XRP price holds steady after several weeks of uneven action, and the chart now approaches an important area that could shape the next direction. Buyers show interest near reclaimed levels, while sellers continue meeting them at upper barriers, which keeps movement tight.

Meanwhile, liquidity changes across exchanges add more layers to the current setup. The picture remains open, and XRP price continues attracting attention as both sides prepare for the next decisive reaction.

XRP Price Testing Channel Ceiling Again

XRP price continues to trade inside a long descending channel that guided its structure for months. At the time of press, XRP value trades at $2.22, and the current reaction builds right under the channel’s upper boundary.

Notably, this zone carries weight because buyers attempted several breakouts, yet sellers rejected each one. Notably, the market now watches how price behaves at this ceiling, since a clean move above it may unlock space toward higher levels.

The nearest hurdle stands near $2.25, where sellers react quickly. Above that, the $2.60 region forms the next key barrier. Each push into these zones draws sharp responses, and the structure tightens with every test. A confirmed break above $3.13 would shift the broader layout and clear the path toward $3.60.

Meanwhile, the Stoch RSI signals intense buying strength, with the %K line at 97.56 and the %D line at 90.06, showing firm upside pressure as XRP price pushes against a crucial resistance area. XRP price benefits when these signals align near structural turning points.

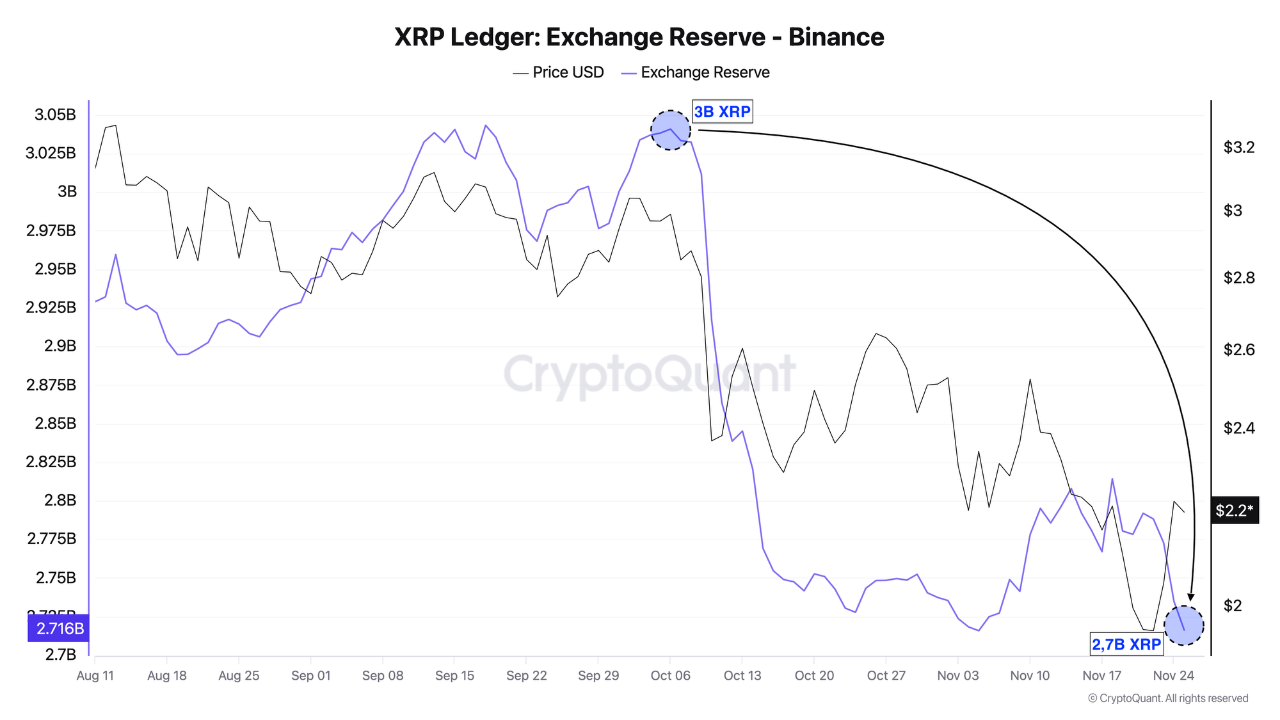

Exchange Reserves Fall Sharply on Binance

Binance’s XRP reserves continue dropping, and the decline remains steady. The platform now holds roughly 2.7 billion XRP, down from nearly 3 billion seen earlier in the cycle.

Since early October, close to 300 million XRP have left the exchange, and that steady drain reflects confidence from holders who choose tighter control. This shift also removes a large portion of near-term sell supply, which creates cleaner conditions around major chart levels.

Meanwhile, institutional access through ETF routes adds another layer. As structured investment channels expand, more holders opt to withdraw XRP from exchanges, which tightens liquidity further. Less supply on the books reduces knee-jerk selling and gives buyers more breathing room during reactions.

These movements support the overall XRP price setup because they strengthen areas where demand seeks continuation. A market with shrinking reserves often builds healthier technical structures, especially when chart levels already show increased engagement.

Can This Lift XRP Price?

XRP price sits near a decisive point where supply trends and chart structure work together. The channel ceiling remains the key obstacle, and each test increases tension around it.

Meanwhile, the continued reserve decline improves liquidity conditions and strengthens the environment for a larger move. If buyers keep pressure at these levels, the setup leans toward progress, and XRP could build a path toward higher targets as long as demand stays firm.

Source: https://coingape.com/markets/is-xrp-price-gearing-up-for-a-rally-as-reserves-collapse/