- Fed to reduce interest rates post-December, impacting crypto positively.

- Markets react bullishly with anticipated rate cuts in 2026.

- Risk assets like BTC and ETH expected to benefit.

Société Générale strategists suggest Federal Reserve interest rates may be cut post-December 2025, with the U.S. economic data reflecting resilience despite inflation and labor challenges.

These expected rate cuts could lower Treasury yields, bolster risk assets like cryptocurrencies, and potentially trigger renewed interest in the DeFi market amid economic adjustments.

Fed’s Rate Cut Strategy to Boost Risk Assets

Société Générale’s interest rate strategists predict that the upcoming economic data will maintain the resilience of the U.S. economy despite persistent inflation. The analysis suggests interest rate cuts after December 2025, with continued reductions in 2026. David Mericle, Chief Economist at Goldman Sachs, aligns with this view, indicating institutional agreement on the outlook. He states:

The expected cut in rates suggests a positive scenario for risk assets. Past trends show that lower rates encourage risk-taking, potentially leading to increased bullish sentiment in markets. Cryptocurrencies like Bitcoin and Ethereum could see upward moves, as traders adjust for predicted changes.

“We continue to see a December cut as quite likely … two 25-basis-point cuts in March and June 2026 to a terminal rate of 3-3.25%.”

Market observers and officials, including New York Fed President John Williams, have expressed support for short-term rate reductions. The anticipation of the Fed’s accommodative strategy has sparked discussions among industry leaders, with recent press conferences confirming the end of quantitative tightening and a move toward easing monetary policies. Federal Reserve FOMC official statement dated Oct 29, 2025, reaffirms these adjustments.

Impact on Crypto Markets: Historical Insights and Future Potential

Did you know? Interest rate cuts in past Fed easing cycles have historically boosted growth sectors and encouraged risk-taking, often leading markets like cryptocurrency to experience significant rallies.

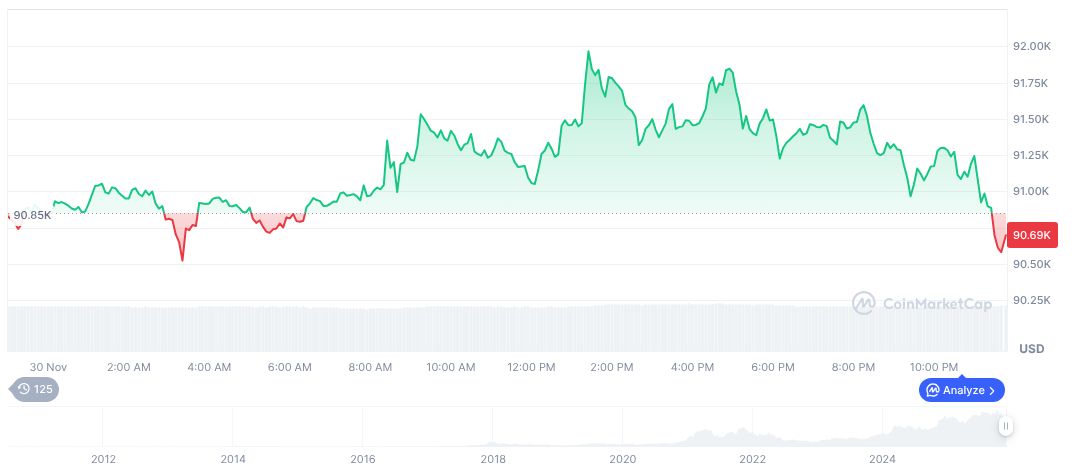

According to CoinMarketCap, Bitcoin (BTC) currently trades at $86,478.65, with a market cap of $1.72 trillion. It dominates 58.72% of the crypto market. Recent data indicates a 4.90% price decrease over 24 hours, with a 21.42% decline in the past 30 days.

Experts from the Coincu research team project that sustaining a lower interest rate environment could significantly benefit cryptocurrencies and blockchain technology development. Reduced borrowing costs might fuel investment in digital asset infrastructure and expand decentralized finance activities, aligning with historical growth patterns following monetary easing.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/fed-rate-cuts-impact-crypto-3/