- Trump plans to announce the new Federal Reserve Chair soon.

- Markets anticipate monetary easing with Hassett as frontrunner.

- Potential shift in interest rates impacts financial markets and crypto.

On December 1st, former U.S. President Donald Trump announced his intent to nominate a new Federal Reserve Chair, hinting at Kevin Hassett as the leading candidate.

Hassett’s potential nomination is significant as markets react favorably, expecting policy easing which could influence cryptocurrency market dynamics by increasing liquidity and investor risk appetite.

Trump Poised to Announce Fed Chair Nominee

Donald Trump announced his intention to disclose his Federal Reserve Chair nominee. Markets keenly await this revelation, as the Fed Chair plays a critical role in shaping U.S. monetary policy.

Many believe that Kevin Hassett, currently part of Trump’s economic team, is the leading contender. Hassett is known for supporting rate reductions, which could potentially lead to a shift in market dynamics as lower rates generally stimulate economic activities.

The anticipation around this announcement has stirred financial markets. Kevin Hassett explicitly refrained from confirming his status as the frontrunner in public forums, referring to news reports as rumors. Nonetheless, the markets have reacted positively, suggesting a preference for more lenient monetary policies.

“I know who I am going to choose as the Fed Chair, and I will announce it soon,” said Trump.

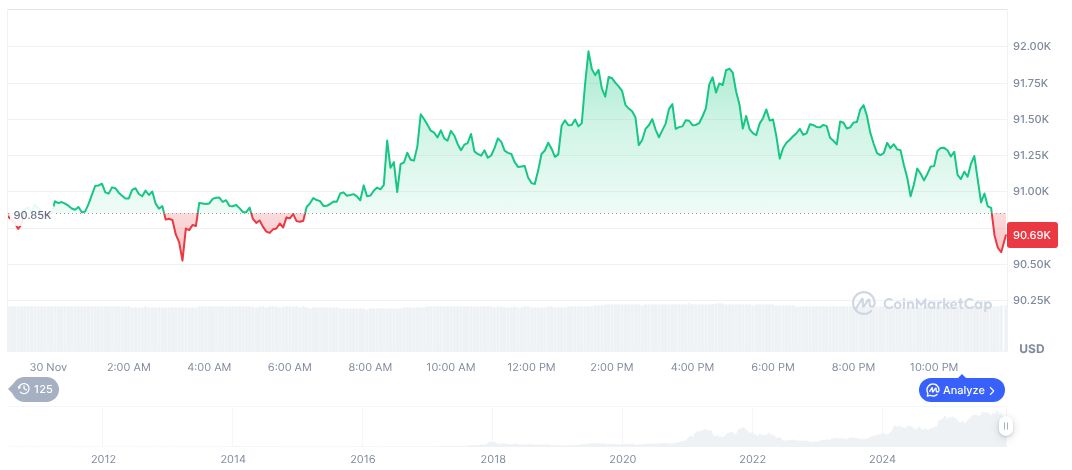

Bitcoin Price Movements Amid Fed Chair Speculations

Did you know? Previous nominations for Federal Reserve Chairs often sparked significant changes in market sentiment, particularly influencing cryptocurrencies due to their sensitivity to interest rate policies.

Bitcoin currently trades at $88,938.22 with a market cap of $1.77 trillion. CoinMarketCap reports a 24-hour trading volume of $40.16 billion, showing recent price movements including a 2.18% dip in the past day and a 3.10% rise over the past week. The supply stands at 19,956,043 BTC.

The Coincu research team notes that a shift in Federal Reserve policies, particularly under potential candidates like Hassett, could significantly affect environments dependent on liquidity, such as crypto markets. Historical trends suggest risk assets may benefit from lower interest rates similar to past monetary easing periods.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/trump-fed-chair-hassett-nomination/