Key Takeaways

How does the new Visa Direct pilot work?

Businesses can fund payouts in fiat currency, while recipients can choose to receive them in USD-backed stablecoins like USDC.

Who benefits from this new system?

Creators, freelancers, and global marketplaces benefit from faster, borderless, and more stable payments, especially in underbanked regions.

Visa Inc. has unveiled a new pilot program enabling businesses to send payouts directly to recipients’ stablecoin wallets.

Visa’s stablecoin bet

Announced at the Web Summit, the initiative leverages Visa Direct to allow companies to fund payouts in fiat currency, while recipients can pick to receive them in USD-backed stablecoins like USDC.

This marks a significant innovation in global payments, offering creators, freelancers, and marketplaces a faster, more stable, and borderless way to access funds, particularly in regions struggling with currency volatility or limited banking access.

Chris Newkirk, President, Commercial & Money Movement Solutions, Visa, said,

“Launching stablecoin payouts is about enabling truly universal access to money in minutes – not days – for anyone, anywhere in the world.”

Newkirk added,

“Whether it’s a creator building a digital brand, a business reaching new global markets, or a freelancer working across borders, everyone benefits from faster, more flexible money movement.”

Are people actually ready for this?

According to Visa’s 2025 Creator Economy Report, demand for faster access to funds is a key trend in the digital economy.

The report found that 57% of content creators prefer digital and blockchain-based payment methods because they provide instant access to payments.

With the rise of independent creators, freelancers, and global marketplaces, Visa’s stablecoin payout pilot aims to meet the need for speed, flexibility, and financial independence.

Building on its earlier initiatives, Visa is expanding its stablecoin-powered payment ecosystem through Visa Direct.

At SIBOS 2025, the company introduced a pilot allowing businesses to pre-fund payouts using stablecoins, enabling seamless and near-instant transfers worldwide.

Together, these pilots mark a significant evolution in Visa’s mission to modernize payments, giving consumers and businesses more control, transparency, and choice in how they send and receive money.

Why USDC and not USDT?

Initially, Visa will partner with select companies and expand in late 2026. This aligns with growing client demand and clearer regulations.

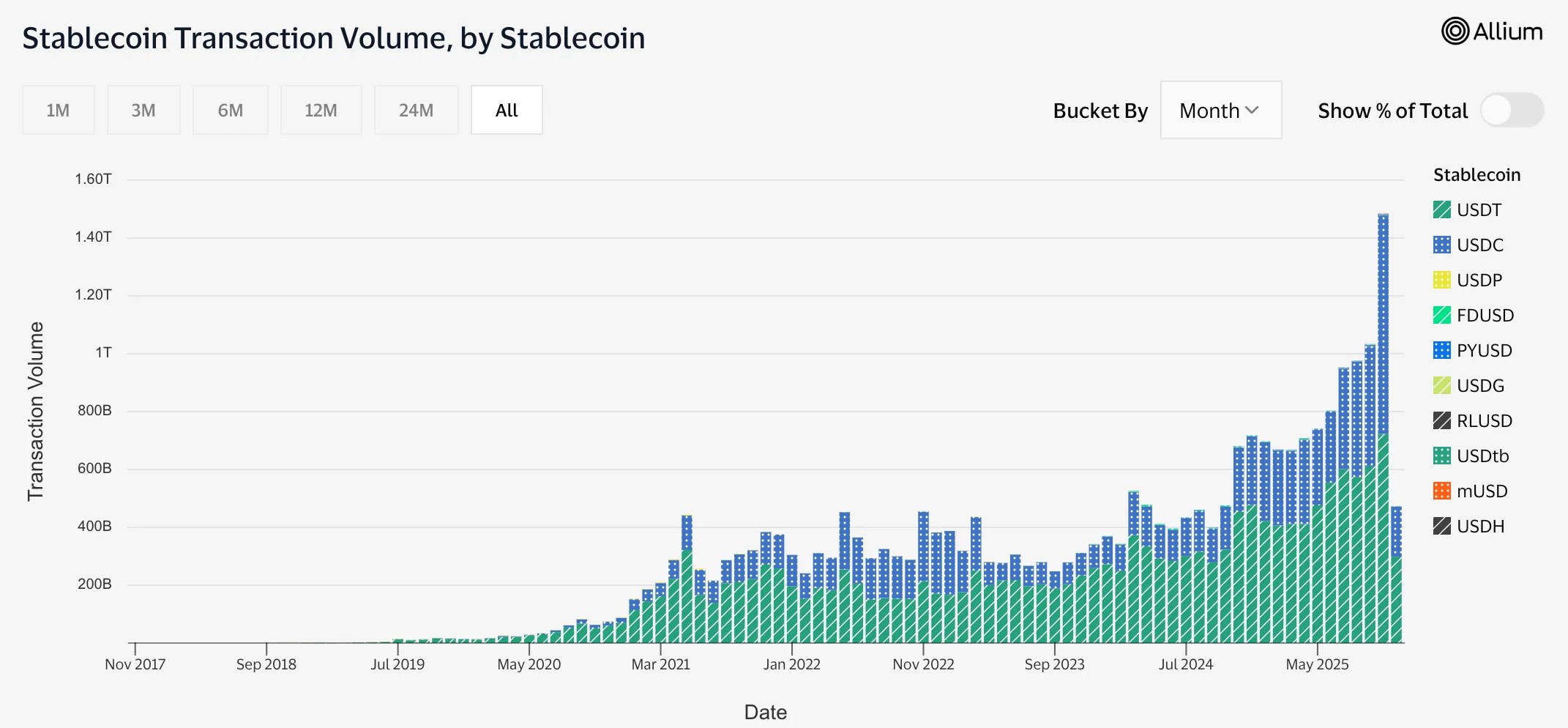

Notably, USD Coin (USDC) is gaining traction in the stablecoin market. Data showed USDC briefly surpassed Tether (USDT) in transaction volume in October.

Source: Visa on-chain analytics

However, as of November, USDT has regained the top spot, with USDC holding a strong second position, reflecting a dynamic and competitive stablecoin landscape.

Source: https://ambcrypto.com/visa-launches-stablecoin-payouts-what-it-means-for-the-creator-economy/