is now stabilizing and holding key support levels.

The analyst stated that if Cardano continues to hold the $0.36 support and moves above $0.45, it may trigger a short-term relief rally. If this rally continues, the price will likely target the $0.71 consolidation zone, where sellers are likely to re-enter. Such a move would result in 70% gains from the current price.

However, if the broader structure remains bearish and buyers fail to step in now, Cardano could drop to $0.32. Short sellers appear to be positioning for such a move, as on-chain data shows they have increased their positions.

According to TapTools, this short positioning could be bullish for ADA. This is because if the price were to rise to $0.46, $24 million short positions would be wiped out, creating fresh buying pressure.

At press time, ADA was trading at $0.39, down 3.69% over the past 24 hours.