- Onfolio Holdings secures $300 million for digital asset treasury.

- Investment includes Bitcoin, Ethereum, Solana.

- Market reacts with 36% increase in Onfolio share price.

Onfolio Holdings Inc. announced securing up to $300 million financing through a convertible bond from a U.S. investor to enhance its digital asset treasury, including Bitcoin.

This financing enables Onfolio to invest in key cryptocurrencies, impacting market dynamics and potentially increasing institutional participation in digital assets.

Onfolio’s $300 Million Financing Boosts Digital Asset Holdings

Onfolio Holdings announced securing up to $300 million through a convertible bond facility, allowing the company to enhance its digital asset holdings, as detailed by CEO Dom Wells. This facility primarily aims to invest in Bitcoin, Ethereum, and Solana, using these assets for staking to generate yield and support operations.

Immediate financial implications are evidenced by the first $6 million tranche expected to close on November 18, 2025, with an additional $2 million to follow within 30 days. Up to 75% of these funds are allocated for digital asset acquisition, while the rest supports operational growth.

Dom Wells, CEO, Onfolio Holdings Inc., “We’ve structured this facility to allow us to invest directly in Bitcoin, Ethereum, and Solana, and stake those assets through established digital finance platforms to earn a return on invested capital, while also adding meaningful cash to support our operations and our path toward sustained profitability.”

Bitcoin Market Insights Amid Onfolio’s Strategic Move

Did you know? Corporate treasury investments in Bitcoin, similar to those by Onfolio, have previously led to increased market confidence and price appreciations, as seen in historic moves by companies like MicroStrategy.

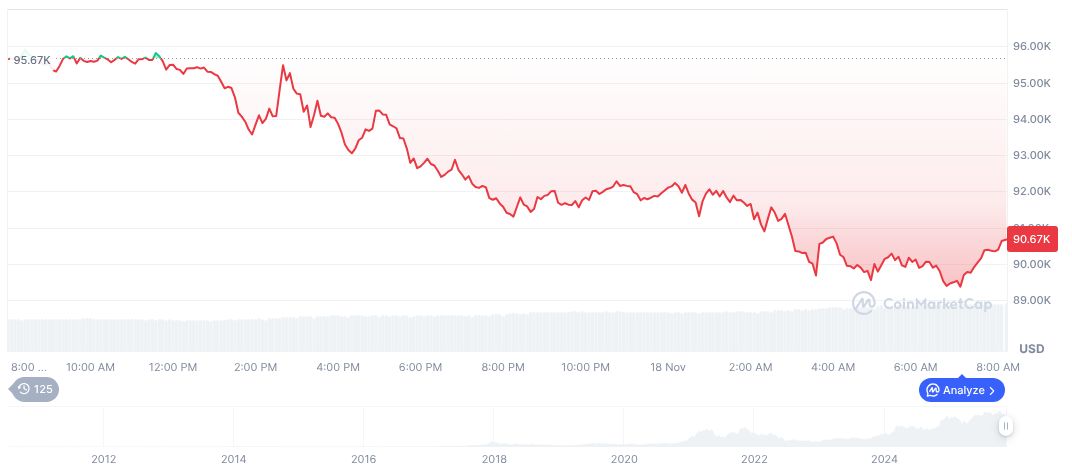

Bitcoin (BTC) currently trades at $93,342.26, with a market cap of $1.86 trillion, per CoinMarketCap. While recent 24-hour data shows a 1.39% increase, the 90-day period reflects an 18.39% decline. The circulating supply is 19,950,440 out of a 21 million max supply.

Coincu’s research suggests potential long-term positive market impact as Onfolio’s investment may encourage broader institutional participation. Historically, similar moves have resulted in elevated Bitcoin prices and trading volumes, and could lead to increased regulatory attention.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/onfolio-300m-digital-assets-treasury/