Key Takeaways

Is this a good time to buy XRP?

Amid market uncertainty, the 2.7 billion decline in Binance’s XRP reserves signals ongoing accumulation, while continuous inflows into XRP Spot ETFs point to rising demand from Wall Street investors.

Is XRP bullish today?

On the intraday level, traders are heavily focused on long positions. So far today, they have built $72.50 billion worth of long positions around the $2.129 level, reflecting strong bullish sentiment.

XRP’s recent 22% upside rally appears to be mirroring its historical structure, as the token has once again taken support at the crucial $1.85 level — a zone that previously triggered several strong reversals.

Since October 2025, XRP has dropped more than 40% amid market uncertainty, but the latest bounce from $1.85 suggests a potential trend reversal is on the horizon.

Binance XRP reserve declines by 2.7 billion

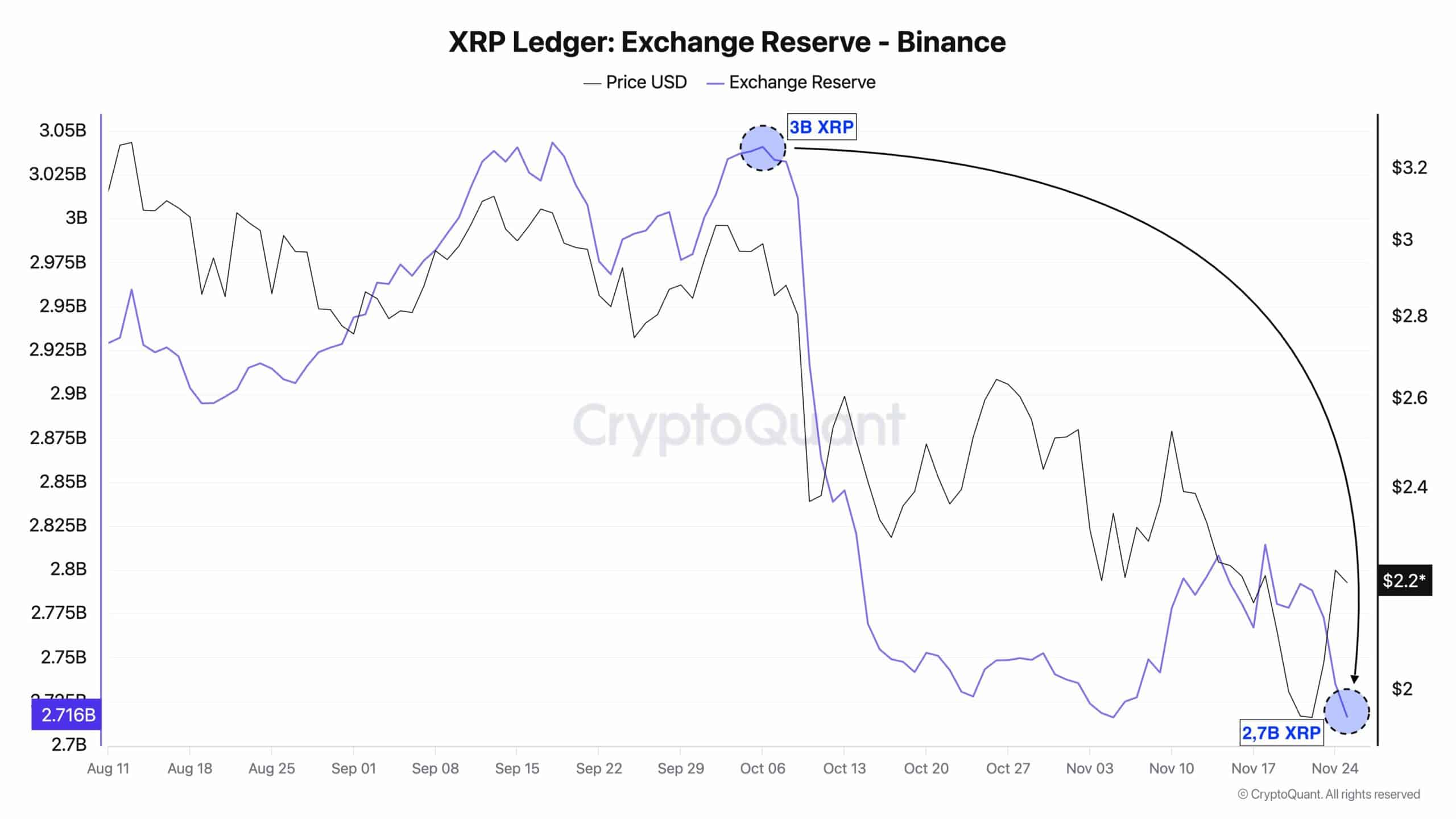

Additionally, the price rebound is further reinforced by a recent analyst report. A crypto analyst shared a post on X, noting that since October 2025, Binance’s XRP reserves have been steadily decreasing.

So far, XRP reserves have plummeted to 2.7 billion, marking one of the lowest levels ever recorded on the platform. The analyst further noted that roughly 300 million XRP have left Binance since the 6th of October.

Source: X/Darkfost_Coc

Exchange reserve is an on-chain tool that tracks token movements, showing whether assets are leaving exchanges or moving into them. This helps identify potential accumulation or upcoming sell-offs.

In this case, the declining exchange reserves point to potential accumulation, which can trigger buying pressure on the asset.

This trend is already reflected in the price, as XRP has jumped 22% over the last five trading sessions.

XRP demand on Wall Street Soars

Besides potential accumulation by crypto whales, traditional Wall Street investors are showing similar behavior.

According to on-chain analytics firm SoSoValue, U.S. XRP Spot ETFs have recorded persistent inflows since their launch on the 14th of November, without a single outflow.

Source: SoSoValue

This indicates that investors are steadily channeling capital into XRP ETFs, highlighting the asset’s strong long-term potential.

XRP price action and key levels

At press time, XRP was trading at $2.20, up 1.05%, while the Open Interest (OI) jumped by 3.09% to $4.11 billion.

This indicated rising leveraged participation in the market and hinted at growing trader confidence ahead of a potential volatility spike.

According to AMBCrypto’s technical analysis, XRP has successfully retested its key support at $1.85 as it rebounded nearly 20% since then, a level it has been revisiting since December 2024.

Source: TradingView

Historically, whenever the asset has touched the $1.85 level, it has consistently rebounded strongly, with gains of 40%, 60%, or even 70% recorded in the past.

The recent market decline and subsequent support retest mark the sixth visit to this level.

Based on past performance, the repeated rebound from this key support suggests that XRP may still have room for further upside momentum.

Traders’ eyes on long position

Given the current market sentiment, traders appear to be strongly following the trend by betting on long positions.

According to the derivatives platform CoinGlass, XRP’s major liquidation levels stand at $2.129 on the lower side and $2.264 on the upper side.

At these levels, traders have built $72.50 billion worth of long positions and $40.95 billion worth of short positions.

Source: CoinGlass

This indicates that bulls are currently dominating the market, with strong confidence that XRP’s price will not fall below the $2.129 level in the near future.

Source: https://ambcrypto.com/xrp-buyers-return-in-force-72-50b-in-longs-placed-at-critical-support/