Bitcoin may be lining up for a powerful rebound, as Fundstrat’s Tom Lee believes a new all-time high could arrive as soon as January. Bitcoin may be on the path to an impressive recovery.

Fundstrat co-founder Tom Lee sees the leading cryptocurrency hitting an all-time high set as early as January 2026. This optimistic view follows strong possibilities that Kevin Hassett is the likeliest candidate to replace Jerome Powell as Federal Reserve Chair.

Bitcoin Could Still Reach New Highs Soon Says Tom Lee

During a CNBC interview, Lee shared his opinion in regards to the current drop in Bitcoin price amid worries that the current bull run might be over already. He differed on this and replied that the overall cycle remains bullish.

Lee stated that the fall around the end of last month was due to concerns related to the tightening of global market policies. He added that the hawkish tone suggested by the Bank of Japan added more downward pressure to the financial markets, which includes crypto market.

In addition, experts such as Peter Brandt have cautioned that the Bitcoin may fall further to $58,000 as long as the pressure causing the drop continues to rise. However, Lee emphasized that these actions do not change the BTC position in the long run.

The Fundstrat co-founder believes Bitcoin is still on track for a record-breaking start to the new year. Lee admitted that reaching a new high in December is unlikely now, but he argued that January remains a realistic target. He said Bitcoin could move above $100,000 before the year ends. Then, challenge the October peak near $125,000 soon after.

Policy Shifts Create New Bitcoin Recovery Path

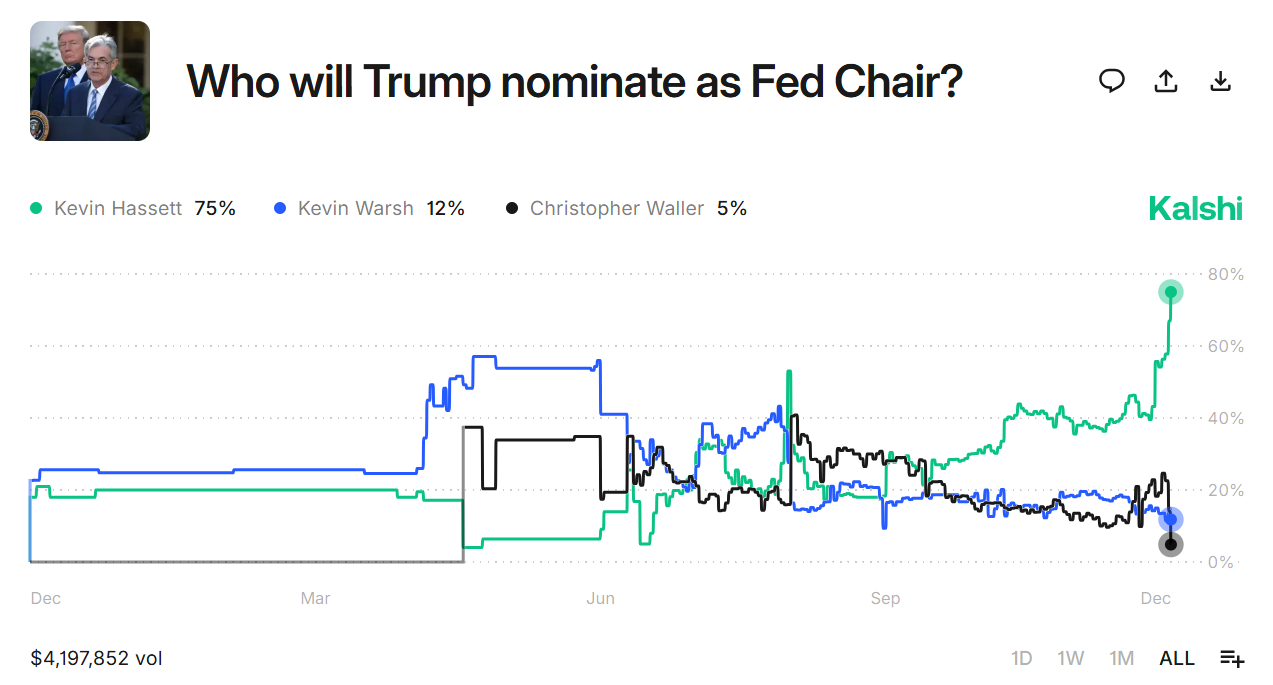

The political backdrop adds a new layer to the story. According to new odds from Kalshi, Kevin Hassett is in a strong lead to become the next Fed Chair. Hassett has indicated readiness to assume the position, which strengthens the prospects of his nomination.

A Hassett appointment is a sign that there would be friendlier crypto policies that would support the growth of the industry. A change towards quicker pace in rate cuts and decreased financial conditions would soften the dollar and boost interest in risk assets.

That outlook is especially important for Bitcoin because its valuation reacts quickly to changes in interest rate expectations. A sharp crypto market downturn erased gains driven by earlier optimism over Fed rate cuts.

This shows how sensitive Bitcoin remains to policy shifts. An increased willingness by the Fed to cut rates would make early 2026 far more optimistic for crypto.

Fed–BOJ Pattern Signals Possible Bitcoin Bottom

A new layer of analysis now comes from Benjamin Cowen. He pointed to a trend associated with policies from the Federal Reserve and the Bank of Japan.

According to Cowen, in July 2024, BTC price dropped significantly as the Fed reduced rates while the BOJ increased theirs. Then, one week later Bitcoin bottomed.

He indicated that the same pattern is set to reoccur on December 10 if the Fed reduce rates once more while the BOJ might increase rates. He predicted that Bitcoin would hit a new low around mid-December and then rise in January, repeating the same pattern of 2024.

Source: https://coingape.com/tom-lee-says-bitcoin-could-hit-new-ath-in-january/