- Kraken secured $200M from Citadel, boosting valuation to $20B.

- The deal signals institutional crypto sector integration.

- Funds earmarked for global expansion, product development, IPO.

Kraken secured a $200 million investment from Citadel Securities on November 19th, raising its valuation to $20 billion. The funding supports global expansion and IPO preparation.

This substantial backing from Citadel enhances Kraken’s market position, signaling a shift in institutional attitudes towards cryptocurrency, potentially stimulating increased adoption and integration within traditional finance sectors.

Kraken Valuation Reaches $20 Billion with Citadel Boost

Kraken’s recent funding round marks a pivotal moment in its development, raising $200 million from Citadel Securities. This investment propels Kraken’s valuation to $20 billion, a significant increase from its previous $15 billion valuation in September when it raised $600 million from notable players such as Jane Street, DRW, and Oppenheimer. Kraken plans to channel these funds into expanding its global presence, particularly in regions such as Latin America, APAC, and EMEA, and in developing its portfolio of trading, payment, and staking products. The move underscores a shift in Ken Griffin’s traditionally cautious stance on cryptocurrencies, indicating Citadel‘s growing interest in digital asset markets.

Market reactions to Citadel’s involvement have been notable. Jim Esposito, Citadel Securities’ President, stated, “We’re excited to support Kraken’s continued growth as it helps shape the next chapter of digital innovation in markets.” Meanwhile, Arjun Sethi, Co-CEO of Kraken, shared that Citadel’s investment would provide expertise at the intersection of markets and technology, hinting at enhanced liquidity and risk management improvements. Despite Ken Griffin’s previous reservations, this engagement highlights a strategic pivot among traditional finance sectors towards embracing digital currencies and infrastructure.

In 2023, BlackRock’s foray into crypto through a Bitcoin ETF catalyzed substantial institutional momentum. Similarly, Citadel’s move with Kraken might set a precedent, fostering greater traditional finance participation in digital markets.

Institutional Moves Drive Crypto Market Dynamics

Did you know? Historical data suggests that involvement of major financial players could expedite regulatory developments and spur technological innovations in the crypto space.

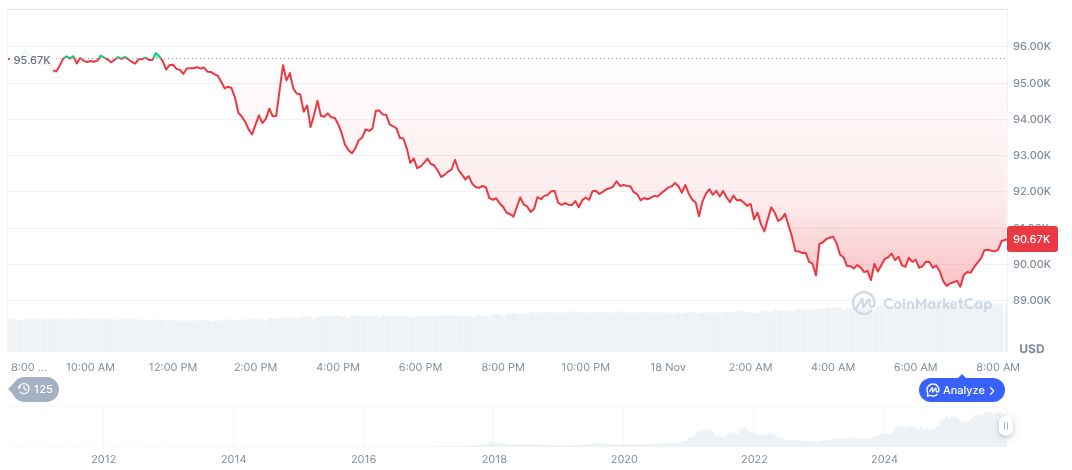

According to CoinMarketCap, Bitcoin (BTC) recently traded at $92,876.13 with a market cap of $1.85 trillion, holding a 58.37% dominance. Despite a 1.08% rise over 24 hours, BTC shows a downward tendency with a 9.73% fall over seven days. This reflects market volatility affecting major cryptocurrencies amid significant institutional maneuvers and shifts.

Expert insights from Coincu research team suggest such strategic investments may enhance liquidity provision within Kraken, promoting broader adoption of digital currencies. Historical data suggests that involvement of major financial players could expedite regulatory developments and spur technological innovations, positioning Kraken and similar platforms for robust future growth.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/kraken-200m-citadel-expansion/