- Morgan Stanley forecasts S&P 500 at 7,800 by 2026.

- Projection influences crypto and financial markets.

- Gold, Dollar Index, and major altcoins affected.

Morgan Stanley projects the S&P 500 to reach 7,800 by 2026, alongside a US Dollar Index decline to 94 with a rebound and gold’s potential rise to $4,500.

These forecasts could trigger significant shifts in crypto valuations, as potential S&P 500 growth and dollar fluctuations influence global market liquidity and investment dynamics.

S&P 500 Forecast and Market Dynamics

Morgan Stanley recently issued a 2026 forecast anticipating the S&P 500 will reach 7,800 points. The institution projects the US Dollar Index will drop to 94 in early 2026 before rising to 99 by year-end.

Expectations of a weaker dollar could bolster cryptocurrency markets, aligning with trends where declining dollar strength has historically supported digital asset valuations.

Market experts and analysts have shown mixed reactions. The expectation for gold prices to reach $4,500 per ounce by 2026 reflects a bullish sentiment on inflation hedges, affecting perceptions around crypto as a ‘digital gold’. As noted by Morgan Stanley Analysts, “Gold Pullback Is an Opportunity! Morgan Stanley Predicts: Gold Price to Reach $4,500 by Mid-2026.”

Cryptocurrency Trends Linked to Dollar Cycles

Did you know? Historical cycles of the US Dollar weakening have coincided with major cryptocurrency bull runs, most notably during the 2020-2021 period when digital assets showed significant growth.

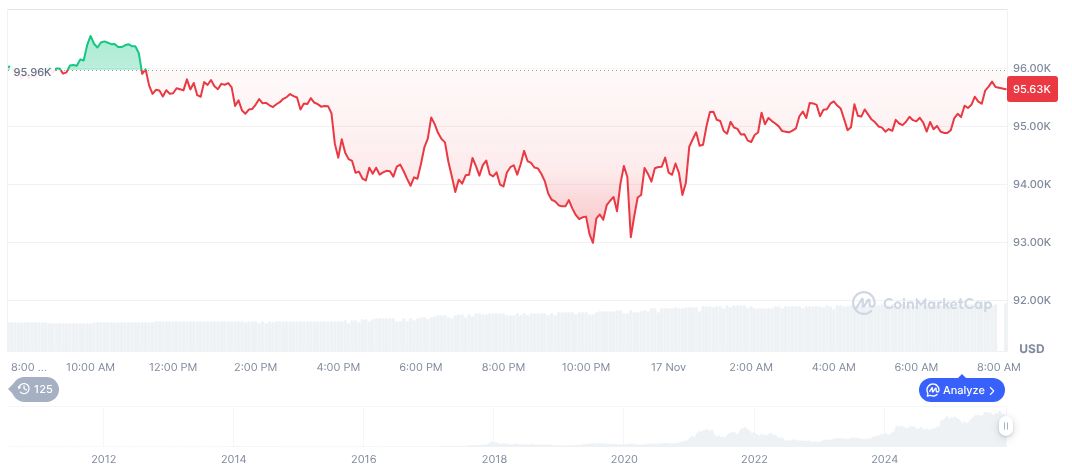

According to CoinMarketCap, Bitcoin (BTC) currently trades at $95,653.31, with a 24-hour trading volume of $78.06 billion, despite a 0.27% decline in the last 24 hours. It maintains a market dominance of 58.75%.

The Coincu research team highlights potential bullish trends in financial and regulatory landscapes, driven by ongoing projections in traditional markets, which could present opportunities for cryptos like BTC and ETH.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/morgan-stanley-sp500-forecast-2026/