Key Takeaways

What’s driving Zcash’s recent surge in price and market cap?

Anticipation of shielded ZEC purchases via Zashi Wallet has sparked aggressive buying across spot and Futures markets.

What price levels are critical for ZEC’s next move?

ZEC must break above $750 to target $875, or it may find support near $495 if momentum fades.

Since hitting a low of $423, Zcash [ZEC] has closed at higher highs for three consecutive days. As a result, the altcoin held above both its short-term and long-term Moving Averages.

In fact, at press time, Zcash was trading at $673, up 30.72% on daily charts. This price uptick was backed by an 82% jump in trading volume.

Equally, its market cap has jumped by 35%, making it the 12th-largest cryptocurrency. But what’s behind this upsurge?

Shielded Zcash purchases trigger speculation

Despite broader crypto market volatility, the Zcash market has remained optimistic, largely due to the upcoming launch of shielded transactions on the Zashi Wallet.

Starting next week, users will be able to privately swap other cryptocurrencies into shielded ZEC via Zashi Wallet, a feature powered by Near Intents and highly anticipated by the community.

Source: Josh Swihart

With this feature, investors can swap their coins, such as Bitcoin [BTC], into shielded ZEC at the same nominal value. While the feature has received praise from many in the market, it has also drawn sharp criticism from ZachXBT.

The on-chain monitor warned of potential leakage from using Zcash transparent addresses for refunds.

Buyers stage a strong comeback

Zcash recorded three consecutive days of positive Buy Sell Delta. Over the past 24 hours, the altcoin saw 1.6 million in Buy Volume compared to 1.4 million in Sell Volume.

Source: Coinalyze

As a result, the altcoin recorded a positive Buy Sell Delta of 200K, a clear sign of aggressive spot accumulation.

Futures are even more aggressive.

After the market signaled recovery, investors rushed into the futures market to strategically position themselves.

In fact, buyers have dominated the futures market over the past week, as evidenced by Futures Taker CVD. This metric has remained green throughout the past week, signaling buyer dominance.

Source: CryptoQuant

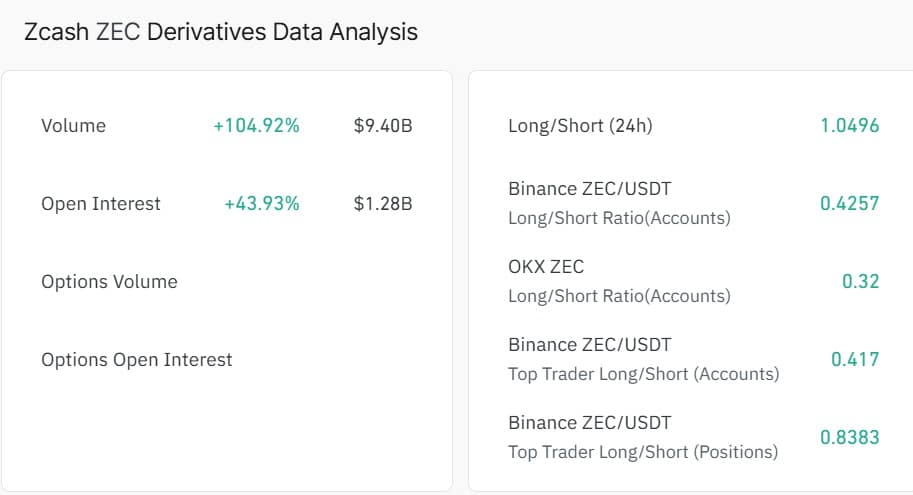

Coupled with that, Derivatives Volume surged 104.92% to $9.4 billion, while Open Interest jumped 43.93% to $1.28 billion, at press time. When these metrics rise together, it indicates increased participation and capital inflows into futures.

Meanwhile, the Long Short Ratio rose to 1.04, suggesting that most of these buyers entered the market to take long positions.

Source: CoinGlass

As such, most participants are bullish and anticipate prices to rise further in the near term.

What’s next for ZEC?

Zcash bounced back amid soaring speculation over the upcoming shielded ZEC purchases next week. Riding in this wave, the altcoin’s demand recovered across the spot and futures markets.

As a result, the altcoin’s Stochastic Momentum Index (SMI) made a bullish crossover, rising to 6.6, indicating strong upward momentum.

Source: TradingView

When this metric crosses over, it usually indicates growing buyer dominance and potential for higher prices. If demand remains strong, ZEC could break through the $750 resistance and target $875.

However, if the breakout fails, ZEC is likely to find support near $495, where the 18-day moving average currently sits.

Source: https://ambcrypto.com/zcash-heres-why-zec-traders-think-875-may-be-next/