Bitcoin and altcoins are experiencing sharp declines due to the US government shutdown and fading expectations for the Fed’s December interest rate decision.

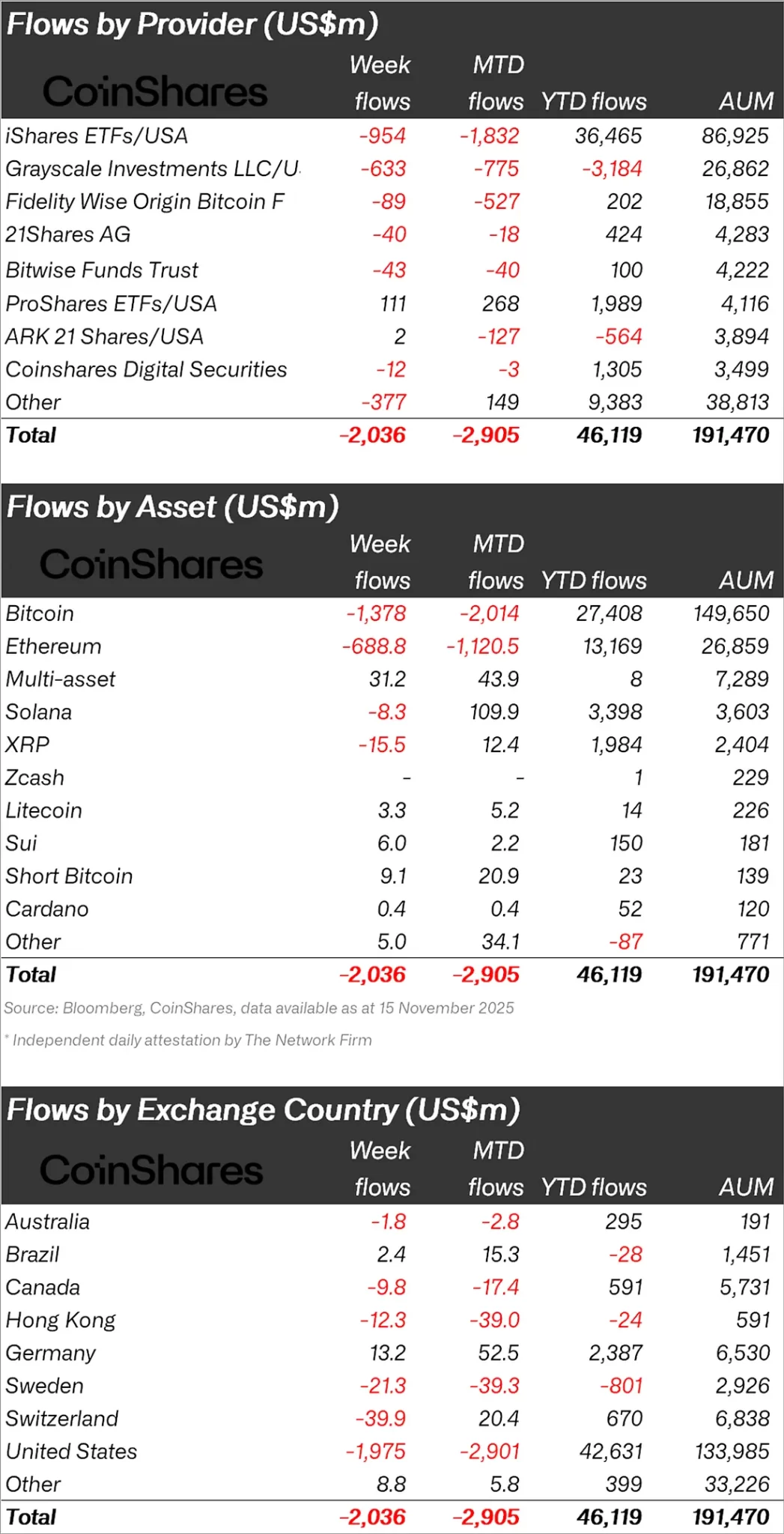

While this situation was also reflected in Bitcoin, Ethereum and altcoin funds, Coinshares published its weekly cryptocurrency report and stated that there was an outflow of $2 billion last week.

“Cryptocurrency investment products saw an outflow of $2 billion last week, driven by monetary policy uncertainty and crypto whale sales.”

Outflows Concentrate on Bitcoin and Ethereum!

When looking at individual crypto funds, it was seen that the majority of outflows were in Bitcoin.

While Bitcoin experienced an outflow of $1.37 million, Ethereum (ETH) experienced an outflow of $688 million.

Looking at other altcoins, inflows in Solana (SOL) and XRP gave way to outflows. Solana saw $8.3 million in outflows and XRP $15.5 million, while Sui (SUI) saw $6 million in inflows and Litecoin (LTC) $3.3 million.

Bitcoin was the hardest hit by the adverse weather conditions, with outflows totaling $1.38 billion last week. This three-week wave of outflows represents 2% of total asset holdings.

Ethereum, on the other hand, performed proportionally worse, with last week’s $689 million outflow representing 4% of the asset’s assets.

Solana and XRP also experienced minor outflows of $8.3 million and $15.5 million, respectively.

When looking at regional fund inflows and outflows, the USA ranked first with an outflow of $1.97 billion.

Following the USA, Switzerland experienced an outflow of $39.9 million and Sweden $21.3 million.

In the face of these outflows, Germany experienced a small inflow of $13.2 million and Brazil $2.4 million.

*This is not investment advice.