Key Highlights

- Senator Cynthia Lummis has slammed JPMorgan for undermining confidence in traditional banks and sending the digital asset industry overseas with the Biden-era policies and Operation Chokepoint 2.0

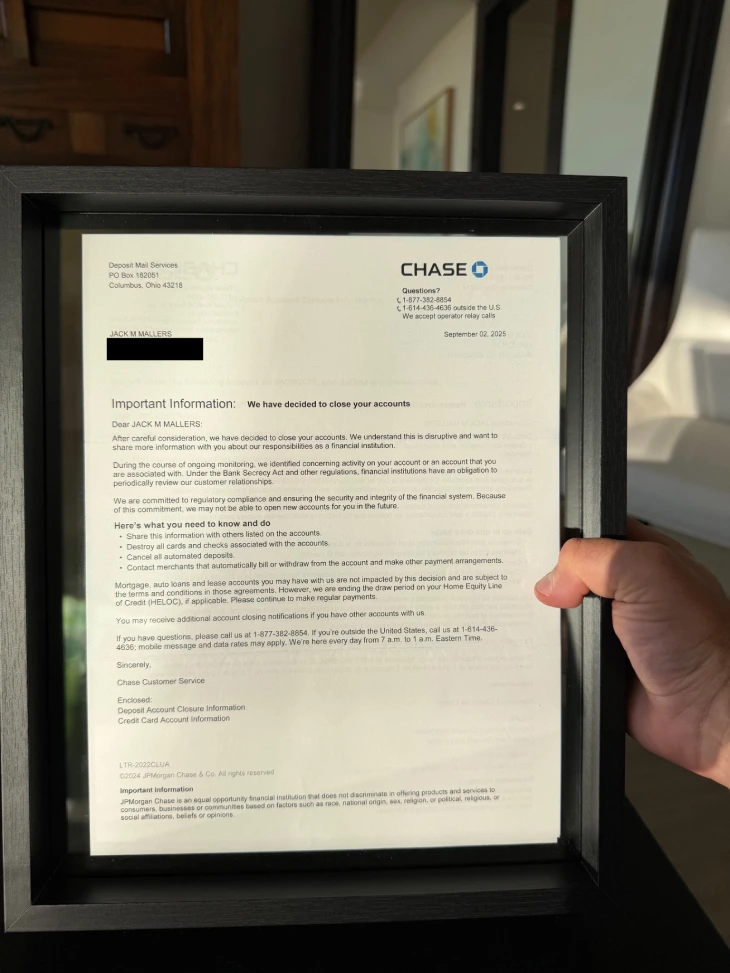

- JPMorgan has officially terminated its banking relationship with Jack Mallers, the popular CEO of the Bitcoin Payment app Strike

- Earlier, the OCC and FDIC removed the vague concept of reputational risk from their bank examinations

In the latest post on X (formerly Twitter), Senator Cynthia Lummis slammed JPMorgan for its anti-crypto policies, comparing it with Operation Chokepoint 2.0.

Operation Chokepoint 2.0 regrettably lives on.

Policies like JP Morgan’s undermine confidence in traditional banks and send the digital asset industry overseas.

It’s past time we put Operation Chokepoint 2.0 to rest to make America the digital asset capital of the world. pic.twitter.com/x9ZdgXialV

— Senator Cynthia Lummis (@SenLummis) November 24, 2025

JPMorgan Debanks Crypto CEO: Is Operation Chokepoint 2.0 Still Alive?

According to the latest report, JPMorgan Chase has cut its banking relationship with Jack Mallers, the popular CEO of the Bitcoin Payment app Strike. JPMorgan reportedly closed Mallers’ personal accounts in September after citing only the unclear status of concerning activity under the Bank Secrecy Act. The financial institution has refused to provide any specific details despite his requests.

(Source: Jack Mallers on X)

There is a buzz in the crypto community about this as the standard case of debanking, where financial institutions cut off services to crypto-related businesses and individuals.

This action has sparked huge backlash from the crypto community and pro-crypto political personalities, including U.S. Senator Cynthia Lummis. She slammed the action as a revival of Operation Chokepoint 2.0.”

Operation Chokepoint 2.0 is allegedly an informal campaign by U.S. government regulators to strategically limit the cryptocurrency industry’s access to the banking system. This initiative is accused of using regulatory pressure guidance to persuade banks to cut ties with crypto companies.

The new controversy comes after an executive order from the U.S. President Trump’s administration, which directs banks and financial institutions to explicitly ban such practices. This executive order is the reflection of Trump’s promise to make America the crypto capital of the world and stop the migration of crypto innovations to foreign countries.

Bo Hines, CEO of Tether USA and a former White House crypto policy executive, questioned this action, saying, “Hey @Chase… you guys know Operation Choke Point is over, right? Just checking.”

On this matter, Tether’s CEO, Paolo Ardoino, stated on X, “Maybe they are just off-boarding some customers to reserve some account space for Beelzebub.”

Trump Administration Reverts to Biden-Era Crypto Policies

After Trump took the presidential oath for the second time, he started working on his promises made during the election campaign to the crypto community. To provide clear regulatory clarity, he directed agencies to prepare clear regulatory guidelines.

He started working on two main priorities, including the end of Operation Chokepoint 2.0 and the creation of a national strategic reserve for Bitcoin. Through a series of executive orders and legislative efforts, the administration is planning to end the financial isolation of the crypto industry while formally recognizing Bitcoin as a strategic national asset.

The crackdown was started with an executive order signed by U.S. President Trump, which also formed a White House Digital Asset Working Group.

After this executive order, in March, the OCC and FDIC took another major decision, where these regulators removed the vague concept of reputational risk from their bank examinations. This policy was fully backed by the Executive Order, which guarantees fair banking for all Americans. It clearly banned politically motivated debanking and mandated a review of past account closure.

The result has been an impressive reopening of the banking system, with reports indicating an impressive surge in crypto firms successfully obtaining bank accounts since the third quarter of 2025.

While regulatory clarity is taking place, many American banks are preparing to integrate crypto-based services. For example, JPMorgan Chase is leading the charge with a multi-pronged strategy that includes expanding its Onyx blockchain for payments, accepting Bitcoin as collateral for loans. Bank of America is developing its own USD-based stablecoin and has already enabled its clients to seamlessly connect their accounts to major cryptocurrency exchanges.

Source: https://www.cryptonewsz.com/senator-lummis-jpmorgan-debanking-strike-ceo/