Bitcoin price is falling in accordance with the historical bull and bear market cycle. According to the 4-year cycle and historical peak patterns, we are now in a bear market. Crypto market participants are in panic, but experts such as veteran trader Peter Brandt predict Bitcoin could rally to at least $200K in the next bull market.

Peter Brandt Predicts Bitcoin Price Rally to $200K

On November 21, Peter Brandt, known for accurate Bitcoin market top and bottom predictions, shared a bold Bitcoin price prediction. He claimed the current crash is the “best thing” happening to Bitcoin.

Brandt predicts Bitcoin price could hit $200,000 in the next bull market. The price rally is expected to happen around Q3 2029. Brandt disclosed that he still owns 40% of his BTC holdings, at a price 1/20th of Michael Saylor’s Strategy (MSTR) average buy.

He revealed his holdings and bullish price predictions after facing backlash from some crypto market participants. It followed his dire warning of a major Bitcoin price crash.

I am now done posting about Bitcoin to public X for now. Way too many trolls. X has become a toxic place to hang out. I will now return to my first love — that is the futures markets I have traded since 1975 for a living. Bitcoin Live members, I should get this analysis to you…

— Peter Brandt (@PeterLBrandt) November 21, 2025

Peter Brandt’s Bitcoin Crash Forecast

Peter Brandt went short on XRP price in October, predicting a fall to $2.2. In the following weeks, XRP dropped straight from $3 to $2.2. He also expected Bitcoin to peak based on the historical cycle top, but shared his confirmation last week.

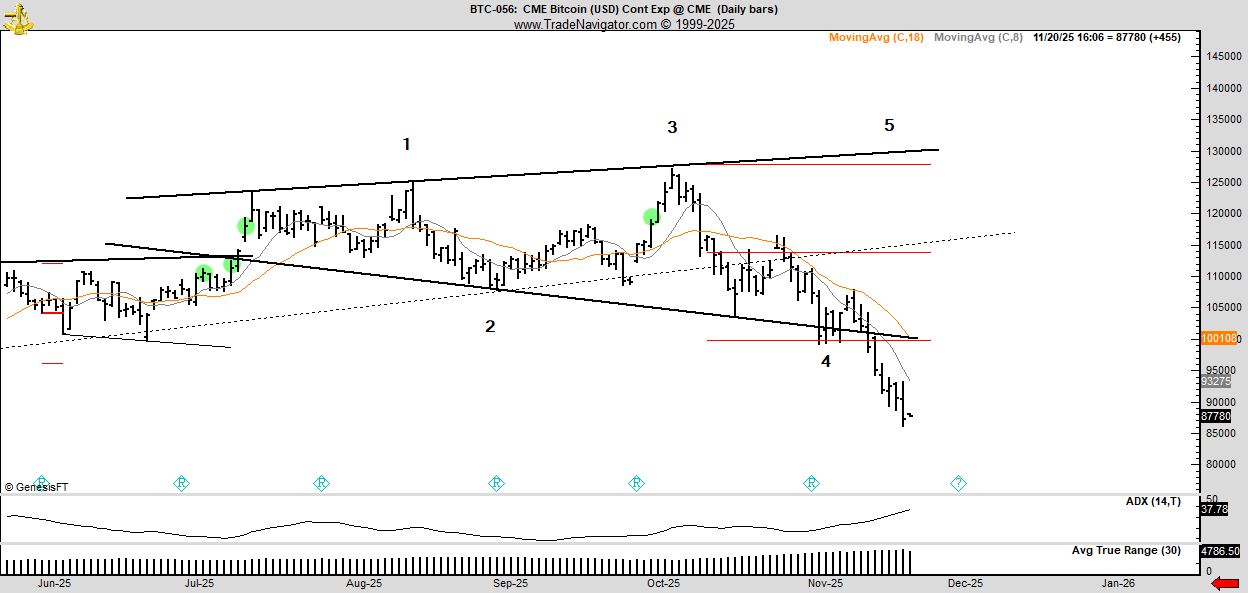

As CoinGape reported earlier, he predicted Bitcoin crash to $58K. The analysis found $81,000 and $58,000 as two primary support levels. “Those who now claim they will be big buyers at $58K will be pukers by the time BTC reaches $60k,” he added.

Even before Peter Brandt, CoinGape shared a potential Bitcoin price crash to its realized price at $56K. It was based on the macro headwinds and bearish technical chart patterns such as falling wedge, head-and-shoulder, or bear flag. 10x Research’s Markus Thielen, CryptoQuant’s head of research Julio Moreno, and other experts confirmed a bear market.

Bitcoin has historically peaked 12-18 months after a halving. Long-term holders (LTH) and whales sold their holdings as they were certain that Bitcoin would peak in October. Also, historical data suggest bull market peaks occur around 1,060-1,070 days, and the pattern held this cycle.

The classic technical chart pattern that confirmed bearishness was a death cross formation on the 1-day chart. The 50-DMA crossover below the 200-DMA, tanking Bitcoin price below $95K. It is worth noting that the 200-week moving average (WMA) is also currently around $56K.

BTC price is currently trading at $84,262, down more than 8% over the past 24 hours. The 24-hour low and high are $82,082 and $92,346, respectively. Trading volume climbed 38% in the last 24 hours.

Also Read: Top Crypto Offers In November 2025

Source: https://coingape.com/bitcoin-price-will-rally-to-200k-after-crashing-to-58k-peter-brandt-predicts/