Disclaimer: This content is a sponsored article. Bitcoinsistemi.com is not responsible for any damages or negativities that may arise from the above information or any product or service mentioned in the article. Bitcoinsistemi.com advises readers to do individual research about the company mentioned in the article and reminds them that all responsibility belongs to the individual.

Ripple has finally reached the moment it’s been fighting for for years. The first spot XRP ETF has launched in the United States, and CEO Brad Garlinghouse has immediately jumped online to acknowledge what the market has been waiting for since the early days of the SEC v. Ripple case.

His brief article carried the weight of a decade-long struggle: regulatory crackdowns, court delays, and an industry watching as XRP remained the only top-tier asset without an ETF product. Today, that era has ended.

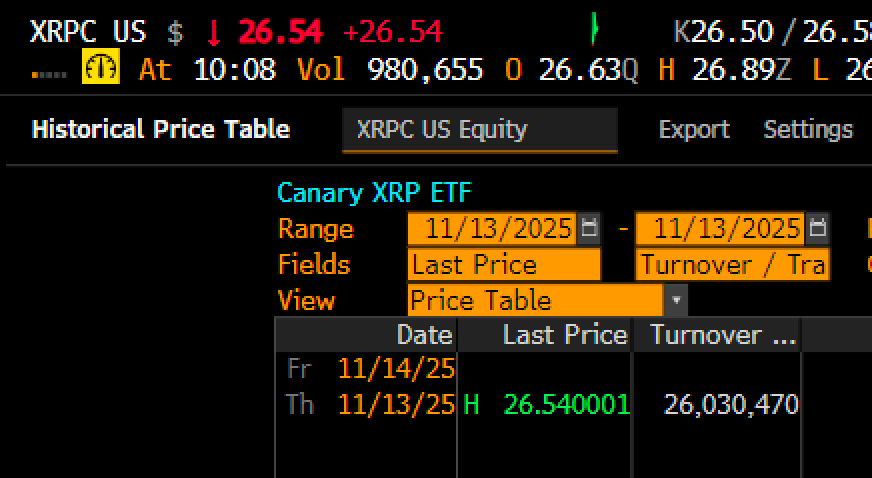

XRPC’s Fiery Debut

Transactions opened and XRPC exploded.

More than $26 million worth of shares had changed hands in 30 minutes. That’s not just a “strong start.” This makes XRPC poised to challenge the year’s best ETF debut: Bitwise’s Solana ETF ( BSOL ) currently holds the 2025 record with $57 million on its first day.

Bloomberg ETF analyst Eric Balchunas says XRPC could easily surpass this limit if early demand continues at this pace.

This kind of volume confirms what Ripple supporters have been arguing for years: there is deep, unmet demand for regulated XRP exposure in US markets.

Bitwise CIO Matt Hougan contributed one of the clearest explanations of XRPC’s explosive start:

“The median opinion on a crypto asset doesn’t determine the success of an ETF. You’d rather have 20% of people like an asset than 80% of people vaguely like it. ETFs die from apathy, not disagreement.”

XRP has never suffered from a lack of interest. It boasts one of the most active global communities in crypto, sustained institutional interest, and years of pent-up demand due to a regulatory freeze that previously prevented a US ETF from launching.

The Bigger Picture

As previously reported, ETF expert Nate Geraci said the spot XRP ETF would deal a final blow to the aggressive anti-crypto stance of previous SEC leaders. The successful launch of the XRPC is a symbolic milestone not just for XRP but for any asset seeking regulatory clarity.

Garlinghouse didn’t need a long explanation. The numbers spoke for themselves: $26 million in 30 minutes.