A new Coinbase prediction markets initiative appears to be taking shape, with leaked images revealing a Kalshi-powered platform for event-based trading across multiple sectors.

What do the leaked Coinbase screenshots reveal?

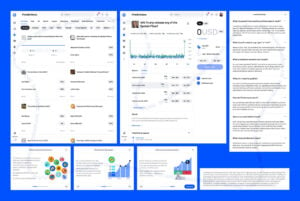

On Tuesday, tech researcher Jane Manchun Wong shared leaked screenshots suggesting that Coinbase is preparing a dedicated prediction markets website. The interface displays Coinbase branding and structured market pages, together with an FAQ section and onboarding guides tailored for new users.

The service appears to be built on Kalshi, the federally regulated prediction market approved by the US Commodity Futures Trading Commission (CFTC). One screenshot states that the product is offered by Coinbase Financial Markets, the exchange’s derivatives arm, “through Kalshi,” underscoring that it would rely on Kalshi’s regulated infrastructure for compliance.

Moreover, the images show a standard event-trading layout that seems to support USDC or USD positions. The menu lists categories such as economics, sports, science, politics, and technology, with wording that hints new markets would be added on a frequent basis.

How does this fit into the Coinbase Kalshi partnership?

Coinbase has signaled interest in event-driven trading for some time. In July, the company told CNBC that it intended to add prediction functionality as part of an overarching strategy to evolve into an “everything exchange” spanning spot, derivatives, and novel financial products.

That direction became more explicit on Nov. 13, when Coinbase and Kalshi publicly unveiled a collaboration allowing the exchange to serve as custodian for Kalshi’s USDC-based event contracts. This agreement, detailed in Kalshi’s own market documentation, positioned Coinbase as a key infrastructure partner for regulated event trading. Further details on Kalshi’s CFTC status can be found in the commission’s designated contract market order.

However, the newly leaked screenshots point to a deeper integration, with Coinbase not just acting as custodian but apparently fronting its own branded interface. The platform would still sit on top of Kalshi’s regulatory framework, aligning with US oversight while offering a user experience familiar to existing Coinbase customers.

Which assets and categories may be supported?

The images suggest that markets could be traded using USDC or USD, further expanding the stablecoin’s role inside the Coinbase ecosystem. That said, no on-chain contract addresses or final fee schedules were visible in the screenshots, so commercial terms remain unconfirmed.

Categories shown in the menu include economics, sports, science, politics, and technology. This mirrors the structure used by other event-trading venues, where contracts reference macroeconomic data releases, election outcomes, sports results, or milestones in technology and science. Moreover, language in the interface implies that additional markets would be listed regularly as new events approach.

How does Coinbase compare with rival crypto prediction platforms?

Prediction markets have experienced rapid expansion in 2024 and 2025. Platforms such as Kalshi and Polymarket have posted record trading volumes as users seek to express views on political, economic, and cultural events via binary contracts. Public dashboards from venues like Kalshi’s markets show the breadth of event-based products now available.

Exchanges have moved quickly to capture this momentum. Crypto.com recently introduced a prediction product in partnership with Trump Media, extending its brand into event-driven speculation. Meanwhile, Gemini announced last week that it is building a similar feature as part of an upcoming “super app” designed to consolidate trading, payments, and other financial tools.

In parallel, Gemini has filed with the CFTC to become a designated contract market, a critical regulatory step for offering fully supervised event contracts in the United States. If the Coinbase interface seen in the screenshots is ultimately launched, the company would join this group of major exchanges entering the fast-expanding sector for event-based crypto trading.

What does this mean for Coinbase prediction markets and regulation?

By building on Kalshi’s federally supervised framework, the planned platform would tackle one of the main hurdles facing crypto-linked prediction services: regulation. Using a partner already approved as a designated contract market by the CFTC could allow Coinbase to route users into contracts that meet existing US derivatives rules.

However, many details remain unknown. There is no public launch date, and Coinbase has not yet issued a formal statement confirming the leaked interface. Moreover, questions remain around geographic availability, leverage limits, fee tiers, and how disputes or event resolutions will be handled within Kalshi’s rulebook.

How is Coinbase expanding its business platform in Singapore?

Alongside its push into event-based trading, Coinbase is also expanding its enterprise services. The company has launched Coinbase Business in Singapore, marking the crypto exchange’s first international rollout of its business-focused operating platform for corporate users.

The new service gives local startups and small businesses access to instant USDC payments, global transfers, automated accounting integrations, and a suite of tools for day-to-day digital asset management. Furthermore, it is designed to integrate with existing finance workflows rather than replace traditional banking entirely.

The debut builds on Coinbase’s collaboration with the Monetary Authority of Singapore through the BLOOM Initiative. That program focuses on improving compliant cross-border digital payments and fostering responsible innovation. According to Coinbase, Singapore’s regulatory clarity and strong fintech ecosystem made it a logical first market for the platform.

What features does the Singapore platform offer businesses?

The Singapore rollout centers on USDC-based global payouts and lower-cost international transfers. Companies can use the platform to send stablecoin payments worldwide, then convert into local currencies where supported. An API enables automated payroll and vendor management, linking crypto treasury tools with existing HR and procurement systems.

All of this is backed by real-time SGD banking rails via Standard Chartered, which helps bridge fiat and digital asset liquidity. Importantly, Coinbase positions the service as a full financial stack that blends traditional finance and crypto under transparent local rules, rather than as a purely speculative trading product.

For Singapore’s fast-growing innovation economy, the exchange argues that such infrastructure supports companies that need both on-chain efficiency and regulated access to fiat rails. An overview of the local regulatory setting is available from the central bank’s own guide to digital token offerings.

What comes next for Coinbase in prediction and business markets?

If confirmed, the Coinbase prediction markets website built through Kalshi would mark a significant step into the maturing landscape of regulated event contracts. At the same time, the Singapore business launch shows the exchange pushing beyond retail trading into payments and enterprise-grade infrastructure.

Together, these initiatives suggest Coinbase aims to operate not just as a spot exchange, but as a broader financial platform spanning derivatives, event contracts, and cross-border business payments. How quickly the leaked interface moves to public beta and how regulators respond will determine the pace of this next phase of growth.

Source: https://en.cryptonomist.ch/2025/11/19/coinbase-prediction-markets-kalshi-platform/