Key takeaways

Why is Grayscale going public in 2025?

Grayscale aims to raise capital and reduce its reliance on ETFs amid rising competition and outflows.

What caused Grayscale’s revenue decline this year?

The firm’s overdependence on GBTC and ETHE, which saw massive outflows, led to reduced earnings.

In 2025, high-profile crypto firms have taken the opportunity to go public amid crypto-friendly policies.

Some of these firms include Circle and the crypto exchange Gemini. With the wave of companies rushing to get SEC approval before the 2026 Midterm elections, Grayscale has also followed suit.

Grayscale file IPO to go public

In a significant development, Grayscale has filed to go public on the New York Exchange, becoming the latest crypto firm to seek a U.S. listing.

The firm submitted its S-1 registration form to the United States Securities and Exchange Commission (SEC) on the 13th of November 2025.

However, the filing failed to disclose the number of shares to be sold or the value of those shares. According to reports, the company will remain under Digital Currency Group’s control.

Importantly, Grayscale will reserve a part of the IPO allocation for investors in its Bitcoin spot ETF and Ethereum ETF. These investors will gain early access to Gray shares through a directed share program.

Grayscale’s revenue plummets

Grayscale’s IPO filing reveals a notable revenue decline between January and September 2025.

During this period, the firm reported $318.7 million in gross revenue and $203.3 million in net revenue.

In comparison, the same timeframe in 2024 saw $397.9 million in gross revenue and $223.7 million in net revenue, highlighting a significant year-over-year drop.

Significantly, Grayscale recorded a sharp drop in revenue due to its overreliance on its ETFs. According to the filing, Grayscale’s GBTC and ETHE make up 70% of the firm’s total assets under management.

At the same time, fees from these two funds accounted for 88% of its total revenue over the nine months ending in September 2025.

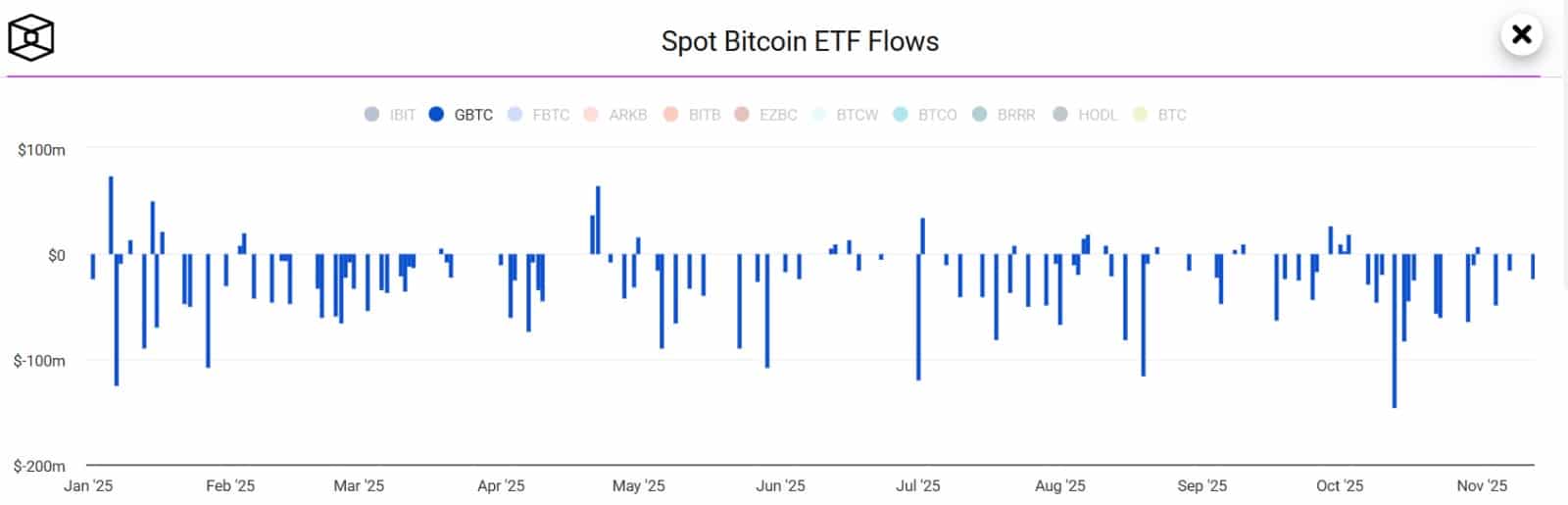

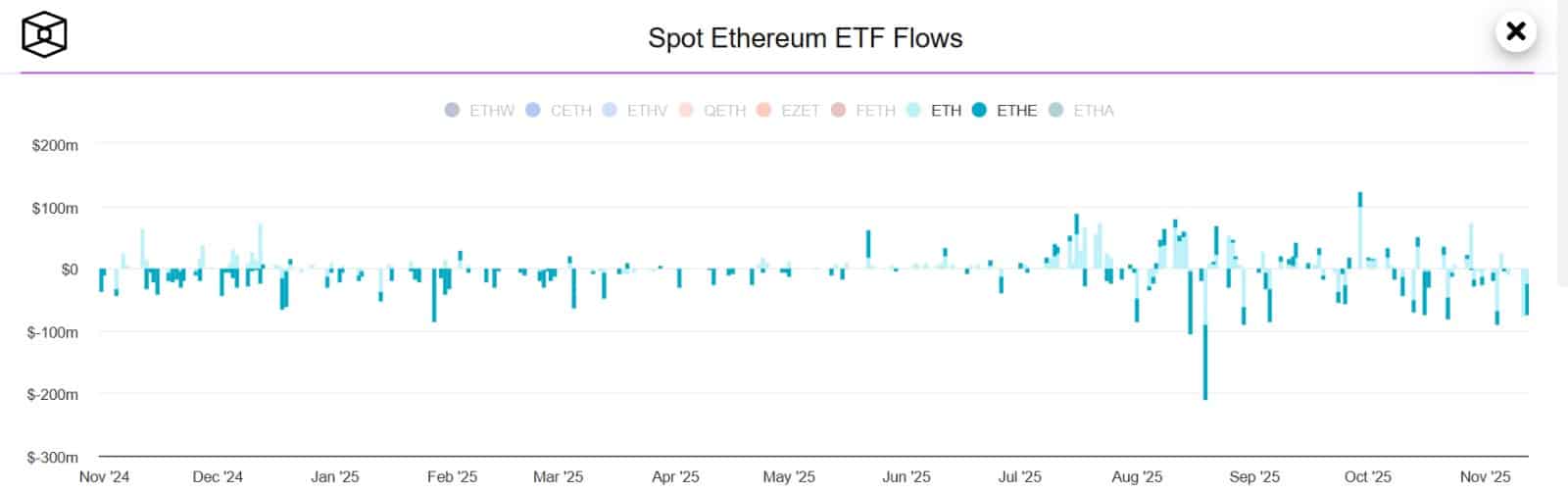

As such, both Grayscale’s Bitcoin and Ethereum ETFs have faced massive outflows over the past year. In 2025 alone, GBTs recorded $3.3 billion in outflows, while ETHE recorded $1.2 billion, bringing the total ETF outflows to $4.5 billion.

Source: TheBlock

Recent data shows that GBTC posted net outflows of $23 million, with consistent negative flows throughout November.

Meanwhile, ETHE recorded $75 million in daily net outflows and has seen negative flows for 18 straight days. Similarly, ETH has experienced continuous net outflows since the 5th of November.

Source: TheBlock

In contrast to the outflows from ETHE and GBTC, Grayscale’s Ethereum Mini Trust and Bitcoin Mini Trust ETFs have attracted $3.3 billion in cumulative inflows.

This shift highlights growing competition in the ETF space and mounting pressure on Grayscale’s flagship funds.

Therefore, Grayscale’s move to go public not only aims to increase its revenue but also to hedge against ETF dependency.

In doing so, the firm will raise significant capital, which in turn could be used in diversification, further helping boost the firm’s financial performance.

Source: https://ambcrypto.com/heres-why-grayscale-wants-to-go-public-despite-4-5b-in-etf-outflows/