- BitMine has significant cryptocurrency holdings totaling $11.8 billion.

- Current ETH price decline causes $2.98 billion in unrealized losses.

- Strategic expansion and market adaptation are crucial amidst volatility.

BitMine Immersion Technologies reports cryptocurrency holdings at $11.8 billion, including 3.56 million ETH, amid significant unrealized losses in its portfolio, according to recent disclosures.

The company faces a $2.98 billion unrealized loss, highlighting market volatility’s impact on institutional cryptocurrency investments.

Market Liquidity Challenges and Strategic Insights

BitMine has disclosed its significant cryptocurrency holdings totaling $11.8 billion, including 3.56 million ETH, which represents a substantial portion of their assets. Thomas Lee, Chairman of BitMine, stated the company has recently expanded its ETH holdings by acquiring over 54,000 ether for approximately $173 million.

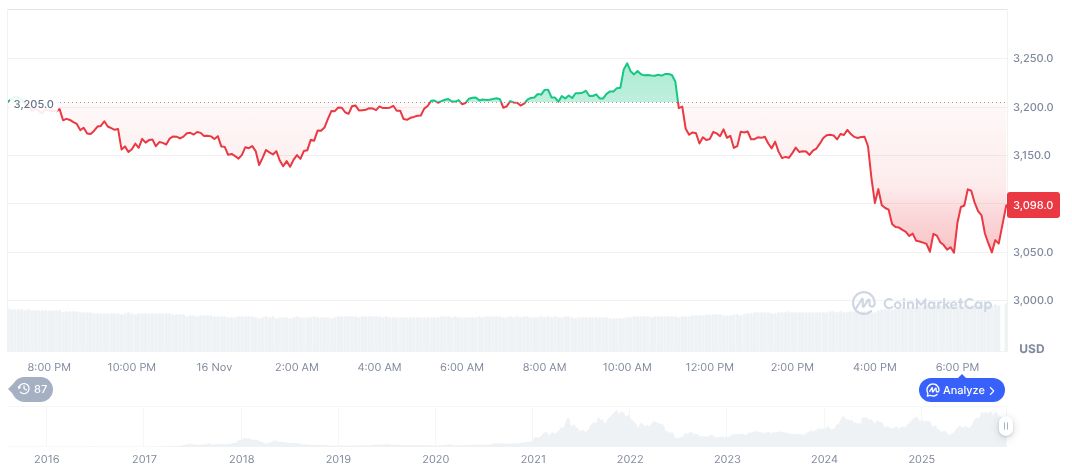

Facing a significant unrealized loss, BitMine’s comprehensive cost for ETH is estimated at $4,009, far above the current spot price of $3,120. This discrepancy results in a 21% decrease in value, equating to nearly $2.98 billion in unrealized losses according to on-chain analyst Yu Jin.

Thomas Lee, Chairman, BitMine Immersion Technologies – “The current crypto price weakness is due to reduced market liquidity in the aftermath of the October crash, but the cycle hasn’t topped yet.”

Thomas Lee addressed the ongoing market turbulence, highlighting reduced liquidity post-October crash as a cause for current price weakness. His official comments suggest the market cycle remains active, despite present challenges.

Market Data and Insights

Did you know? BitMine’s intention to control up to 5% of Ethereum’s global supply marks a bold strategy, reminiscent of MicroStrategy’s Bitcoin accumulation approach that began in 2020.

According to CoinMarketCap, Ethereum (ETH) is currently priced at $3,079.81 with a market cap of $371.72 billion, reflecting an eleven percent dominance. In recent movements, ETH has seen a 1.06% decline over 24 hours and a more severe drop of 20.55% over 30 days as of November 17, 2025.

Insights from Coincu’s research team suggest potential regulatory and financial challenges ahead for firms like BitMine, especially if Ethereum volatility persists. It highlights the need for strategic market adaptation to counteract the effects of large-scale crypto investments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/bitmine-crypto-holdings-report/