- The Solana price rebounds with the channel pattern, signalling a fresh recovery cycle ahead.

- BSOL ETF now holds 4.317 million SOL with a total value of about $587 million.

- A recent bearish crossover between the 100-day and 200-day EMA slopes signals a bearish sentiment in the market.

SOL, the native cryptocurrency of the Solana blockchain, jumps 3.0% during Wednesday’s U.S. market hours to trade at $142. Along with general bullish sentiment in the broader market, the Solana price gained additional momentum amid the recently launched spot SOL ETFs from multiple issuers, institutional interest, and technical support. Will this altcoin flip its current relief rally to a sustainable recovery?

Bitwise BSOL ETF Crosses $500M Inflows

Since last week, the Solana price has bounced from $121.6 to the current trading value of $143, registering a gain of 17.5%. The advance has followed a broader rebound in risk assets after several Federal Reserve officials gave hints of willingness to cut interest rates in December.

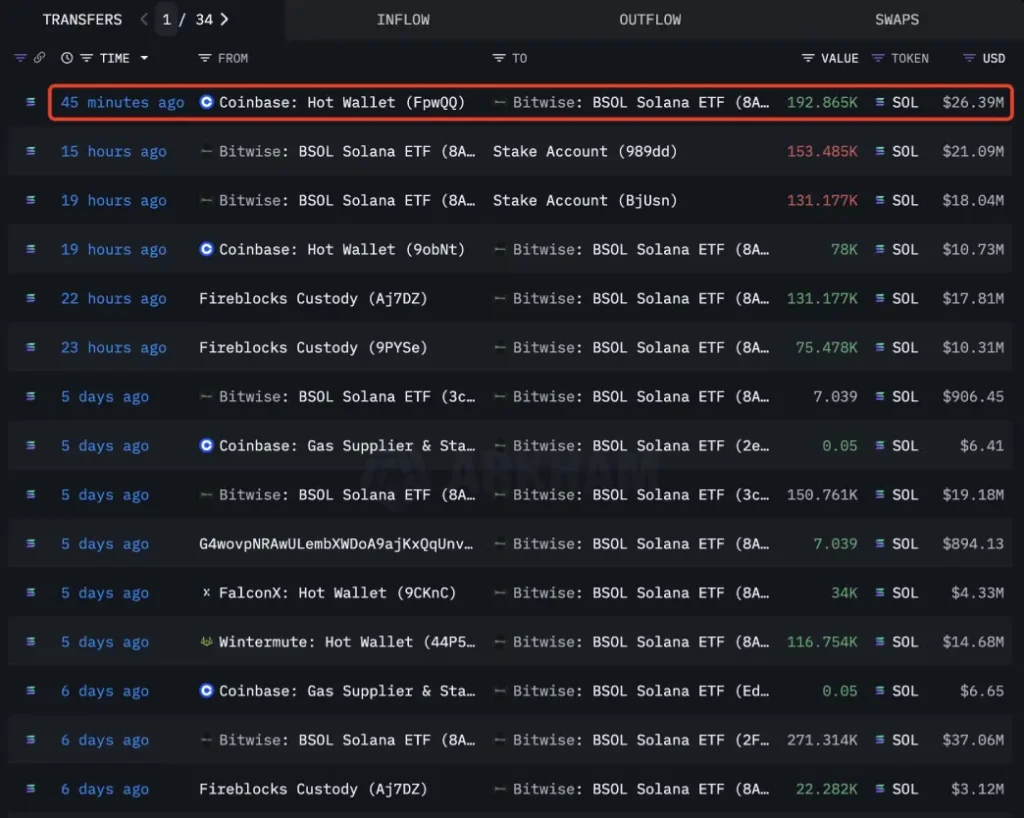

Institutional demand is quite solid. On-chain records indicate Bitwise BSOL Solana ETF withdrew another 192,865 SOL, roughly $26.4 million, from Coinbase Prime in the past day. The fund now has 4.317 million SOL, which is worth about $587 million. Since its October introduction, BSOL has not had a single day of outflow.

Separate flow data compiled by Farside Investors show the product received $31 million on Wednesday alone, sending cumulative inflows past $500 million.

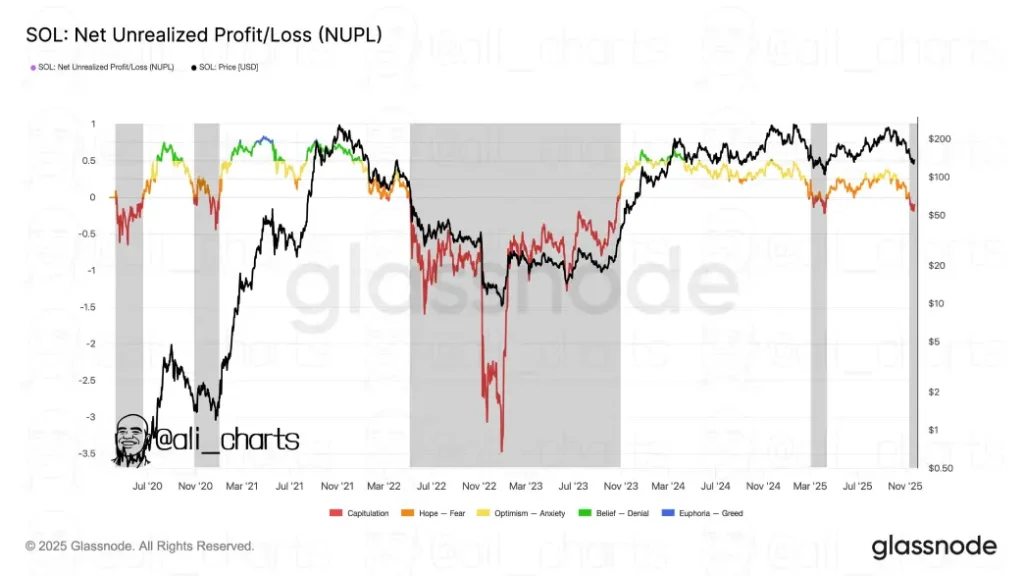

Separately, analyst Ali Martinez noted that we have historically seen Solana’s price hit the bottom once exchange depositors and leveraged traders start capitulating en masse. Active deposit addresses and liquidation volumes indicate that the process has been underway over the past two weeks, and the heaviest selling pressure now seems to be easing.

The combination of receding retail despair and unabated ETF accumulation has fueled the current leg higher, even though the token has still taken about 45% off of its November 2021 all-time high.

Solana Price Hits Key Resistance at 20-Day EMA.

An analysis of the daily time frame chart shows that the recent upswing in Solana price is positioned precisely above the bottom trendline of a falling channel pattern. Since mid-September, the SOL price has been actively resonating within the two parallel trendlines of the channel.

The recent history of the channel shows that a price retest to the lower trendline has often bolstered buyers to recoup the bullish momentum and drive bullish recovery.

With today’s jump, the coin price challenges the immediate resistance of $142, which currently coincides with the 20-day exponential moving average. A bearish crossover within other key EMAs further bolsters sellers to drive an extended correction.

However, the momentum indicator RSI (Relative Strength Index) bounced to 42% to accentuate the restoring bullish momentum in price.

A potential breakout from the resistance will accelerate the price for a potential 20% upswing and challenge the channel resistance at $173. An upside breakout from the barrier is key to sustainable recovery.

On the contrary, if the Solana price reverses from the $145 barrier, the sellers could force a high-momentum downtrend in their daily chart.

Also Read: Bitcoin Price Reclaims $90k as US Jobless Claims Slip to 216k

Source: https://www.cryptonewsz.com/solana-price-on-heavy-etf-accumulation/