Is now the right time to buy back Dogecoin? The meme coin has been significantly discounted after maintaining an overall bearish trend since mid-September. Moreover, numerous factors may support a reversal from its current position.

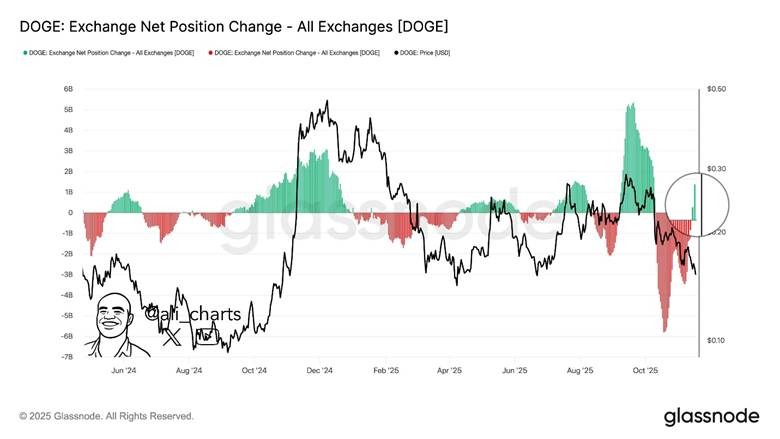

Recently observed spikes in Dogecoin exchange net position changes were among the reasons for the rising bullish optimism around the meme coin. Positive net position changes have historically been linked with bullish momentum while negative figures were linked to bearish momentum.

Interestingly, the Dogecoin exchange net position change just flipped back into positive. This could potentially signal that an accumulation event may be happening.

The spike in the exchange net position change could signal that DOGE price may be in the early stages of a potential reversal. Moreover, multiple other signals may reinforce the same point.

Dogecoin Bears Cool off Near its 12-Month Support Level

Doge price has been forming its 12-month lower range near the $0.15 price level. Unsurprisingly, its sell pressure this week leveled out within the same support zone.

The king of the meme coins traded at $0.158 at the time of observation.

Aside from sell pressure leveling out at the long-term support, Dogecoin’s Money Flow indicator also registered a slight uptick. This confirmed that buyers were scooping up some DOGE coins at the support level.

For reference, DOGE price at press time was equivalent to a 48% discount from its highest point in September. The same price point represented a 67% discount from its 12-month high, and almost 80% from its all-time high.

In other words, Dogecoin proponents may find the discounted prices attractive hence demand build-up at the current levels.

The 10 October pullback already demonstrated robust accumulation at lower prices, further making a case for the bulls.

However, it was worth noting that a bullish case may not necessarily shield DOGE price from more potential downside.

Another capitulation could still occur bearing in mind that it already happened before, and the bearish state of the market, combined with weak demand.

Here’s How Dogecoin Demand profile Looks This Week

Whales outflows dominated over the last few weeks across multiple top cryptocurrencies. This includes Dogecoin but a glance at the whale order book flows revealed that they might be building up their positions after the recent discount.

According to Coinglass, whales acquired over $8 million worth of the meme coin within the spot segment in the last 3 days. This was across Coinbase, Binance and OKX. A contrarian outcome to previously observed whale outflows.

Whales also sided with the bulls as far as derivatives were concerned. The whales cohort executed more than $9 million worth of long positions on the OKX and Binance futures during the same 3-day period.

Rising demand for whales confirmed bullish expectations. However, this may not necessarily be a guarantee considering that the said investments were relatively low, and were not tantamount to aggressive buying.

Nevertheless, demand build-up from the same cohort in the second half of the week may offer a more concrete bullish case, otherwise DOGE price may still lend itself to sell pressure.

Market forces the market’s grand scale revealed that spot outflows cooled down dramatically. Still, Dogecoin registered about $1.5 million worth of net spot outflows.

The derivatives side revealed that funding rates were back in the green. Furthermore, Dogecoin open interest jumped from less than $1.4 billion last week, to $1.66 billion at the time of observation.

These findings reflected the rising bullish confidence in Dogecoin but relatively weak demand still highlighted a cautious stance.