The bi-weekly TD Sequential just printed a macro buy signal, a development that often appears near medium-term inflection points.

This signal emerged after XRP endured months of lower highs and persistent selling pressure. Importantly, the price already slowed its descent before the count completed. Momentum stopped accelerating lower, and volatility began compressing. Such a shift may be a sign that sellers have lost urgency.

Moreover, higher-timeframe signals filter short-term noise, which strengthens their relevance.

However, the TD buy does not act as a standalone trigger. Instead, it frames market conditions. It seemed to suggest that downside momentum may have peaked.

In such a case, risk often begins shifting asymmetrically. Upside reactions now require less force than before, provided other confirmations follow.

Descending triangle break reshapes XRP’s structure

XRP’s price recently broke out of a descending triangle after defending the $1.80–$1.85 demand zone multiple times.

Each dip into that area attracted buyers quickly, limiting downside continuation. That behavior reflected absorption rather than panic.

As the price compressed towards the apex, pressure built naturally. Eventually, buyers forced a breakout. This move shifts focus towards $2.20 – A key reaction level where sellers previously controlled the price.

Acceptance above that zone would expose $2.60–$2.67, a former range support that now acts as resistance. Above that area, the $3-level stands as the next major upside objective.

However, failure to hold above $1.80 would weaken the breakout narrative and reopen downside risk.

Source: TradingView

ETF inflows reveal steady institutional accumulation

At the time of writing, ETF data revealed that clients added $5.58 million worth of XRP in a single session, pushing total ETF-held assets to $1.24 billion. This accumulation occurred while pthe rice hovered near $1.80–$1.90, not during a breakout.

That timing matters. Institutions typically scale exposure during consolidation, not momentum expansion. As a result, these inflows may be a sign of strategic positioning rather than reactive buying.

Moreover, ETF accumulation removes circulating supply without demanding immediate upside. That dynamic supports price stability first, expansion later.

Additionally, these flows align with the macro TD buy signal, rather than contradict it. In its own way, institutional behavior may be reinforcing the idea that downside conviction is fading.

Source: X

Spot outflows confirm supply absorption phase

Spot exchange data has seen persistent net outflows, including a recent -$7.82 million reading as XRP traded near $1.87. This trend could allude to reduced willingness to sell at press time levels.

Traders often withdraw assets when they expect lower downside risk. While outflows alone do not drive rallies, they tighten available supply. Combined with the structural support, such a dynamic shifts balance.

Sellers are now facing thinner liquidity, something that increases price sensitivity to demand. Moreover, outflows persisted even after the triangle breakout, reinforcing confidence rather than caution.

Consequently, any sustained bid pressure could move the price more efficiently. In doing so, the market would absorb supply, rather than distribute it.

Source: CoinGlass

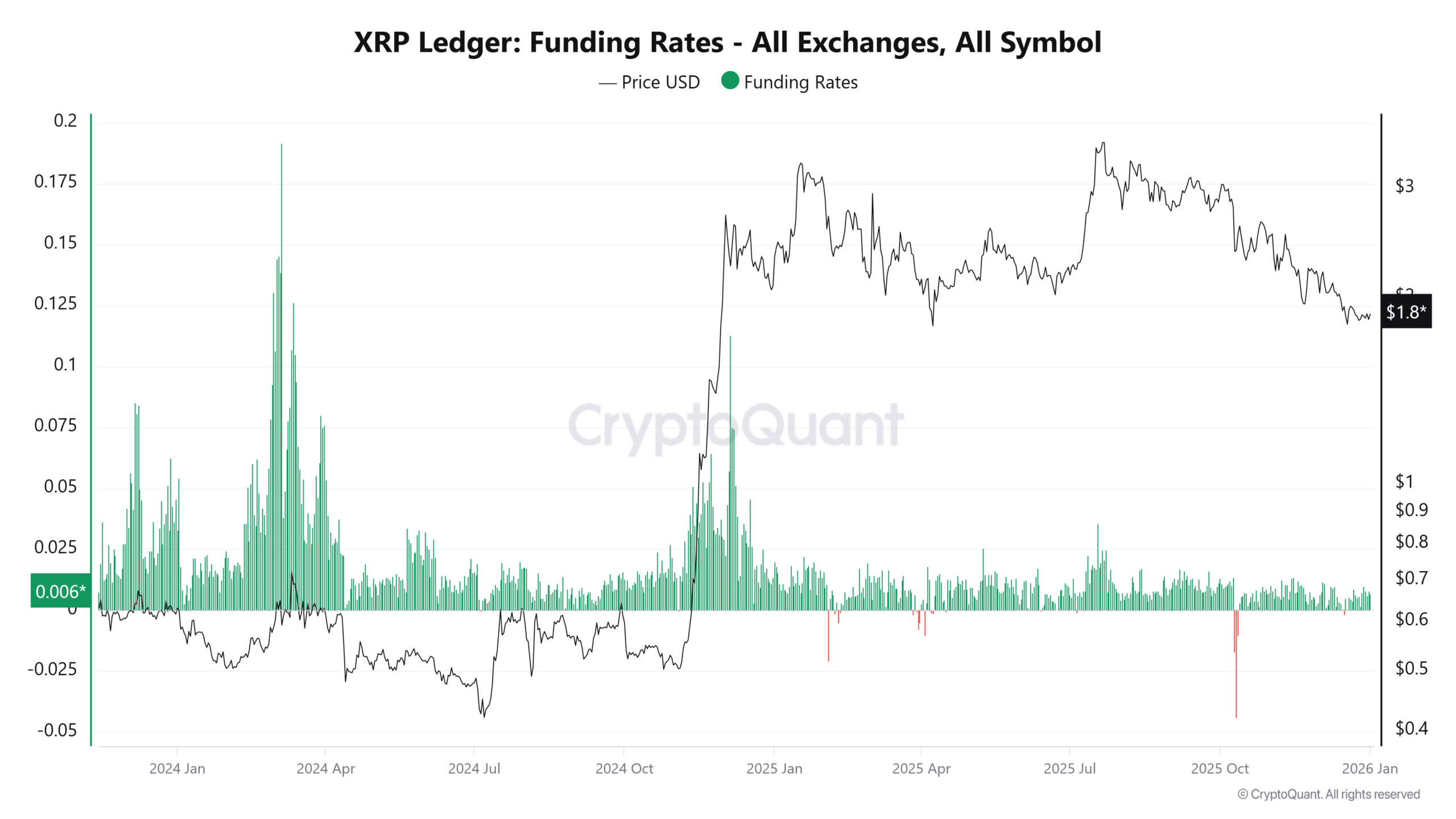

Rising funding rates signal growing conviction

At press time, funding rates remained elevated too, with the latest reading reaching 0.006 – Eepresenting a 94.58% hike. Traders are now paying to maintain long exposure, which is evidence of confidence. However, context remains critical.

Funding rates rose while the price consolidated near $1.85–$1.90, not during an impulsive rally. That divergence suggests positioning, rather than euphoria.

Additionally, leverage entered after the structure improved, not during a breakdown. Such a sequencing ordinarily reduces immediate fragility.

Still, elevated funding introduces risk. If the price fails to hold above the breakout zone, leverage could unwind quickly. For now though, conviction is building carefully, supported by structure and flows.

Source: CryptoQuant

Is XRP preparing for a broader recovery?

XRP is now trading at a point where technical structure, institutional flows, and derivatives positioning converge meaningfully. The macro TD buy framed the shift, the triangle breakout confirmed it, and capital flows are now supporting it.

While short-term volatility remains likely, evidence favors accumulation over distribution. If price maintains acceptance above the former triangle and holds $1.80, momentum could expand towards higher resistance zones.

However, this setup does not guarantee immediate upside. Instead, it means XRP may have completed its bottoming process and entered a phase where sustained recovery will be increasingly viable.

Final Thoughts

Structural breakout, ETF inflows, and spot outflows suggest XRP has entered an accumulation phase.

Sustained acceptance above key support could allow momentum to expand toward higher resistance zones.

Source: https://ambcrypto.com/is-xrps-price-done-bottoming-out-a-look-at-these-metrics-suggest/