- U.S. markets close early for Thanksgiving, impacting futures schedules.

- Early closure for CME and ICE futures trading globally.

- Market reactions indicate potential shifts in global futures markets.

On November 27, US financial markets, including NYSE and Nasdaq, will be closed for Thanksgiving, with futures trading ending early due to the holiday schedule.

This closure impacts trading volumes and liquidity, affecting derivative markets, with potential implications for cryptocurrencies due to correlated asset movements.

U.S. Markets’ Early Closure Alters Global Trading Dynamics

On November 27, 2025, U.S. markets, including NYSE and Nasdaq, observed Thanksgiving closures. Trading in CME Group and ICE futures ended early, altering the global financial trading landscape. This routine closure affects various futures contracts, consistent with yearly holiday schedules.

The changes involve early termination of trading for precious metals, U.S. crude oil, and stock index futures. Such adjustments have broader implications across global market activities, altering future trading patterns. Investors are alert to these shifts, preparing for potential ripple effects.

Tracy R. Wolstencroft, CEO of CME Group, stated, “CME Group’s precious metals and US crude oil futures contracts will end early at 03:30 Beijing Time on November 28.” [PANews]

Crypto Markets React to U.S. Holiday Trading Patterns

Did you know? Throughout history, U.S. market closures during major holidays like Thanksgiving often lead to decreased trading activity, impacting global financial markets. Such patterns reveal the interconnectedness of global trading systems with the U.S. holiday calendar.

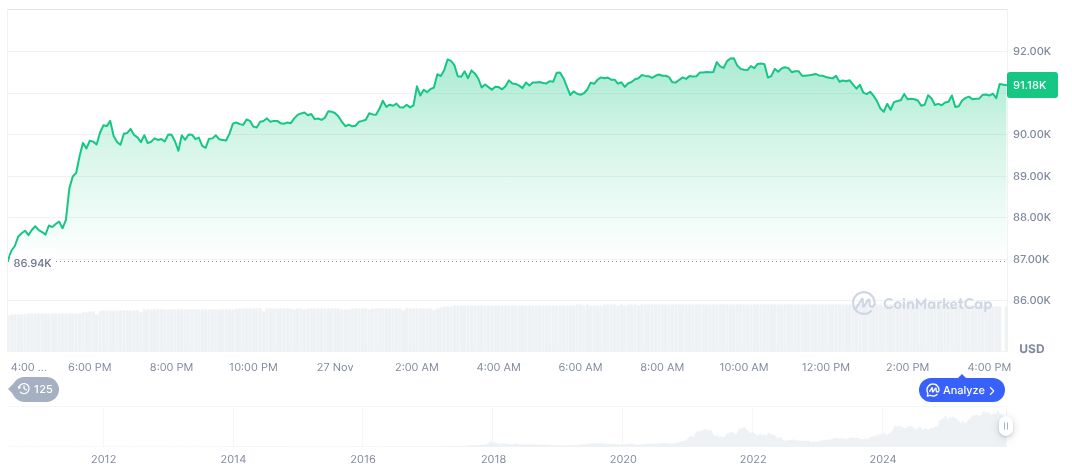

According to CoinMarketCap, Bitcoin (BTC) is priced at $91,513.24, with a market cap of $1.83 trillion and market dominance of 58.53%. Trading volume is $58.97 billion, declining by 10.37%. Recent price changes show a 1.86% rise over 24 hours and a 4.86% increase over the week.

Coincu’s research team highlights how U.S. financial market closures can trigger shifts in cryptocurrency trading behaviors. By analyzing historical trends, experts suggest adjoining market closures prompt temporary shifts in liquidity and transactional activities, particularly in derivative assets related to traditional markets. Such patterns reflect strategic responses from global investors tuned to time-sensitive trading windows.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/thanksgiving-markets-close-early-impact/