- Visa partners with Aquanow for stablecoin settlements.

- Focus on CEMEA region for quicker transactions.

- Aim to cut cross-border transaction costs.

Visa and Aquanow have partnered to enhance financial settlements using stablecoins, announced on November 27, focusing on expedited cross-border transaction capabilities across the CEMEA region.

This move highlights growing institutional interest in blockchain technology, promising improved transaction efficiencies and financial inclusivity, impacting Visa’s market reach and Aquanow’s digital asset platform.

Visa and Aquanow Target $2.5 Billion in Stablecoin Settlements

Visa announced on November 27 that it has partnered with Aquanow to enhance payment settlements using stablecoins. This collaboration aims to serve financial institutions across Central and Eastern Europe, the Middle East, and Africa (CEMEA) effectively.

The partnership underscores the growing institutional interest in stablecoins as a tool for speeding up settlements and increasing transparency in payments. The integration of Visa’s global network with Aquanow’s digital asset infrastructure is expected to cut costs for cross-border transactions.

Reactions from industry leaders highlight optimism about stablecoin scalability and its ability to foster further adoption in institutional settings. Market participants, particularly within emerging markets, expect the technology to simplify transaction processing significantly. Visa and Aquanow are seen as pivotal in this transformative process, with Godfrey Sullivan noting the integration of trusted technological frameworks to provide reliable, efficient payment solutions.

“By harnessing the power of stablecoins and pairing them with our trusted global technology, we are enabling financial institutions in CEMEA to experience faster and simpler settlements,” stated Godfrey Sullivan, Head of Product and Solutions for CEMEA at Visa.

Institutional Growth Fueled by USDC Adoption in CEMEA

Did you know? Stablecoins are increasingly being adopted by mainstream financial institutions to facilitate faster and more transparent transactions.

Visa has aligned with Aquanow to leverage stablecoin technology for a broader and faster application of digital settlements. The use of USDC in these transactions marks a continued commitment to cryptocurrency by mainstream financial institutions. The collaboration addresses the need for quicker transactions, especially beneficial in the context of cross-border payments for the CEMEA region. Aquanow’s infrastructure expertise plays a crucial role in ensuring reductions in settlement times and operational friction.

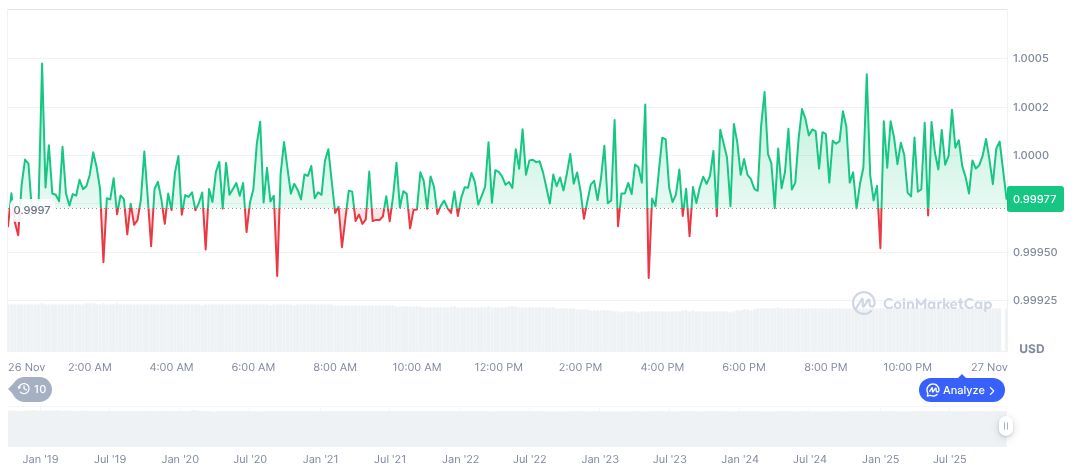

The market impact of this partnership is pronounced. Visa’s annualized transaction rate now surpasses $2.5 billion using USDC, exemplifying a significant demand within institutional networks. Aquanow is not new to handling large transaction volumes, processing billions monthly and thereby enhancing liquidity and reach. Phil Sham, CEO of Aquanow, shared, “Visa’s reliable global network has long moved money securely and efficiently. Together, Visa and Aquanow are unlocking new ways for institutions to participate in the digital economy, leveraging stablecoin technology to settle with the speed and transparency of the internet.”

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/visa-aquanow-stablecoin-settlements/