- Belarus supports Bitcoin mining for economic autonomy amid dollar dependence.

- Lukashenko envisions surplus energy for crypto mining.

- No direct commentary from global crypto leaders has surfaced yet.

On November 14, 2025, Belarusian President Alexander Lukashenko reaffirmed support for Bitcoin mining to enhance economic autonomy during a government energy strategy meeting.

This positions cryptocurrencies as potential growth tools amid geopolitical tensions, potentially boosting Belarus’ economic independence.

Belarus Utilizes Surplus Energy for Economic Growth

President Lukashenko has reinforced support for Bitcoin mining, aligning it with Belarus’s goal to increase economic autonomy. At a recent government meeting, he highlighted digital currencies as potential tools against dollar dependency, leveraging the country’s surplus energy.

Shifts in mining operations could reposition industrial energy consumption, redirecting excess electricity from facilities like the Belarusian Nuclear Power Plant to cryptocurrency mining pursuits. The energy redirection is viewed as economically beneficial, offering a new revenue stream and strategic resilience.

Alexander Lukashenko, President of Belarus – “Our entire world is now grappling with a global problem, namely moving away from dependence on a single currency, the dollar. This process will intensify. Cryptocurrency is probably one of the options.”

Bitcoin Price Dynamics and Regulatory Impact

Did you know? The legal framework established by Decree No. 8 in 2017 was among the earliest in the region, reducing regulatory uncertainty for miners, paving the way for initiatives like El Salvador’s Bitcoin adoption efforts.

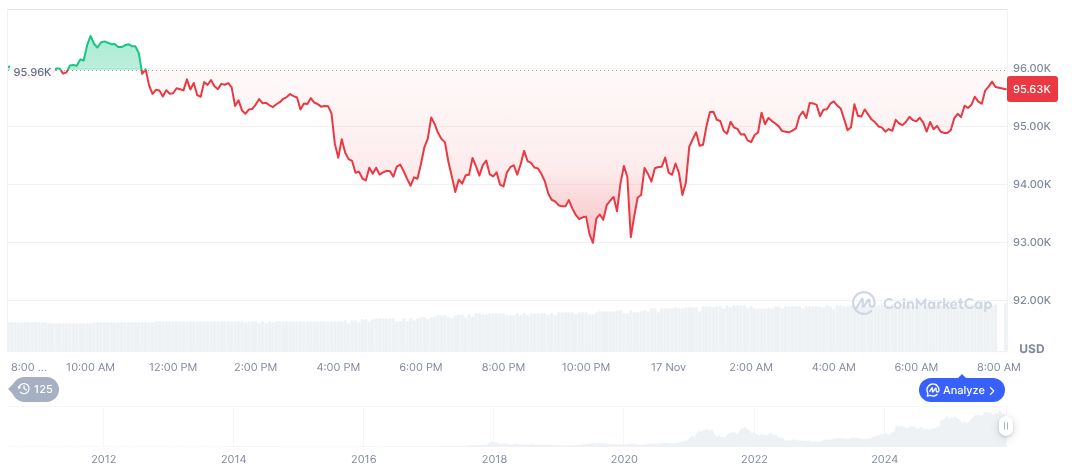

According to CoinMarketCap, Bitcoin (BTC) currently trades at $95,326.93, with a market cap of $1.90 trillion. It holds 58.63% dominance, and its fully diluted market cap is $2.00 trillion. Recent movements show a 0.69% decline over 24 hours, with larger drops over longer durations, including -10.70% over 30 days. 19,948,812 BTC are in circulation, from a max supply of 21 million. Data as of November 17, 2025, highlights Bitcoin’s volatile dynamics, yet its strategic value remains high.

The Coincu research team notes potential increases in foreign blockchain investments, spurred by Belarus’s regulatory approach and energy resource management. This strategic positioning might attract local and international miners, resulting in increased technological collaboration and economic integration within the crypto ecosystem. The planned CBDC rollout could further reinforce these advancements.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/belarus-bitcoin-mining-economic-shift/