- Hong Kong’s fintech initiative explores tokenizing shipping rents.

- This move aims to create traceable blockchain investments.

- Stablecoin licenses are set for 2026 issuance.

Christopher Hui, Hong Kong’s Secretary for Financial Services and the Treasury, announced plans to tokenize stable cash flows such as shipping rents on blockchain, enhancing investment opportunities and asset traceability.

Tokenizing these assets signifies Hong Kong’s commitment to pioneering blockchain in finance, potentially impacting Ethereum and stablecoin markets while promoting regulatory advancements and institutional investment.

Hong Kong Explores Tokenizing Shipping Rents on Blockchain

Christopher Hui revealed that Hong Kong is working on tokenizing stable cash flows, such as shipping rents. This initiative aims to utilize blockchain technology to create new, traceable investment products. The move is part of a larger regulatory push to integrate and regulate digital assets within Hong Kong’s financial ecosystem. The government is reviewing stablecoin license applications, planning to issue them starting next year.

Significant market changes include the potential for increased investment activity in tokenized assets. By placing shipping rents on the blockchain, Hong Kong seeks to stimulate institutional and retail interest in novel investment products. The development anticipates heightened capital inflow and advanced financial infrastructure through blockchain adoption. The regulatory stance ensures these assets are managed under clear guidelines, safeguarding investors.

Blockchain and AI are pivotal technologies in fintech, delivering tangible benefits … The tokenization of the currency market represents an attractive opportunity capable of attracting significant capital inflows. – Christopher Hui, Secretary for Financial Services and the Treasury, Hong Kong SAR

Analyzing Market Dynamics: Ethereum Trends and Regulatory Forecast

Did you know? Hong Kong’s past tokenization efforts, like gold-backed retail tokens, paved the way for stable cash flow innovations in shipping rents, advancing blockchain’s role in mainstream finance.

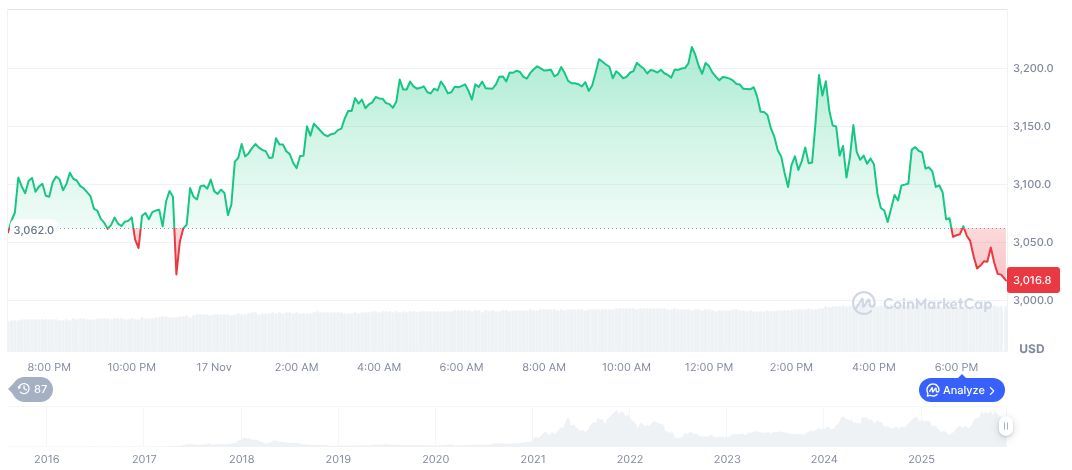

Ethereum (ETH) current data indicates market adjustments, trading at $3,067.08 with a market cap of $370.19 billion. The past quarter saw notable declines, including a 24-hour drop of 2.63%. Recent data from CoinMarketCap highlights this volatility amidst broader economic trends impacting cryptocurrencies globally.

Bold strategies from Coincu’s research predict regulatory stabilization, facilitating digital asset growth. Initial signs suggest a potential rise in digital finance adoption as regulatory frameworks mature. Historical precedents and fiat-backed expansion in blockchain initiatives may further cultivate investor confidence. Coincu’s insights underscore the importance of consistent regulatory support and technological advancement in bolstering these financial innovations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/hong-kong-tokenizes-shipping-rents/