Key Takeaways

What is driving Bitcoin’s recent decline?

Heavy selling from long-term and short-term holders, with LTHs offloading 350,000 BTC in 30 days.

Does Bitcoin still have rebound potential?

Yes—RSI is nearing oversold, but high bond yields may limit any sustained recovery.

Bitcoin [BTC] has suffered one of its steepest declines, dropping below its yearly open of $93,576 in the past 48 hours.

Recent price action on the daily chart shows the market remains in a cautious state. AMBCrypto mapped out the key factors to watch.

Locking profit amid fear

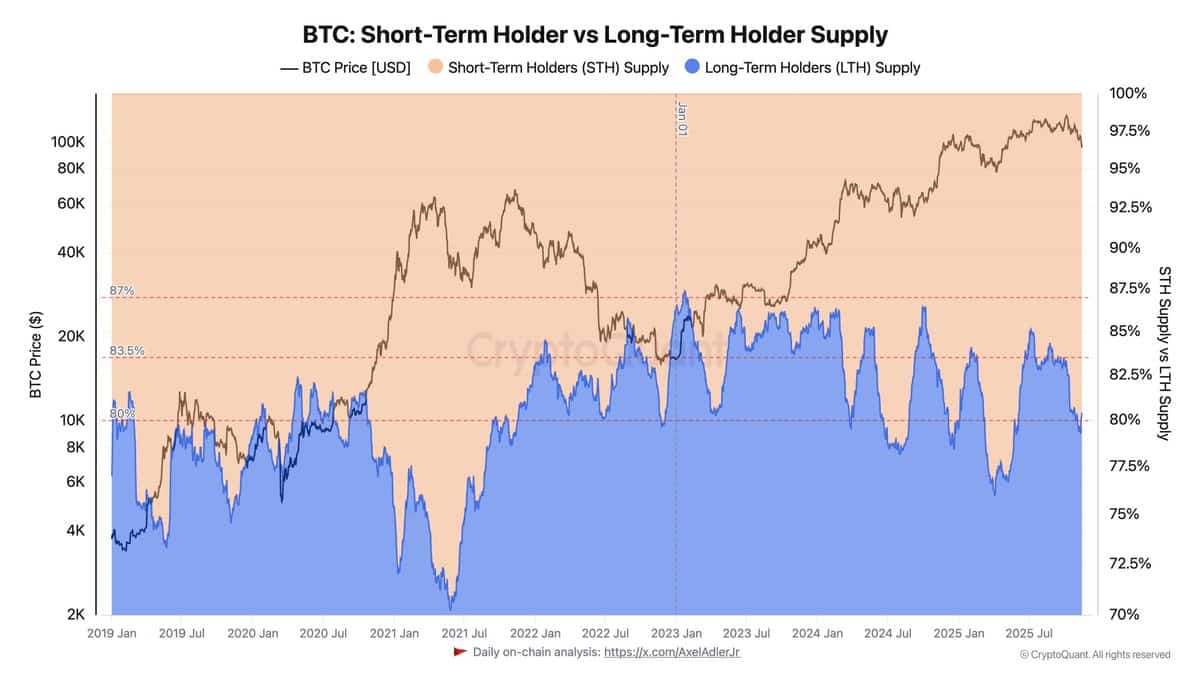

The recent downward pressure on Bitcoin has been driven largely by major holders. These wallets—known for holding Bitcoin for more than six months without spending—have now started offloading into the market.

CryptoQuant data shows that, over the last 30 days, this group has sold 350,000 BTC worth $33.49 billion at press time, with average profits reaching 173%.

Despite this, market liquidity has allowed a significant portion of these coins to be absorbed, mostly by short-term investors.

Source: CryptoQuant

However, STHs are now under pressure. The group—known for holding Bitcoin for shorter periods—has been pushed into losses.

The losses stem from being forced to sell below their average entry price of $110,500, marking a 7% drawdown.

For context, Bitcoin STHs sold 65,000 BTC worth $6 billion on 15 November—its highest level for the month.

Hope for a rebound?

Market analysis indicates that a rebound remains possible.

According to chart analysis, the Relative Strength Index (RSI) shows Bitcoin approaching oversold territory, a region that has historically supported recoveries on several occasions.

Source: TradingView

Pseudonymous crypto analyst Dark Fost noted in his chart updates that the tendency for a rebound remains high—unless broader conditions worsen.

“Given the widening spread between EMAs and the stretched RSI, a technical rebound is likely soon. If conditions worsen, these rebounds should be seen as exit opportunities.”

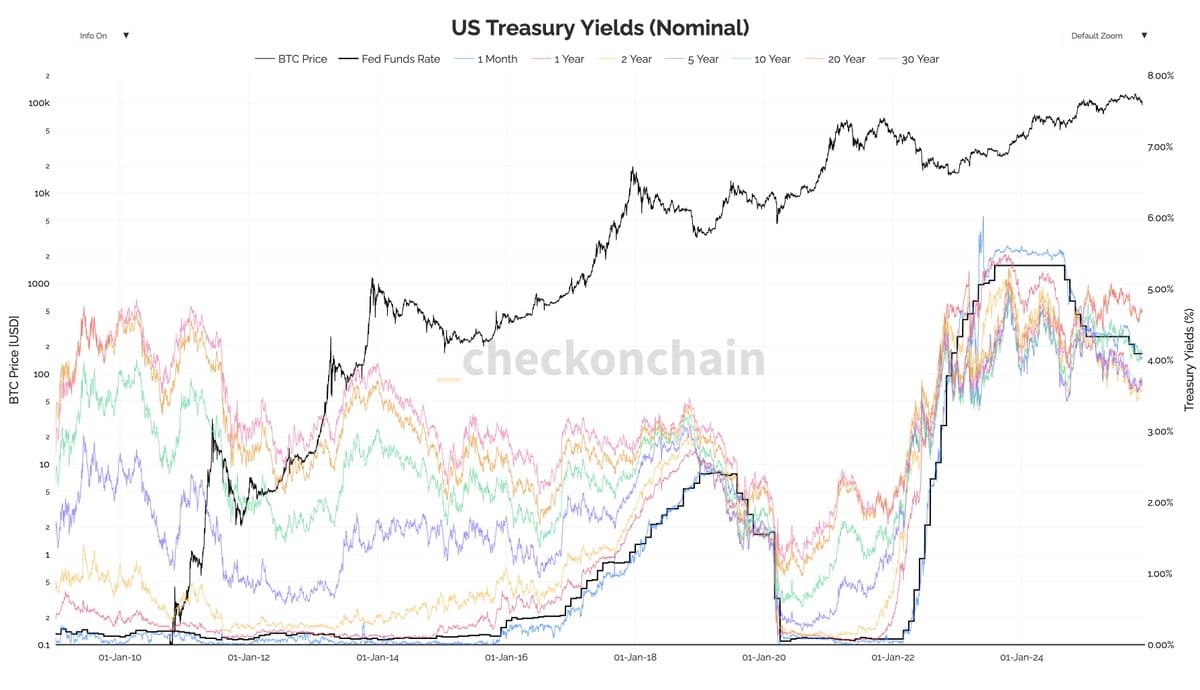

Macro sentiment still plays a role in any potential recovery, particularly bond yields. A favorable environment typically requires both lower interest rates and lower bond yields.

At the moment, interest rates are trending downward, but yields remain elevated. Until both metrics ease, Bitcoin may not feel the full macro impact.

Source: CryptoQuant

Bear market could be minimal

According to Dark Fost, even if Bitcoin fails to rebound and enters a bearish phase, the decline could be short-lived.

His view is based on comparisons to previous market cycles and leverage trends.

Compared to the past five cycles, Bitcoin’s current correction is the most minimal—down 28%, versus the 60% decline seen in 2020—despite high leverage.

Source: CryptoQuant

For context, for every $1 deployed in spot, roughly $4 has been deployed in futures, masking the extent of actual downside.

He added a caveat: volatility continues to cool, especially after the historic $19 billion liquidation event on the 10th of October.

“Over time, volatility keeps decreasing while market capitalization grows, which is perfectly logical. BTC volatility has recently hit the lowest level in its entire history.”

This suggests that Bitcoin’s ongoing correction is likely to remain limited as the market continues to mature.

Source: https://ambcrypto.com/bitcoin-sths-forced-to-sell-65k-btc-in-a-day-but-alls-not-lost/