2025 will likely be remembered as the year crypto derivatives lost their sense of invincibility. What had long been viewed as one of the most efficient and reliable corners of crypto trading suddenly revealed deep structural weaknesses.

For traders and exchanges alike, the past year was less about chasing upside and more about surviving failures hidden deep inside market mechanics.

Key Takeaways

- The October ADL crisis exposed structural fragility inside exchange risk engines and permanently changed market maker behavior.

- Funding rate arbitrage became overcrowded, compressing yields and ending the era of passive crypto income.

- Trust emerged as a critical differentiator, with fair matching engines gaining ground as predatory models lost credibility.

According to a recent BitMEX report, the shift was not driven by macro panic or regulatory shock. Instead, it came from within. Liquidity engines, funding mechanisms, and exchange incentives all came under stress at the same time, exposing which platforms were built to endure volatility and which relied on fragile assumptions.

The October Liquidity Shock That Changed Everything

The defining moment arrived during the 10–11 October crash. While prices fell sharply, the real damage occurred behind the scenes. Auto Deleveraging systems, designed to protect exchanges from insolvency, began interacting with each other in destructive feedback loops.

Instead of liquidating overleveraged retail traders, these systems turned on professional market makers. Delta-neutral strategies that had worked reliably for years suddenly failed. When short perpetual hedges were forcibly closed, market makers were left with unhedged spot exposure in a falling market.

The result was a historic liquidation cascade estimated near $20 billion. Liquidity providers responded by pulling capital, and order books across major venues thinned to levels not seen since 2022. From that point forward, liquidity became selective rather than abundant.

This event marked a structural turning point. Market makers no longer assumed neutrality was safe, and exchanges could no longer assume liquidity would always return.

Funding Rates: From Easy Yield to Crowded Trade

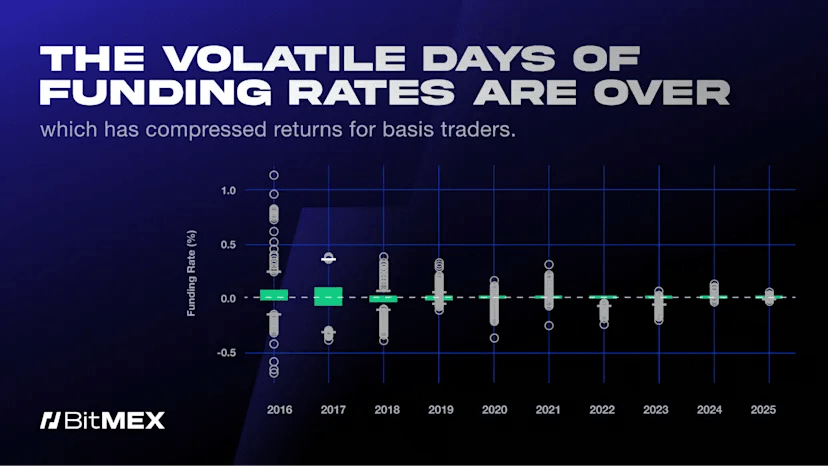

For years, funding rate arbitrage had been treated as crypto’s closest equivalent to risk-free yield. That perception finally broke in 2025.

As more exchanges integrated automated delta-neutral products, the trade became crowded. Every new synthetic dollar entering the system created an automatic perpetual short, overwhelming natural long demand. Funding rates compressed steadily, eventually falling below levels that justified the complexity and risk.

By mid-year, yields from funding arbitrage were hovering around low single digits, often trailing traditional fixed-income alternatives. The strategy did not fail spectacularly – it simply stopped being worth the effort.

This was not a temporary distortion. It reflected a market that had matured, where inefficiencies were quickly absorbed and monetized away.

A Growing Divide Between Fair and Predatory Exchanges

As volatility increased and profits became harder to extract, exchange behavior started to matter more than ever. 2025 drew a clear line between neutral matching engines and platforms operating internal B-Book models.

Several exchanges faced backlash after invoking vague “abnormal trading” clauses to void profitable trades. In practice, this revealed that some platforms were taking the opposite side of user positions and refusing to honor losses.

Incidents involving thinly traded perpetual listings further damaged trust. Coordinated squeezes in low-liquidity markets exposed how easily internal order flow could be exploited when transparency and safeguards were lacking.

In contrast, exchanges operating peer-to-peer models, including BitMEX, benefited from renewed focus on execution fairness rather than headline volume.

Perp DEXs Grow, but New Risks Emerge

Decentralized perpetual exchanges gained momentum in 2025 as traders searched for alternatives. Platforms like Hyperliquid attracted significant volume, especially during periods of centralized exchange stress.

However, decentralization introduced new vulnerabilities. On-chain transparency made it easier for attackers to map liquidation levels. In pre-token markets without robust oracle aggregation, price manipulation became an effective weapon rather than a theoretical risk.

High-profile disputes, including profit reversals on platforms such as Paradex, highlighted another issue – accountability. When pricing errors occurred, users often had little recourse beyond public outrage.

The lesson of 2025 was clear. Transparency alone does not guarantee fairness, and decentralization does not eliminate platform risk.

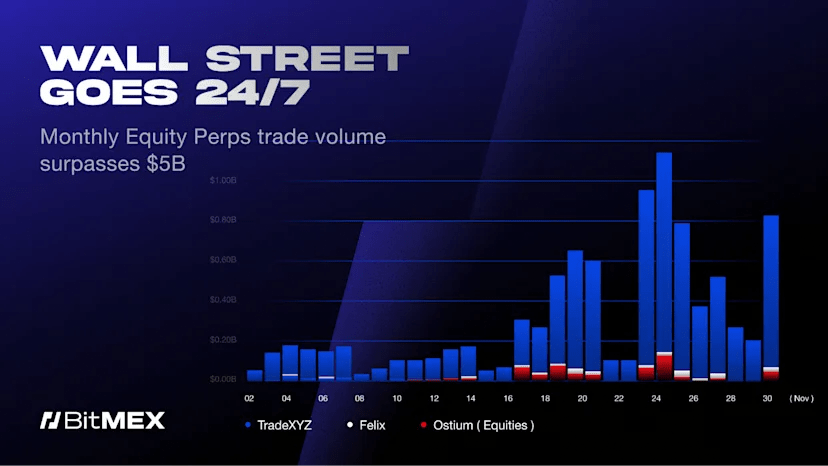

Equity Perps and the Rise of 24/7 TradFi Trading

As traditional crypto strategies weakened, traders gravitated toward new products. One of the strongest trends was the growth of equity-linked perpetuals.

Demand surged for leveraged exposure to stocks like Nvidia and Tesla outside traditional market hours. Crypto derivatives infrastructure proved uniquely suited for this role, offering continuous access and flexible collateral.

At the same time, funding rates themselves became tradeable instruments. Instead of farming yield, traders began speculating on funding volatility, treating it as a market signal rather than a passive income stream.

These innovations did not simplify trading. They raised the bar, favoring active strategies and deeper risk management over automation.

What 2025 Revealed About the Future of Derivatives

The events of 2025 forced the crypto derivatives market to confront its own assumptions. Liquidity is not guaranteed. Neutral strategies are not immune. Transparency without safeguards can be weaponized.

What emerged instead was a more grounded market. One where infrastructure quality, incentive alignment, and execution integrity matter more than novelty or yield promises. The era of easy money faded, but in its place came more resilient models and clearer standards.

The next cycle will not reward passivity. It will reward traders and platforms that understand how the system breaks – and design for that reality.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

Source: https://coindoo.com/how-2025-exposed-the-hidden-risks-of-crypto-perpetuals/