In Brief

- Only 5% of top 500 altcoins remain in profit, entering historic capitulation territory.

- Bitcoin drops 23% from ATH, matching previous cycle lows and pressuring short-term holders.

- $2.3B in long liquidations and negative Coinbase premium signal ongoing market weakness.

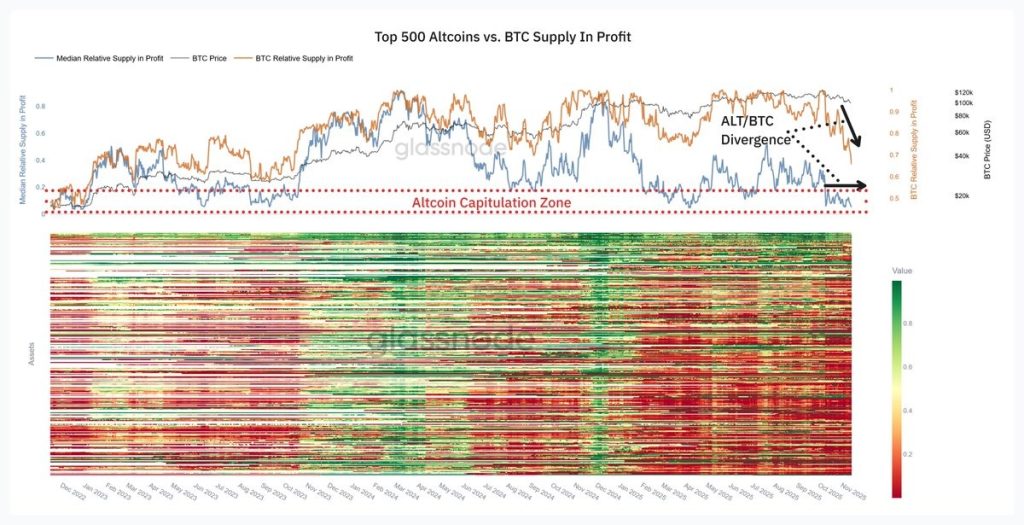

Altcoin holders are under extreme pressure as only 5% of the top 500 altcoins remain in profit, according to Glassnode. Median altcoin profit supply has entered the historical capitulation zone, showing a sharp divergence from Bitcoin’s more stable supply in profit.

Despite Bitcoin holding relatively higher profit levels, the divergence from altcoins has grown, signalling broader market stress. The BTC relative supply in profit remains above 60%, while altcoins have fallen below 20%, marking a rare decoupling.

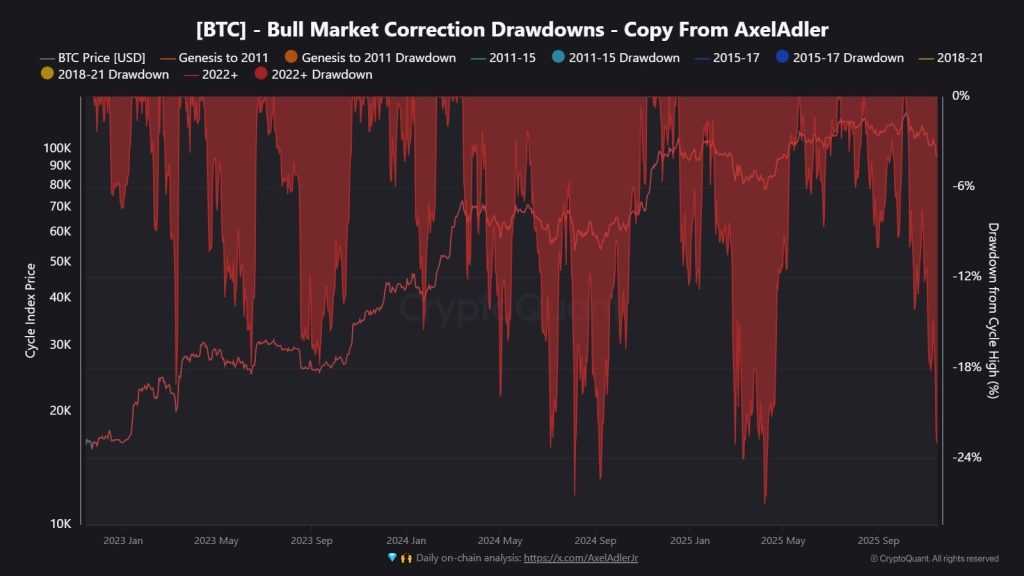

This contrast is intensifying as Bitcoin itself is now down 23% from its all-time high, mirroring April 2025’s correction, CryptoQuant reports. The ongoing drawdown has reached -23%, close to prior major corrections of -26% and -28% in September 2024 and May 2025, respectively.

However, this correction is impacting the market more severely, with Bitcoin’s supply in profit dropping to 69.5%, the lowest since October 2023. This drop suggests that short-term holders (STH) are facing one of the most challenging phases in the current cycle.

Liquidations Surge While Coinbase Premium Remains Deeply Negative

Over $2.3 billion in long positions were liquidated in the past week, Coinglass data shows. Although smaller than the $16 billion spike in October, the trend shows sustained trader exhaustion.

Adding to bearish pressure, Bitcoin’s Coinbase premium index remains negative, signalling persistent sell pressure from US-based investors. A prolonged negative premium suggests lack of institutional buy support and adds weight to the recent correction.

Meanwhile, CryptoQuant highlights that Bitcoin’s 90-day supply in profit change is sharply negative, adding to signs of cyclical stress. Bitcoin’s price decline to around $95,000 further confirms sentiment deterioration, especially with no strong recovery signs.

Altcoins, already battered, now show signs of mass capitulation, while Bitcoin enters critical technical territory. Analysts urge close monitoring over the next few weeks as the market tests key thresholds across multiple metrics.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/altcoin-profits-collapse-as-bitcoin-hits/