The crypto market has experienced a challenging period, marked by extreme volatility and uncertainty. Fear and panic have dominated sentiment, driving significant price swings and cautious behavior in the market.

Despite this, there is evidence that the market is not fundamentally broken, though manipulation remains a factor, primarily benefiting those accumulating large positions in Bitcoin, XRP, and other major assets.

Historical context provides insight, as previous government shutdowns have been followed by sharp recoveries in Bitcoin, sometimes exceeding 700% gains, suggesting that periods of uncertainty can precede substantial upside when liquidity returns.

Will the Federal Reserve Hold Off on a December Rate Cut?

Currently, key economic factors, including Federal Reserve decisions, contribute to market uncertainty. With the recent government shutdown, crucial economic reports such as CPI, PPI, and employment data were delayed, creating uncertainty across the market.

Investors now see less than a 50% chance of a Fed rate cut in December, according to a post from DustyBC Crypto on X. Federal Reserve Chair Jerome Powell was clear when he recently warned that a December cut is not guaranteed.

Comments from other Fed officials reflect growing hesitation about whether the central bank should move forward with a third straight policy easing at the Dec. 9–10 meeting.

As a result, market expectations have shifted. Just a few days ago, traders were assigning stronger odds to a quarter-point cut, but those expectations have now settled into a highly uncertain outlook, according to futures data from the CME Group’s FedWatch tool.

Overall, the mixed signals from policymakers are keeping investors cautious as they wait for clearer direction from upcoming economic data.

Bitcoin Faces Breakdown: Can $BTC Rebound After Closing Below the 50-Week Average?

According to the crypto YouTube channel Crypto Underground, Bitcoin is facing increasing bearish pressure after closing below the 50-week moving average for the first time in the current bull cycle.

The weekly candle settled at around $94,400, bringing the asset closer to filling the remaining gap near $91,000. Despite this weakness, technical indicators on the daily chart show deeply oversold conditions, suggesting a relief bounce may occur soon.

Key resistance lies near $110,000, where a rally into the developing death cross will determine whether a full bear market is confirmed. Failure to reclaim that level on both daily and weekly closes would indicate a decisive shift into bearish territory.

Until this crucial bounce unfolds, Bitcoin remains at a pivotal moment that will determine whether the bull trend resumes or the broader downtrend takes control.

Source – Crypto Underground YouTube Channel

Harvard Moves $443M Into IBIT, Making Bitcoin Its Biggest ETF Investment

Meanwhile, Harvard University’s endowment has revealed a $443 million holding in BlackRock’s iShares Bitcoin Trust (IBIT), making it the fund’s largest known equity stake in a spot bitcoin ETF.

Bloomberg senior ETF analyst Eric Balchunas highlighted that it is uncommon for major endowments to invest in exchange-traded funds, particularly at elite institutions such as Harvard or Yale.

Although the position accounts for about 1% of Harvard’s total assets, it is sufficient to place the university 16th among IBIT shareholders. The investment also became Harvard’s largest reported holding in its 13F filing and represented its most substantial increase in Q3.

Institutional investors like Harvard usually steer clear of ETFs, favoring private equity, real estate, and direct investments, making this IBIT allocation especially noteworthy.

Layer-2 Crypto Presale Boosts Bitcoin Speed, Lowers Fees, and Enables DeFi

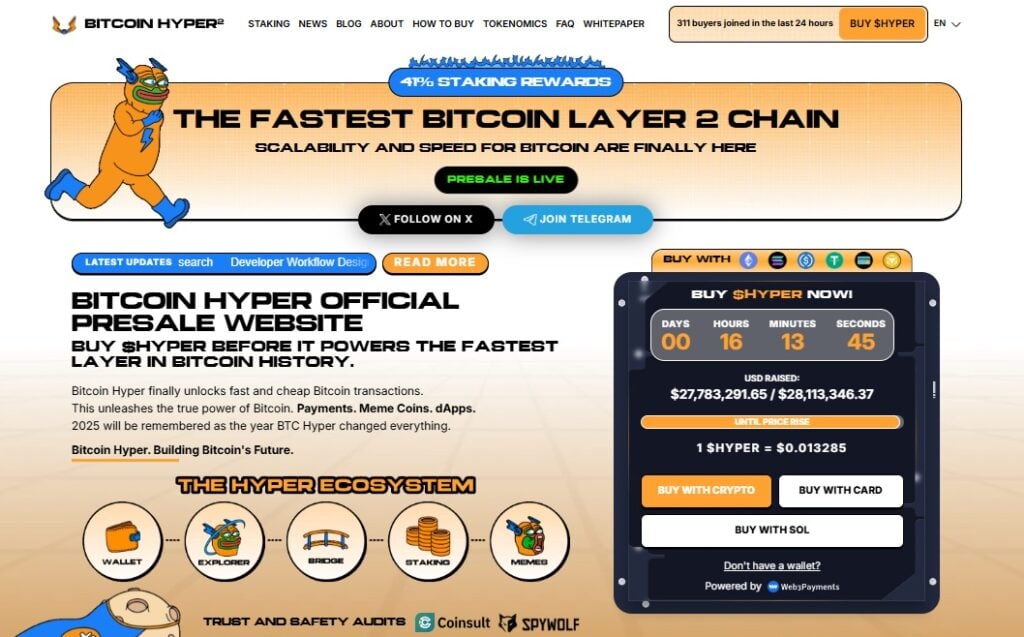

While many retail investors have exited, some are still seeking high-upside opportunities alongside Bitcoin. One example is the Bitcoin Hyper presale, which recently recorded a massive on-chain purchase of around $502K, pushing its total funds raised to nearly $28 million.

Bitcoin Hyper is a Bitcoin Layer-2 solution designed to provide the speed and scalability that the original blockchain lacks. The project enables fast, low-cost Bitcoin transactions, addressing long-standing issues with slow processing times and high fees.

By using a canonical bridge and smart contract verification, Bitcoin can be seamlessly minted onto the Layer-2 network, allowing near-instant transfers and minimal transaction costs.

The system supports advanced functions such as DeFi, staking, decentralized exchanges, and meme coin activity, all powered by Solana’s high-throughput virtual machine. Security is reinforced through zero-knowledge proofs and regular settlement commitments to Bitcoin’s Layer-1.

With strong technical foundations and increasing visibility across major crypto media outlets, Bitcoin Hyper is positioning itself as a meaningful expansion of Bitcoin’s utility. To take part the HYPER token presale, visit bitcoinhyper.com.

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.