Cosmos has continued with its remarkable uptrend since it broke out and retested the trendline days ago. In fact, ATOM jumped to a high of $2.65, a level last seen in November – Signaling renewed market optimism.

At the time of writing, Cosmos [ATOM] was trading at $2.64 – Up 8.2% on the daily charts and 19% on the weekly charts. The altcoin’s price uptick was backed by a 20% jump in volume and 8.2% in market cap, alluding to a hike in usage activity.

On-chain activity indicates a rising adoption rate

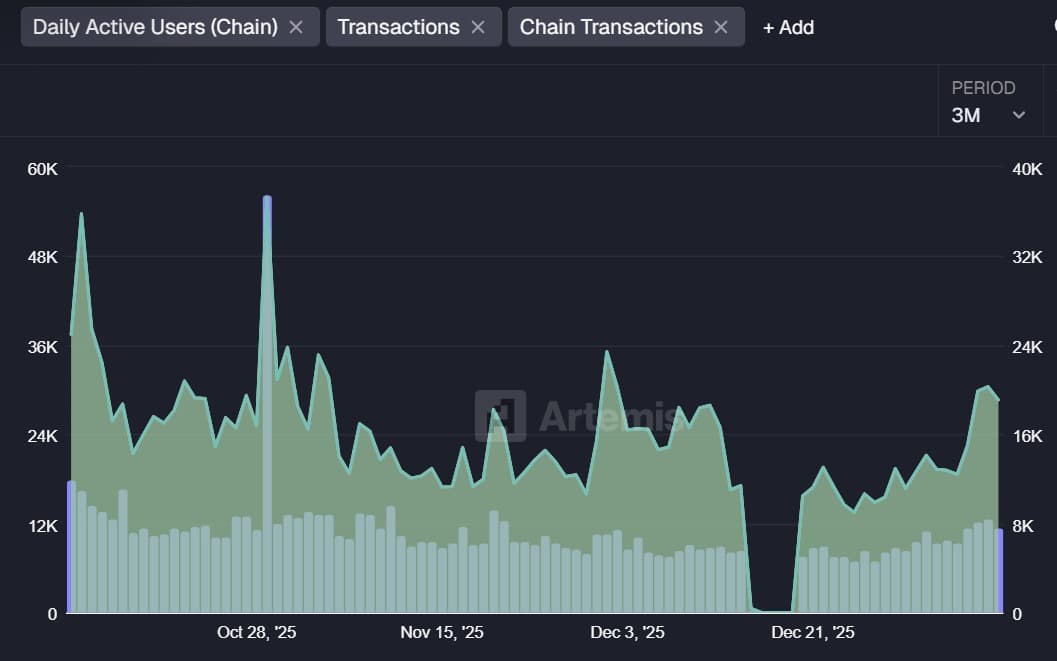

Cosmos saw a sharp drop in its network usage through the fourth quarter of 2025. In fact, network activity plummeted, with active addresses dropping from an average of 60k to below 1k.

However, as 2026 kicked in, Cosmos saw renewed demand, and the network usage rebounded. The number of active users increased from 4k to 8k, pushing the total addresses to 3.5 million.

Source: Artemis

Over the same period, the number of daily transactions rebounded from 13k to 30k, extending total transactions to 86.9 million.

Typically, when both transactions and addresses rise in tandem, it signals growing network adoption. The demand linked to such hikes is often organic. Not driven by a few large wallets reflecting strengthened fundamentals. In fact, such demand supports the token’s long-term value.

Demand for ATOM surges across market participants

As the market rebounded, buyers stepped in and defended higher levels across the Spot and Futures markets.

According to Coinalyze, buyers displaced sellers after six days of sustained selling pressure. Cosmos recorded 4.2 million in Buy Volume compared to 3.9 million in Sell Volume.

Source: Coinalyze

As a result, the altcoin recorded a positive Buy Sell Delta of 300k – A clear sign of aggressive spot accumulation. Historically, strong demand on the spot market has accelerated the price’s upward momentum due to rising scarcity.

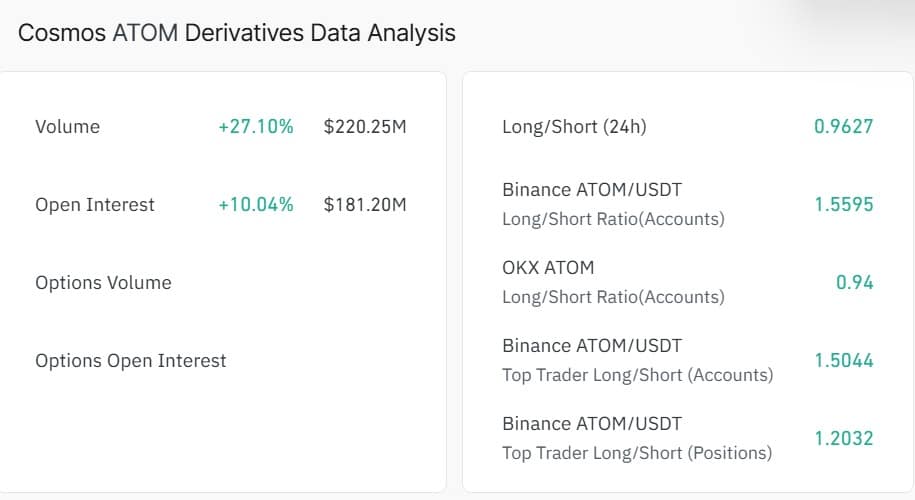

On the Futures side, ATOM’s Open Interest climbed by 10% to $183 million while derivatives volume jumped by 27% to $220 million.

Source: Coinglass

Often, a rise in derivatives volume alongside OI means greater participation with higher capital flows. In fact, Futures inflows surged to $53.09 million while outflows fell to $49.04 million too.

As a result, Futures netflows surged by 475.9% to $4.05 million – Indicative of strong demand for Futures positions, whether short or long.

Source: Coinglass

In this case, most participants took short positions as the Long/Short Ratio remained below 1 and hinted at bearish expectations.

Can ATOM’s momentum hold?

The altcoin recorded sustained gains on the price charts as buyers stepped in with strength across the Spot and Futures markets, backed by strong fundamentals. In doing so, they bolstered the tokens’ momentum and ATOM flipped short-term moving averages, EMA 2o and 50.

At the same time, ATOM’s Relative Strength Index (RSI) surged to 70, indicating total buyer dominance in the market. Such market conditions are evidence of its trend strength and its likelihood to continue.

Source: Tradingview

Therefore, if demand across the market holds, ATOM could successfully test EMA 100 at $2.7 and target its long-term resistance at $3.3.

However, if the momentum fades, ATOM will retrace to $2.2.

Final Thoughts

- ATOM surged by 8% and hit a two-month high of $2.65, before retracing on the price charts.

- Network usage rebounded, driving demand for ATOM across the Spot and Futures markets.

Source: https://ambcrypto.com/after-atoms-2-month-high-is-3-3-next-for-the-altcoins-price/