- Monad airdrop leads to token sell-offs, affecting market prices.

- 52.4% of wallets fully liquidated their allocations.

- Early liquidity marks significant network participation.

PANews reported on November 27 that 52.4% of wallets participating in the Monad airdrop sold or transferred their allocations, reflecting immediate liquidity and sell pressure.

This large sell-off highlights typical airdrop behavior, impacting Monad’s market stability amid robust early adoption and liquidity on its Layer 1 network.

Over 76,000 Wallets Participate in Monad’s Airdrop

Monad launched its mainnet on November 24, distributing 3.33 billion MON tokens to roughly 76,021 wallets through a $105 million airdrop. Adam’s statistics indicate that over half of the token holders have already sold or transferred their tokens, intensifying the liquidity in the market. Notably, 52.4% of wallets completely offloaded their MON quotas, while 35.7% maintained their full allocations.

The airdrop aimed to decentralize ownership, kickstarting a notable transaction volume on Monad’s new network. While creating significant early liquidity, the high sell-off rate has fueled market volatility, affecting token stability.

Arthur Hayes, Co-founder, BitMEX, – “Monad is another low-float, high-FDV layer-1,” acknowledging both its potential and speculative momentum.

The quick turnaround of sold tokens signals both an active trader interest and potential challenges for sustaining long-term market development.

Potential Price Stability Challenges Amidst High Sell Pressure

Did you know? The rapid sell-off of Monad’s airdropped tokens mirrors trends in prior Layer 1 launches, where early holders often liquidate to capitalize on speculative gains, underscoring typical market reactions to large airdrops.

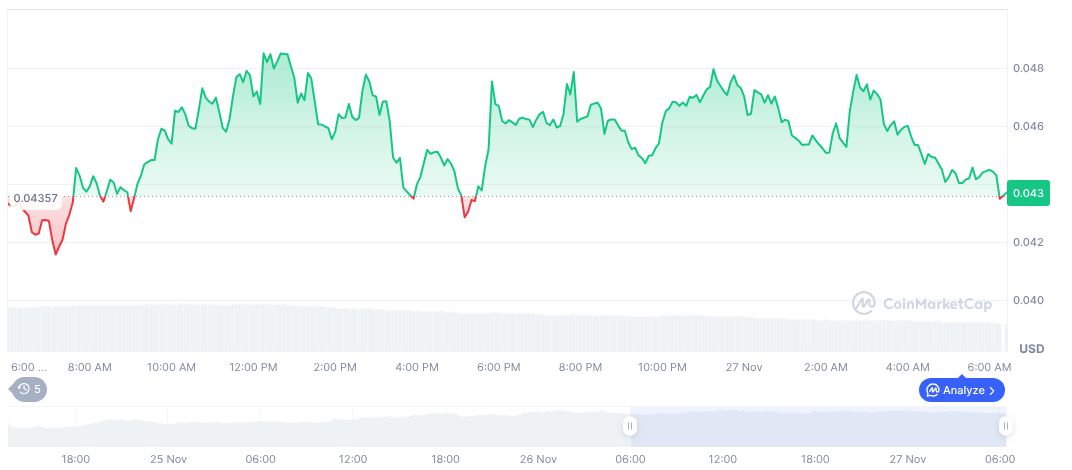

CoinMarketCap reports Monad (MON) trading near $0.04, with a market cap exceeding $467.84 million. Despite a trading volume drop of 35.64% in 24 hours, the token recently surged 49.99% across several weeks, reflecting the ongoing volatility post-launch.

Industry experts from Coincu note that while early liquidity influxes suggest strong project interest, the persistence of high sell pressure may challenge price stability. Long-term prospects could hinge on the network’s ability to foster organic growth beyond speculative trading activities.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/monad-airdrop-token-sales-impact/