As the 2025 year closes, the crypto market enters January 2026 with fresh momentum and cautious optimism.

The global crypto market rose 0.79% in the last 24 hours, recovering slightly from recent oversold conditions. Bitcoin is holding above $87,000, while Ethereum has stabilized over $2,900.

Nevertheless, wider crypto markets are still under strain, and ill liquidity and divided sentiment are hitting altcoins.

January 2026 would be the most significant price catalyst with macroeconomic risks and the regulatory decision on the cards.

These are the best crypto-related events to consider in this month that can shape the direction of the market.

Government Shutdown Risk Grows Before January 31 Deadline

Congress went on vacation over the Christmas holidays with no complete budget or even a vote schedule. =

That lack of action has brought the U.S. government within a stone’s throw of a possible shutdown with only weeks to go before the January deadline of 31.

Despite the consensus reached among the Senate and House negotiators on the amount of money to be spent, Congressmen still cannot agree on the distribution of the funds. Democrats profess they are willing to continue on the new constraints.

In the meantime, Republican fiscal conservatives insist that agency budgets must stay constant and reject bills to increase spending.

Failure to reach an agreement would affect the federal agencies and postpone the functioning, and also create a state of uncertainty in the market.

This might influence regulatory activities of crypto markets, which is why this is one of the most pressing crypto developments to observe in early 2026.

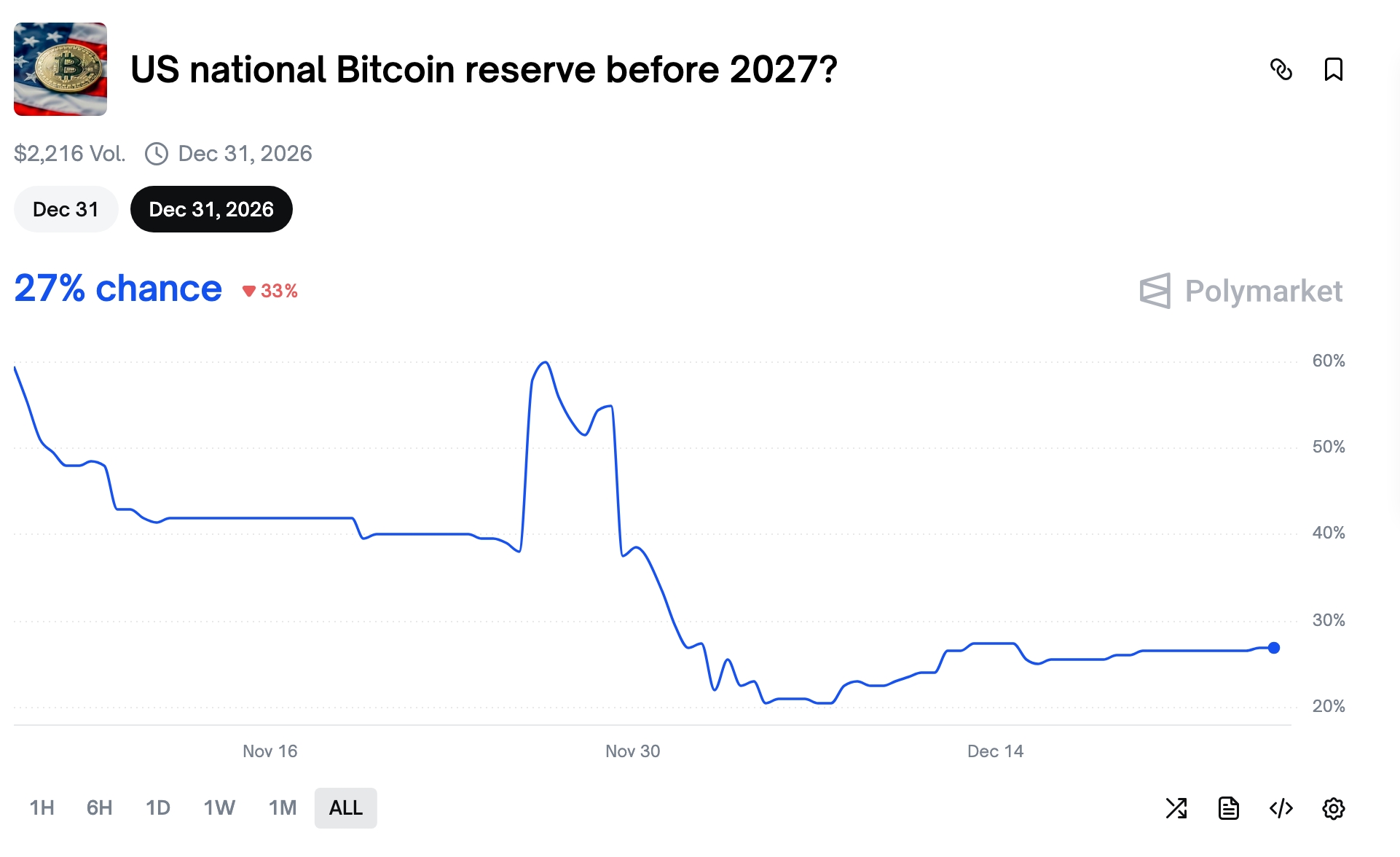

Crypto Event To Watch: Crypto Reserve

House passed Digital Asset Market Clarity Act of 2025 (CLARITY Act) now awaits Senate action. This bill will codify the definition of digital commodities, waive SEC regulation on some established blockchains, and establish new compliance rules on crypto exchanges and brokers.

Another significant crypto event that can be observed is the CLARITY Act, specifically to Bitcoin, Ethereum, Solana, and XRP, which are already accepted in ETFs. Provided that it passes in January, the legislation may enhance regulatory predictability and bring in additional institutional capital.

Meanwhile, there exists a political discussion on a U.S. crypto reserve. However, though former President Trump is in favor of the plan, there are still divisions in Congress. A Polymarket prediction indicates that there is only a 27% probability of the U.S. having a reserve of Bitcoin before 2027.

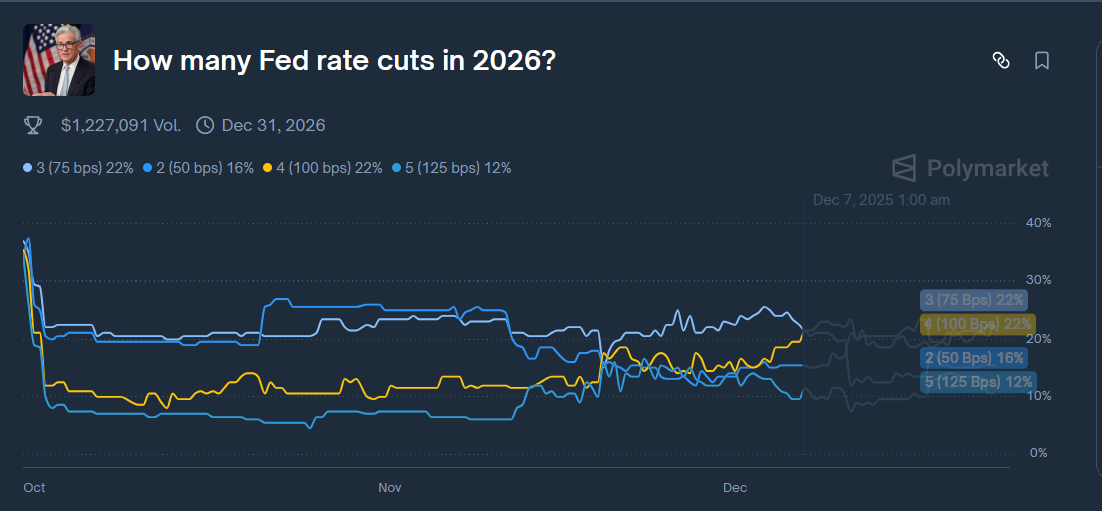

Fed Rate Cut Bets

The likelihood of a rate cut during the January Federal Reserve meeting has dropped sharply. CME FedWatch indicates that there is only a 13.3% probability of a 25 basis point cut, which stands lower than before. There is an 86% probability that the Fed will leave rates unchanged.

This reversal is after the publication of better-than-forecasted Q3 GDP data and significant prior cuts in rates in 2025.

The officials of the Fed, such as New York Fed President John Williams, have already indicated that they are cautious moving toward 2026.

The decrease in odds of a rate cut may put a strain on Bitcoin and other cryptos, which have been increasing following every cut.

As the liquidity tightens once more, it is one of the most important crypto events to follow as traders change their strategies with regard to interest rate predictions.

To sum up, with a looming government shutdown to landmark U.S. crypto laws, and Fed policy resolutions, January 2026 is starting with high-takes events. All these crypto events to observe might trigger new volatility or make the future market directions.

Source: https://coingape.com/trending/top-3-important-crypto-events-to-watch-in-january-2026/