- Bitcoin’s cost basis cluster forms in the low $80,000 range.

- Market support bolstered by recent buyer activity.

- Analytics signal dense price zone as potential floor.

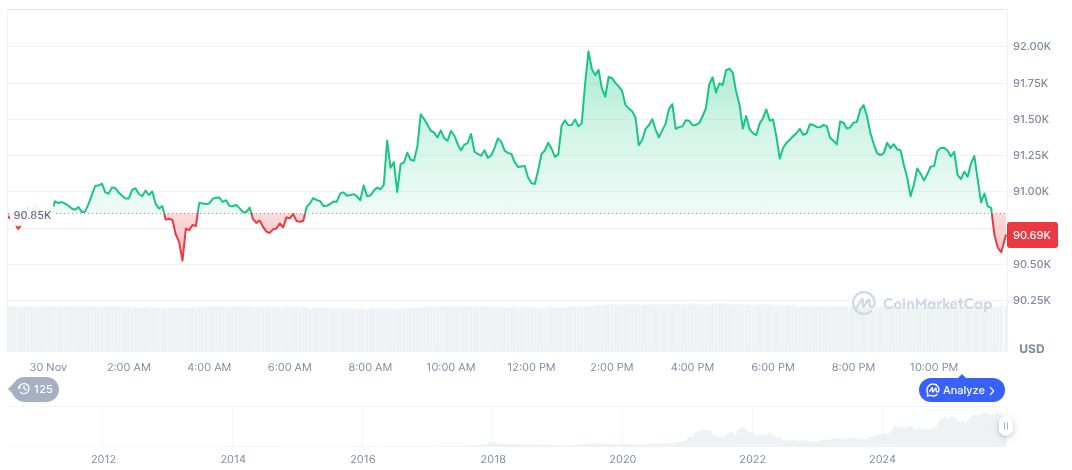

On December 1, 2025, Glassnode reported a new Bitcoin cost-basis cluster in the low $80,000 range, highlighting significant buying and potential price support for BTC.

This development suggests increased investor confidence and could stabilize BTC’s price amid recent volatility, with traders closely monitoring its impact on market strategies.

Bitcoin Locates Strong Support at Low $80,000 Range

A new Bitcoin cost-basis cluster has appeared in the low $80,000 range, as noted by Glassnode’s Cost Basis Distribution Heatmap Analysis. Recent accumulation at this price level is evidenced by the high density on the heat map, indicating strong buyer interest and suggesting this area could act as a substantial support zone. Analysts believe this structure might be actively defended by recent buyers.

Market activities are changing due to this development, as investors consolidate positions at the $80,000 mark. A similar financial pattern has been observed historically, with new buying momentum strengthening potential support levels at critical price points. The On-Chain Insights: Weekly Update – Week 47, 2025 report from Glassnode further discusses the implications of such formations in market stabilization.

Market reactions to this news reveal confidence in current pricing, as demonstrated by institutions and individual traders actively supporting this price level. Major stakeholders, like Binance, have acknowledged these signals and reflected this analysis in their commentary, aligning with the overarching sentiment in the trading community.

Insights on Historical Patterns and Current Market Data

Did you know? Historically, Bitcoin’s price floors established around peak clusters have served as launching pads for notable rebounds, often observed during previous bull cycles where accumulation zones fortified support levels at key times.

Bitcoin (BTC) currently trades at $86,707.88 with a market cap of approximately 1730361175338 billion USD, indicating substantial market dominance at 58.72%. The 24-hour trading volume stood at 63366038410 billion USD, reflecting a 67.88% change over the same period. CoinMarketCap data notes a 5.01% decrease in the 24-hour price change, with a 7-day change of 0.97% and a 30-day decline of 21.06%.

Experts from Coincu suggest that the price defense at the $80,000 level could act as a stabilizing factor amid market uncertainties. Such cost anchoring has been highlighted in historical analytics, where buying at key clusters aided in bolstering market floors. Bitcoin Market Trends by Matrixport provides valuable insights into these broader crypto-market movements.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/bitcoin-support-cost-basis-cluster/