- VIX hits one-month high; crypto sentiment at extreme fear.

- Gold prices rise amid increased market anxiety.

- Crypto market shows signs of caution and consolidation.

On November 18, 2025, the VIX surged above 23 as spot gold climbed to $4060 per ounce, signaling heightened risk aversion across traditional markets and suppressed crypto activity.

This market turbulence underscores ongoing risk aversion, impacting cryptos like BTC and ETH. Fear & Greed Index at extreme lows reflects investor caution and potential consolidation.

VIX Peaks to 23.58, Drives Market into Fear

On November 18, the VIX reached 23.58, a level not seen in a month, reflecting heightened volatility in financial markets. This increase coincided with a rise in spot gold prices, peaking at $4060 per ounce, suggesting a flight to safety by investors. Economic conditions are prompting this cautious behavior, with investors and institutions seeking stability amidst unpredictable market signals. CryptoQuant Analyst Axel commented, “Given the current funding level, the market may continue to consolidate. If the VIX starts to rise, it will be a worrying risk pressure signal.”

The crypto Fear & Greed Index has fallen to 10/100, indicating a state of extreme fear. This drop has stalled trading activity, as participants remain wary of further volatility. Analysts note the ongoing consolidation, with funding rates on exchanges such as Binance remaining low. As no major crypto leaders have commented directly on these developments, speculation about the market’s next move continues to mount.

Did you know? During the 2020 market volatility peak, similar VIX spikes preceded short-term declines in Bitcoin before a subsequent bull run.

Bitcoin’s Performance Amid Historical Market Volatility

Did you know? During the 2020 market volatility peak, similar VIX spikes preceded short-term declines in Bitcoin before a subsequent bull run.

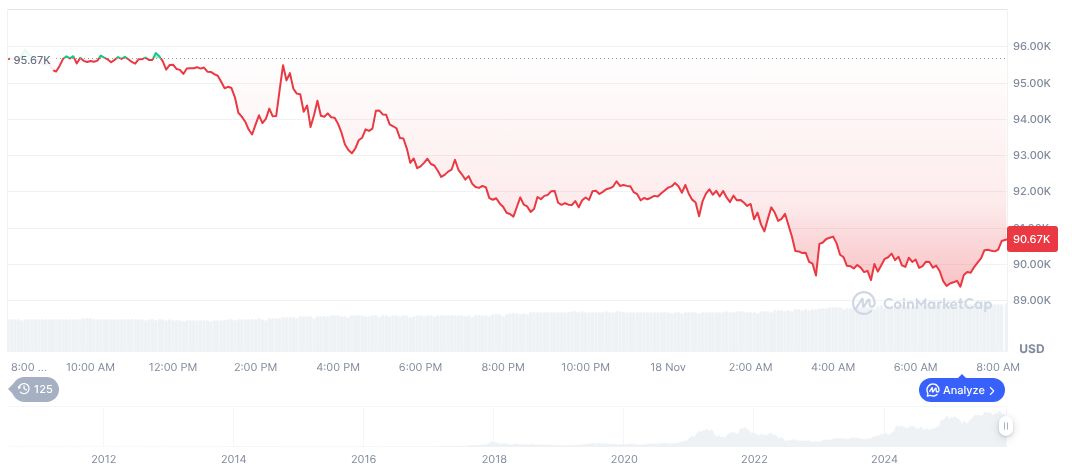

Bitcoin (BTC), as of November 18, 2025, is priced at $92,847.35, with a market cap of $1.85 trillion. Trading volume over the past 24 hours reached $104.22 billion, showing a 10.58% change. Data from CoinMarketCap highlights a 1.11% price increase in the last day following a 9.71% decline over seven days.

Coincu research suggests we may witness continued volatility in the crypto space if traditional markets remain tense. Past patterns reveal that similar trends often precede significant corrections, followed by eventual recovery as market sentiments evolve. Given the current conditions, investors are cautiously monitoring potential shifts in market dynamics.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/vix-high-crypto-sentiment-low/