- Tether’s U.S. Treasury profits surpass $10 billion amid questioning.

- Arthur Hayes questions Tether’s asset liquidity transparency.

- Market confidence depends on Tether’s Treasury-backed stability.

Tether CEO Paolo Ardoino revealed on December 1 that the company holds $135 billion in U.S. Treasury bonds, generating substantial monthly profits, as discussed by Arthur Hayes.

This disclosure, highlighting Tether’s financial robustness, raises questions about asset liquidity’s impact on market confidence amid volatile investments.

Tether’s $135 Billion U.S. Treasury Holdings Under Scrutiny

Tether, under CEO Paolo Ardoino, revealed substantial U.S. Treasury bond investments totaling $135 billion, which generate approximately $500 million monthly. This disclosure highlights substantial profits and Tether’s role as a dominant stablecoin issuer.

Arthur Hayes criticized the lack of formal dividend policy or overcollateralization benchmarks at Tether. He raised concerns about asset liquidity, particularly if Tether’s reserves contained illiquid investments rather than U.S. Treasuries.

“If Tether’s liability is in USD and its assets are U.S. Treasury bonds, then there is basically no major issue; however, if Tether’s assets are illiquid private investments, once an accident occurs, the market will have doubts about Tether’s overcollateralization.” – Arthur Hayes, BitMEX Co-founder

Community reactions were mixed. While some trust Tether’s strong U.S. Treasury backing, others echo Hayes’ concerns regarding transparency over non-Treasury assets. These reactions emphasize ongoing scrutiny of Tether’s financial practices.

Transparency Concerns and Regulatory Implications for Tether

Did you know? Tether’s scale of U.S. Treasury holdings makes it one of the largest holders globally, positioning it uniquely among stablecoins during market fluctuations.

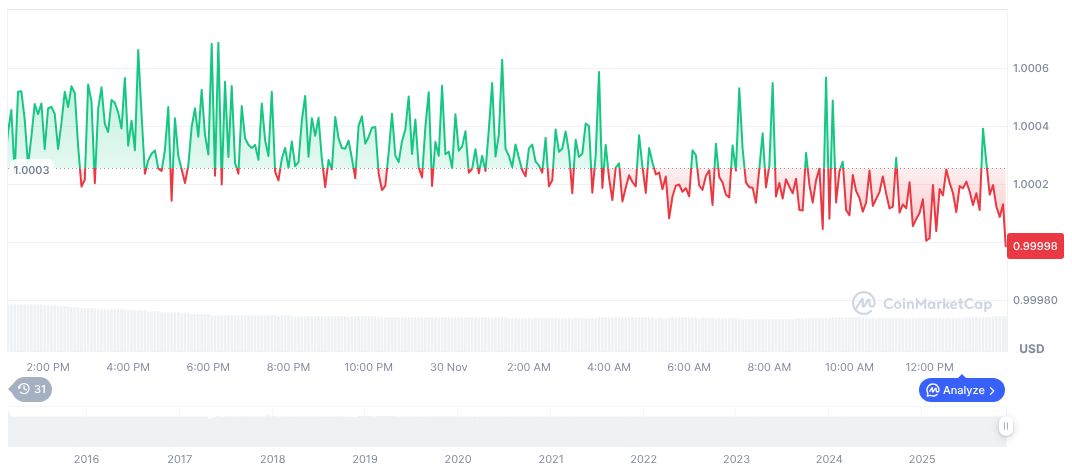

According to CoinMarketCap, as of December 1, 2025, Tether (USDT) maintains a $1.00 peg, with a market cap of $184.60 billion and trading volume of $92.38 billion, reflecting a 69.18% change. The slight price shifts over varying periods underscore its stablecoin status.

The Coincu research team indicates that while Tether’s substantial Treasury assets ensure stability, concerns over non-U.S. Treasury asset transparency could invite regulatory scrutiny. Such regulatory focus may drive chatter around stablecoin reserve requirements and transparency enhancements.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/tether-profits-policies-hayes-questions/