- Federal Reserve Vice Chair signals cautious approach amid easing inflation risks.

- Labor market shows gradual cooling and supply-demand balance.

- Upcoming Beige Book to guide future policy decisions.

Federal Reserve Vice Chair Philip Jefferson discussed monetary policy and economic outlook on November 17, noting a cooling labor market and diminished inflation risks during a speech in Washington, D.C.

Jefferson’s cautious monetary stance suggests stable interest rates, affecting crypto markets like BTC and ETH due to investor sentiment shifts toward risk assets amid economic policy stability.

Federal Reserve Maintains Stability as Inflation Dangers Decrease

Federal Reserve Vice Chair Philip Jefferson addressed the economic outlook on November 17, stating that the current labor market is demonstrating a gradual cooling in supply and demand dynamics. He emphasized that the monetary policy is now nearing a neutral interest rate, suggesting a more measured approach to future policy actions.

Jefferson highlighted that the dangers of rising inflation have decreased, with tariff impacts likely to be short-lived. His cautious outlook indicates that the Federal Reserve is inclined to maintain policy stability, which may not necessitate immediate changes to interest rates.

“Upward risks to inflation have diminished and the effects of tariffs may be temporary” – Federal Reserve Speech Transcript.

Crypto Markets Respond to Federal Reserve’s Neutral Rate Approach

Did you know? Periods when the Federal Reserve has signaled pauses or moderated rate increases have historically seen positive market responses in equities and crypto, particularly during previous neutral rate discussions in 2019 and 2023, boosting investor confidence and asset valuations significantly.

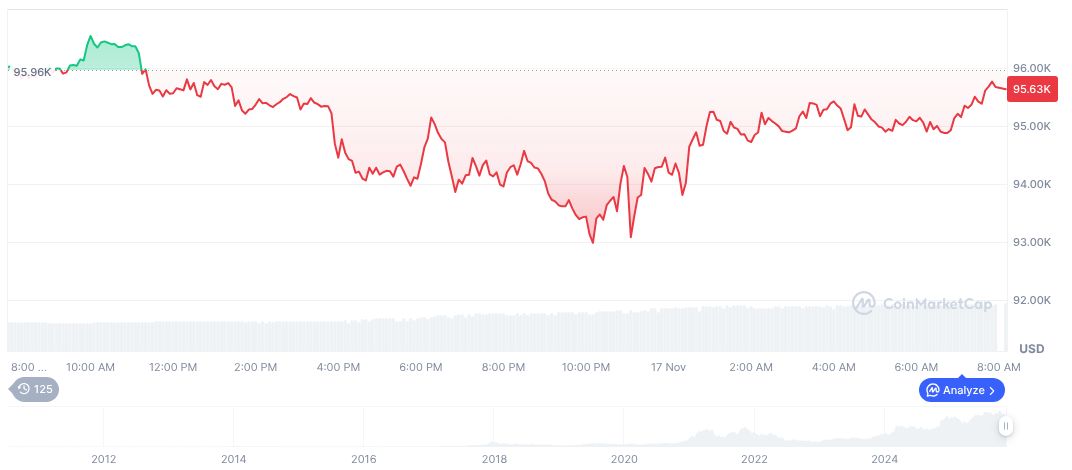

Bitcoin (BTC) is currently trading at $94,808.88, with a market cap of $1.89 trillion and dominating 58.77% of the market, according to CoinMarketCap. The 24-hour trading volume reached $84.08 billion, though BTC’s value decreased by 0.50% in 24-hours, marking a challenging period as it also recorded a 16.69% decline over 90 days.

From the Coincu research perspective, this measured Federal Reserve approach amid easing inflation risks could bolster crypto market stability. Historical trends indicate that such periods encouraged risk-taking behaviors in digital assets, supporting both price recoveries and market participation over time.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/federal-reserve-jefferson-cautious-approach/