- Fed’s rate cut probability hints at market shifts.

- 44.4% chance of rate cut in December.

- Crypto assets may gain from expected dovish policies.

According to CME FedWatch data on November 16, 2025, the probability of a Federal Reserve rate cut in December is 44.4%, with a 55.6% chance of no change.

Market reactions suggest increased demand for BTC and ETH as speculators expect a liquidity boost from potential Fed dovishness.

Fed Rate Cut Odds: A 44.4% December Probability

Current data highlights the Federal Reserve’s position on interest rates. As of mid-November, there is a 44.4% probability of a December rate cut, with a 55.6% chance rates remain unchanged. Key Federal Reserve figures, including Chair Jerome Powell, have indicated that such a move is not certain, noting potential internal disagreements.

A rate cut could potentially invigorate risk assets within the cryptocurrency market, allowing BTC and ETH to continue benefiting from expanded liquidity. Current trends show an increased interest in digital assets, as low-interest environments generally make cryptocurrencies more attractive due to reduced yields on traditional assets.

High-profile personalities in the cryptocurrency field, such as Arthur Hayes and Raoul Pal, have publicly expressed that a rate cut might lead to notable growth in Bitcoin and Ethereum. Market participants continue to watch the Federal Reserve closely for any clues on upcoming monetary policy decisions.

Crypto Market’s Potential Boost from Fed Policy Moves

Did you know? In 2020, previous rate cuts by the Fed led to substantial rallies in Bitcoin and Ethereum, showcasing the potential impact of fiscal policy shifts on crypto assets.

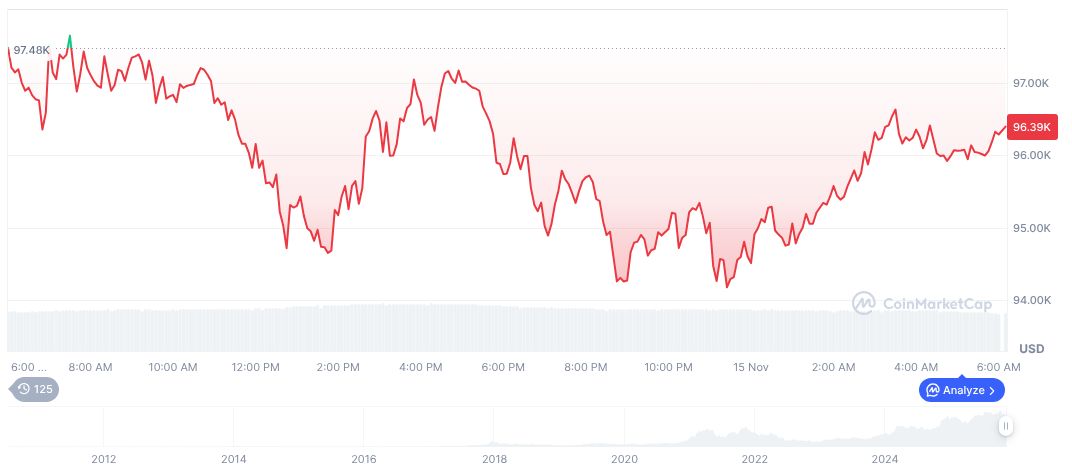

According to CoinMarketCap, Bitcoin (BTC) is currently priced at $95,280.99, with a market cap of approximately $1.90 trillion. Despite recent fluctuations, including a 0.36% increase over 24 hours, BTC’s value has decreased by 18.76% over the past 90 days. Market activity shows decreased trading volumes by over 67% as of November 16, 2025.

Coincu’s research team notes potential financial outcomes, suggesting cryptocurrencies could benefit from increased liquidity resulting from lower interest rates. Historical patterns suggest digital assets respond well to favorable macroeconomic conditions, providing fertile ground for growth in decentralized finance activities.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-rate-decision-crypto-impact-8/