- Circle introduces StableFX and a multi-currency stablecoin program on Arc blockchain.

- Enhances 24/7 on-chain forex and stablecoin settlements.

- Launch involves partnerships with regional stablecoin issuers from several countries.

Circle announced the launch of its StableFX on-chain forex engine and a multi-currency stablecoin partnership program on the Arc blockchain, partnering with global institutions, expected to launch fully in 2026.

This development signifies a major shift in forex and stablecoin markets, enabling real-time, compliance-focused settlement solutions, and involving key financial institutions globally.

StableFX Launch: Global Partnerships and Settlement Innovations

Circle has joined with various regional stablecoin issuers from countries such as Brazil, Australia, and Japan. The StableFX engine offers a solution for multi-currency transactions and atomic settlements using stablecoins, aiming to streamline processes traditionally mired in complexities. According to the Coincu research team, Arc’s deployment could yield advanced financial outcomes like streamlined funding and multi-currency payouts.

The original purpose is to foster innovation within compliant institutions, facilitating faster and more seamless transactions 24/7. This technology could redefine forex operations by removing barriers associated with traditional counterparties and clearing processes.

Industry leaders have expressed optimistic views on this development. Raj Dhamodharan of Mastercard stated,

“Circle’s launch of Arc is a meaningful step toward advancing programmable money and digital financial infrastructure. Deepening our longstanding work with Circle as an early design partner, Mastercard is exploring how we can help shape Arc’s foundation to enable secure, simple payment experiences across both fiat and stablecoin rails.”

Circle’s Arc Blockchain: A Catalyst for Financial Evolution

Did you know? Circle’s latest endeavor mirrors past advancements like USDC’s launch, which significantly boosted on-chain settlement utility for institutions, setting a precedent for stablecoin-based infrastructure.

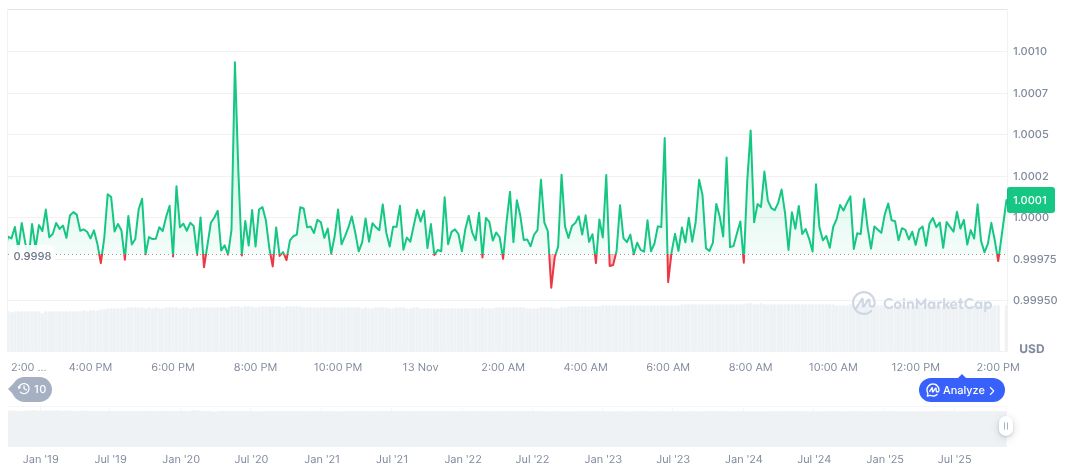

The USDC currently maintains a market cap of 76,003,983,875.00 and accounts for 2.20% of market dominance as of November 13, 2025. This stablecoin’s price stability remains intact over 24 hours. However, a 1.01% decline occurs over 30 days, while a 1.84% increase is noted over 60 days, as per CoinMarketCap analytics.

For further details on Circle’s partnerships, explore Circle’s partnerships for stablecoins and their impact.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/circle-stablefx-arc-blockchain/