- JPMorgan Chase launches USD deposit token via blockchain for institutional clients.

- Innovative solution enables 24/7 instant settlement.

- Pilot included Mastercard and Coinbase participation.

JPMorgan Chase has launched JPM Coin, a USD deposit token, for its institutional clients via the Base blockchain, enhancing payment efficiency by enabling 24/7 transactions.

JPM Coin’s launch signifies a pivotal shift in digital finance, facilitating real-time settlements and broadening blockchain adoption across institutional finance.

JPM Coin’s 24/7 Service on Base Blockchain Unveiled

JPMorgan Chase has introduced JPM Coin for institutional clients, leveraging the Base blockchain for 24/7 payments. Naveen Mallela, Kinexys’ global co-head, emphasized that JPM Coin supports direct and instant US dollar transactions. Mastercard and Coinbase participated in initial trials, indicating market interest.

Industry observers note the strategic timing of JPMorgan’s expansion into digital assets. Larger financial networks could see a broader shift as other institutions evaluate inclusion in similar implementations. Noteworthy market players closely observe developments.

Working with DBS on this initiative is a clear example of how financial institutions can collaborate to further the benefits of tokenised deposits for institutional clients while protecting the singleness of money and ensuring interoperability across markets. — Naveen Mallela, Global Co-Head, Kinexys, JPMorgan

Blockchain Adoption in Finance Spurs Strategic Innovation

Did you know? JPMorgan’s plan to expand JPM Coin into a euro-denominated token aligns with similar precedents by major banks adopting blockchain.

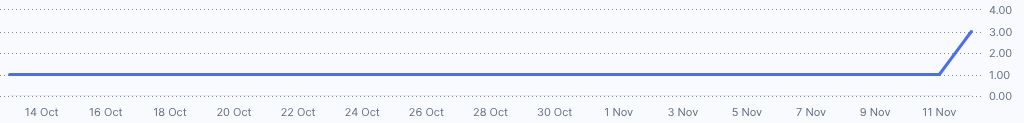

As of November 12, 2025, CoinMarketCap reports JPMD’s data reflect largely inactive trading, with no significant price movements over several time frames. Notable figures: $0 price, $0 market cap, 0% 24-hour change. This absence of volatility suggests a gradual roll-out.

Coincu analysts highlight JPMorgan’s strategic shift in utilizing blockchain for real-time settlement, attracting institutional clients looking for swifter transaction methods. As technology and regulations evolve, more banks may follow suit, bolstering the financial sector’s blockchain integration.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/jpmorgan-digital-deposit-token-launch/