Key Takeaways

How much Bitcoin does El Salvador hold now?

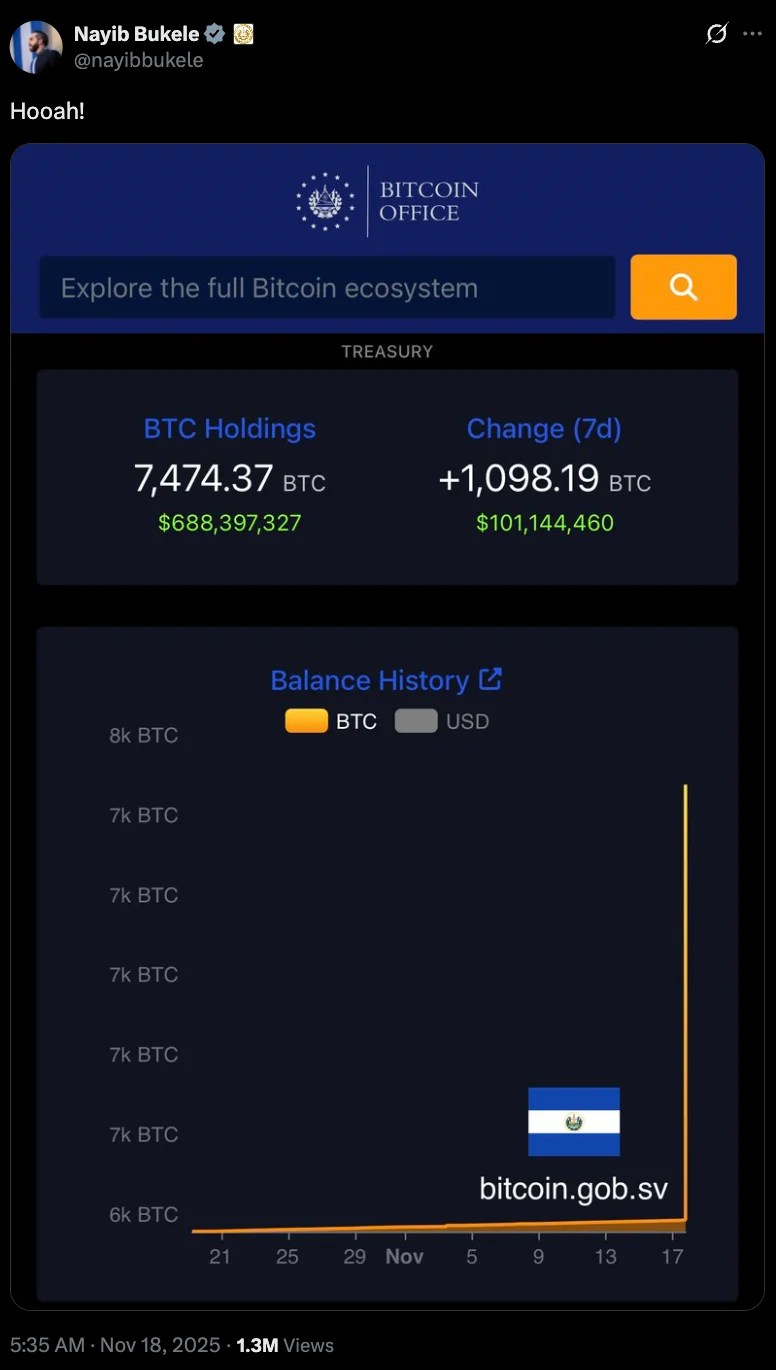

The country now holds 7,474 BTC, valued at around $676 million.

Why did the government buy more Bitcoin during a market drop?

El Salvador follows a long-term accumulation strategy and often buys during dips to maximize future value.

El Salvador has made headlines once again as it doubles down on its bold Bitcoin [BTC] strategy.

The country, already the first in the world to adopt Bitcoin as legal tender in 2021, has now executed its largest single-day BTC purchase, acquiring more than $100 million worth of the asset.

El Salvador’s new Bitcoin purchase

According to the country’s Bitcoin Office, El Salvador purchased the massive batch at 6:01 p.m. ET, bringing its total holdings to 7,474 BTC valued at roughly $676 million.

The latest buy included 1,090 BTC, added as Bitcoin briefly dipped below $90,000, its lowest price since April.

This opportunistic purchase aligns with the country’s long-term accumulation strategy, which has included buying 1 BTC daily since November 2022.

True to its pattern of buying during price drops, El Salvador continues to expand its BTC reserves with the same conviction that has influenced other nations to explore their own crypto adoption paths.

President Nayib Bukele further reaffirmed the nation’s commitment by sharing a screenshot of the new purchase on his official X account and said,

Source: Nayib Bukele/X

Bitcoin’s price action and other nations’ Bitcoin plans

His declaration arrives as BTC undergoes sharp market turbulence, falling from highs of $125,000 to $91,286.39 at press time, marking a 4.71% decline in the last day and more than 15% over the past month, according to CoinMarketCap.

Yet despite the concerning price action, various nations are not shying away from Bitcoin.

In fact, in a historic move, the Czech National Bank [CNB] recently completed its first-ever crypto investment, allocating $1 million into Bitcoin, U.S. dollar-backed stablecoins, and a tokenized deposit.

Meanwhile, France has taken an even bolder step.

The conservative UDR party has introduced a groundbreaking bill proposing the creation of a national Bitcoin reserve managed by a dedicated public institution.

The proposal calls for holding 420,000 BTC, an amount large enough to make France one of the world’s biggest sovereign Bitcoin holders if approved.

Adding to this growing momentum, Luxembourg has become the first Eurozone country to officially invest a portion of its sovereign wealth fund into Bitcoin.

As confirmed by Finance Minister Gilles Roth during the 2026 Budget presentation, the nation’s sovereign fund [FSIL] has allocated 1% of its portfolio to BTC.

What’s more?

On the other hand, despite years of crackdowns, both Japan and China are also now showing that Bitcoin mining is evolving in unexpected ways.

Japan’s government-linked, renewable-powered mining project demonstrates how BTC mining can support, rather than strain, modern energy grids.

Meanwhile, China’s quiet resurgence to 14% of global hashrate proves that mining never truly died there, instead shifting underground and adapting.

Taken together, these developments make one thing clear, and that is even as the market cools, Bitcoin is not losing its charm.