- Elon Musk suggests currency will become obsolete in favor of energy as a true currency.

- Bitcoin is seen as an energy-backed asset, stirring positive sentiment in crypto markets.

- Institutional interest in Bitcoin is increasing amidst Musk’s energy-centric narrative.

Elon Musk, speaking on a podcast, predicted that as material needs are fulfilled, traditional currency will become obsolete, with energy assumed as the next standard of value.

This shift marks potential changes for Bitcoin, perceived increasingly as an energy-backed digital asset, influencing investor sentiment and cryptocurrency markets amid ongoing value speculation and economic debates.

Musk: ‘Currency Will Become Obsolete’ with Energy’s Rise

Elon Musk recently expressed that currency will become obsolete once humanity’s material needs are met, suggesting that energy will be the true currency. He remarked during a podcast that Bitcoin exemplifies an energy-backed asset, as its existence hinges on energy consumption rather than legislative control.

Musk’s emphasis on energy as an economic bedrock positions Bitcoin as a resistant asset against inflation. This notion has stirred positive sentiment in cryptocurrency markets, particularly among institutional investors who view Bitcoin as a reliable store of value and hedge against inflation.

Elon Musk, CEO, Tesla and SpaceX, recently stated, “Energy remains the true currency, and Bitcoin reflects that idea. Governments can print money, but they cannot print energy. This creates a natural barrier strengthening Bitcoin’s foundation.” (source)

In response, Bitcoin has experienced increased attention, with renewed institutional interest and heightened market activity. Figures like Peter Schiff, however, remain skeptical, describing Bitcoin as a “fake asset” amidst debates on its legitimacy. Social media platforms have seen robust discussions on the future implications of Bitcoin positioned as an energy currency.

Bitcoin’s Market Trajectory Shifts Amid Energy-Centric Narrative

Did you know? The conceptual parallel between energy and monetary frameworks, popularized by Musk, draws on historical perspectives where energy and monetary systems have been tightly interwoven, reflecting value dynamics in macroeconomic contexts.

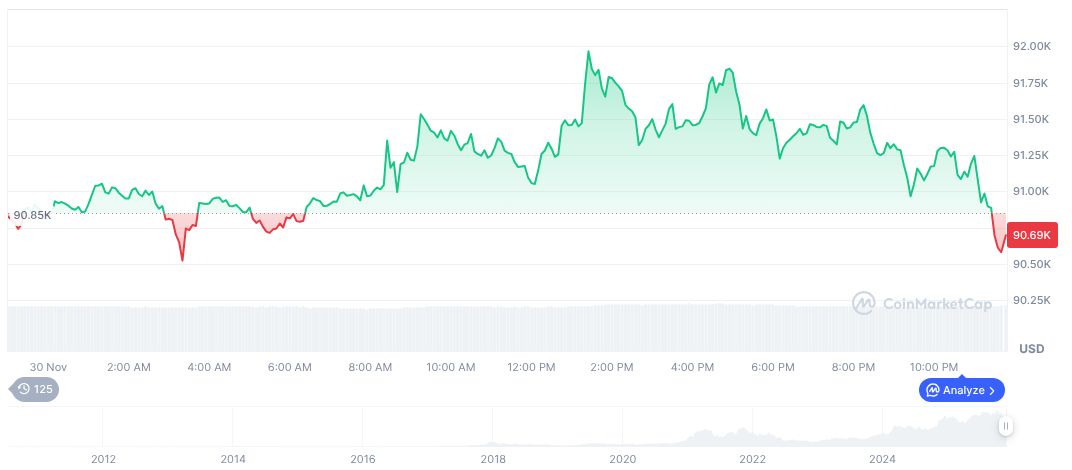

As of December 1, Bitcoin trades at $86,458.96 with a market cap of $1.73 trillion USD, commanding a market dominance of 58.78%. The 24-hour trading volume hit $53.42 billion. The asset’s price offshoots follow Musk’s energy-centric narrative amid a volatile crypto market landscape (Source: CoinMarketCap).

Coincu Research suggests that Musk’s vision may push further utilization and integration of Bitcoin in mainstream financial portfolios. This trend aligns with broader regulatory dialogues on cryptocurrency valuation, potentially steered by Bitcoin’s distinctive energy association, shaping future adoption frameworks.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/musk-energy-future-bitcoin-role/