Key Takeaways

Why is Canton Network up today?

Buyers returned aggressively, with a strong buy-sell delta and record negative netflow showing dominant demand.

What confirms renewed market confidence?

Open Interest jumped 11.87%, volume surged 87%, and long positions slightly outpaced shorts.

After Canton Network went live on exchanges two weeks ago, it skyrocketed to an all-time high of $0.21. Shortly after, though, Canton [CC] crashed, dropping to a low of 0.72.

After a period of closing at lower lows, the market has signaled a potential recovery. In fact, CC successfully held $0.074 support and touched a local high of $0.087.

As of this writing, Canton was trading at $0.085, up 13.21% on the daily charts. At the same time, Volume surged 358% to $351 million, while market cap reclaimed $3 billion, reflecting an influx of liquidity.

But why is Canton Network up today?

Canton buyers stage a strong comeback

As Canton’s price decline prolonged, holders and investors panicked and sold, with sellers dominating the market.

After four days of sellers’ dominance, buyers have staged a strong comeback, totally displacing sellers over the last 24 hours.

Over this period, Canton Network saw $6.4 million in Buy Volume compared to $4.5 million in Sell Volume, according to Coinalyze.

Source: Coinalyze

As a result, the altcoin recorded a positive Buy Sell Delta of 1.9 million, a clear sign of aggressive spot accumulation.

Often, a higher buying pressure has accelerated upward momentum, a precursor to higher prices.

Furthermore, exchange activity further echoed this accumulation trend. According to CoinGlass, the altcoin’s Spot Netflow has remained negative for six consecutive days.

Source: CoinGlass

At press time, Netflow was -$8.99 million, marking an all-time low. Such a drop in netflow suggests increased outflows, with buyers dominating the market.

Derivatives follow suit

Interestingly, after Canton Network signaled a rebound, speculators rushed into the market to chase the rally.

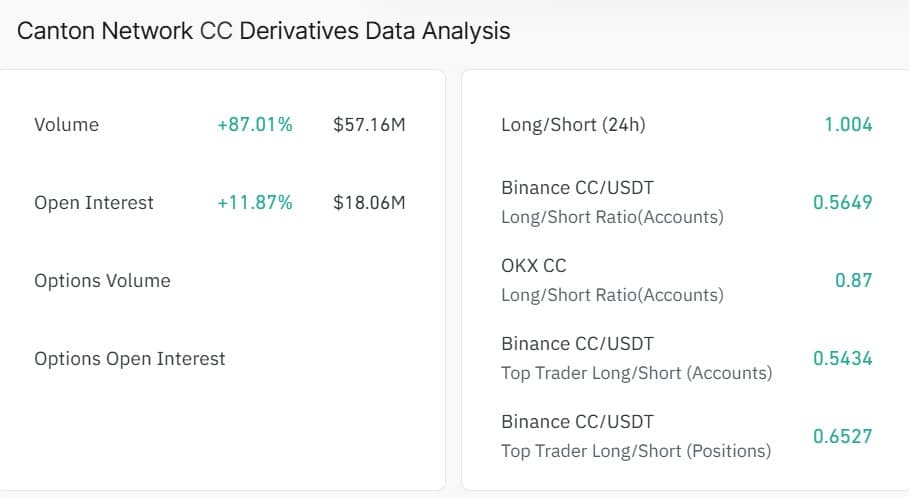

According to CoinGlass, Open Interest jumped 11.87% to $18.06 million, while Volume surged $87 to $571.16 million.

Source: CoinGlass

Typically, when OI and Volume rise in tandem, it signals increased participation and capital flows into the Futures market.

Thus, traders either opened long or short positions. In fact, the Long/Short Ratio rose to 1.004, indicating higher demand for long positions.

When longs dominate, it suggests most participants are bullish and anticipate prices to rise even further.

Is this the start of a sustained uptrend?

Canton Network rallied as buyers bounced back across both spot and derivatives markets, accumulating and taking strategic positions.

However, although buyers returned, the upward momentum remains relatively weak. At press time, the Relative Strength Index (RSI) sat around 59, while its signal line was 72.

Source: TradingView

When the signal line sits above its RSI, it suggests weakened bullish momentum, with sellers and buyers both active in the market.

This is further evidenced by declining MACD, which has dropped to 0.018 after a bearish crossover.

Such market conditions leave CC at a crossroads, with bears and bulls fighting for market control. If buyers continue to accumulate, CC will continue with the recovery, hitting $0.10.

However, if sellers manage to retake the market, the altcoin will retrace to $0.074.

Source: https://ambcrypto.com/canton-network-hits-crossroads-buyers-push-up-price-but-cc-warns-of/