Paxos acquires Fordefi to expand regulated custody and wallet tools for institutions seeking secure digital asset operations.

Institutional demand for stronger custody and wallet tools continues to grow, and Paxos is moving to meet it. The company has confirmed the acquisition of Fordefi, which is a well known provider of institutional crypto wallet and custody technology.

The move increases Paxos reach in the on chain economy and expands its set of tools for businesses that use digital assets. Fordefi is known for its multi party computation wallet system.

It supports secure transaction approvals and offers simple integration for firms active in decentralized finance. Paxos intends to merge this technology with its regulated custody platform, and the company expects this will create a unified system for stablecoin issuance, asset tokenization, and institutional level transaction management.

Paxos is acquiring @FordefiHQ, the leading custody and wallet technology platform for on-chain operations.

This strengthens our ability to support institutions with more flexible and sophisticated digital asset infrastructure. pic.twitter.com/t7aFVhyflu

— Paxos (@Paxos) November 25, 2025

Expansion of Custody and Wallet Capabilities

Paxos has provided regulated digital asset services for many years, and the company aims to secure a broader role in institutional markets. The addition of Fordefi brings advanced wallet controls, which include strong security checks and policy settings for on chain activity.

These features give institutions more ways to manage transactions and permissions with reduced operational risk.

The acquisition also gives Paxos new ways to serve enterprises with different asset needs. Many companies want a platform that supports tokenization, payments, and stablecoin services in one place.

Paxos plans to use Fordefi software to strengthen that model and offer a platform that can support a wide range of digital asset operations. Fordefi will continue to run its existing product for now, and its clients will not see any immediate changes.

Paxos intends to integrate Fordefi systems over time, and the combined platform will support new institutional workloads as demand increases.

Rising Enterprise Interest in DeFi Connectivity

More businesses are exploring decentralized finance because they want direct access to yield tools, tokenized assets, and on chain transfers. This trend has led several major companies to introduce new DeFi services.

Some firms already allow users to engage with lending pools, and others are exploring tokenized equity plans.

The crypto sector has seen more established institutions adopt on chain connectivity. Several exchanges have linked their platforms with DeFi lending systems, and some have started to support wrapped assets for users who want yield options inside their own ecosystems.

These steps show that DeFi is becoming a common part of new digital asset services. Fordefi technology was designed with these needs in mind.

The platform supports many DeFi integrations and gives institutions a direct path to interact with decentralized tools. This makes the acquisition valuable for Paxos because it gives the company a deeper link to enterprise DeFi activity.

Related Reading: Paxos Proposes USDH Stablecoin with Revenue Sharing to Back Hyperliquid Growth

Market Context and Industry Growth

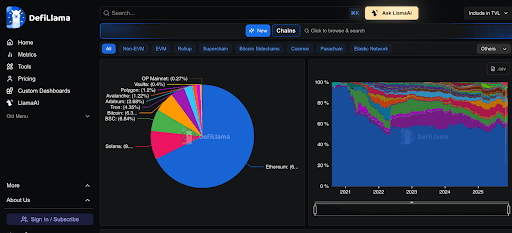

Data shows that the broader DeFi market continues to expand, even during periods of volatility. Total value locked across major protocols is near one hundred billion dollars.

This figure changes often, but it reflects the steady interest that institutions have shown in on chain activity.

Many businesses rely on trusted custody partners before they engage in DeFi related tools. Paxos has served this role through its regulated platforms, and the company aims to support growing enterprise demand with the help of Fordefi systems.

The acquisition positions Paxos to deliver custody, wallet, and stablecoin services from a single controlled environment. The deal also gives Paxos a wider reach across the global market. Fordefi has a strong client base that includes hundreds of institutions.

These clients use Fordefi tools for secure wallet activity, and many rely on its policy engine to manage internal approvals. Paxos plans to support these users while it builds new features for long term growth.

The acquisition shows that institutional custody and wallet infrastructure continues to evolve. Paxos is moving to offer an all in one system for secure digital asset operations, and the company expects the combined platform to support the next stage of enterprise adoption.