Takeaways:

- A bipartisan Senate draft pairs with the CLARITY Act to sketch CFTC-led spot oversight and cleaner SEC lanes, bullish for risk appetite.

- Bitcoin Hyper targets Solana-grade throughput on a $BTC-anchored Layer-2, aligning with where on-chain activity is migrating.

- The $HYPER presale has already raised over $26.8M and offers staking rates of 43% APY.

Crypto has received another major policy boost from Washington. The US Senate Agriculture, Nutrition, and Forestry Committee has introduced a bipartisan plan to create clear-cut rules for the digital-asset market.

The plan’s goal is simple: define what a commodity is, what a security is, and who regulates what.

- The CFTC (Commodity Futures Trading Commission) would oversee spot digital-commodity markets (like Bitcoin).

- The SEC (Securities and Exchange Commission) would handle investment-contract tokens (securities).

This kind of clarity is huge. It means cheaper compliance and less headline risk, which is exactly what altcoins and presales crave.

The proposal, led by Committee Chair John Boozman and Senator Cory Booker, also explicitly protects self-custody rights, a concrete nod to how crypto is actually used. It’s not law yet, but markets usually price in the direction of travel, and this direction is clear: less ambiguity means faster return of liquidity.

This Senate draft doesn’t stand alone either; it follows other wins like House action on crypto bills such as the CLARITY Act. This mosaic suggests a policy pivot from improvisation to frameworks, and that lowers the bar for risk-taking.

Bitcoin Hyper ($HYPER) — $BTC Security Meets SVM Speed at the Execution Layer

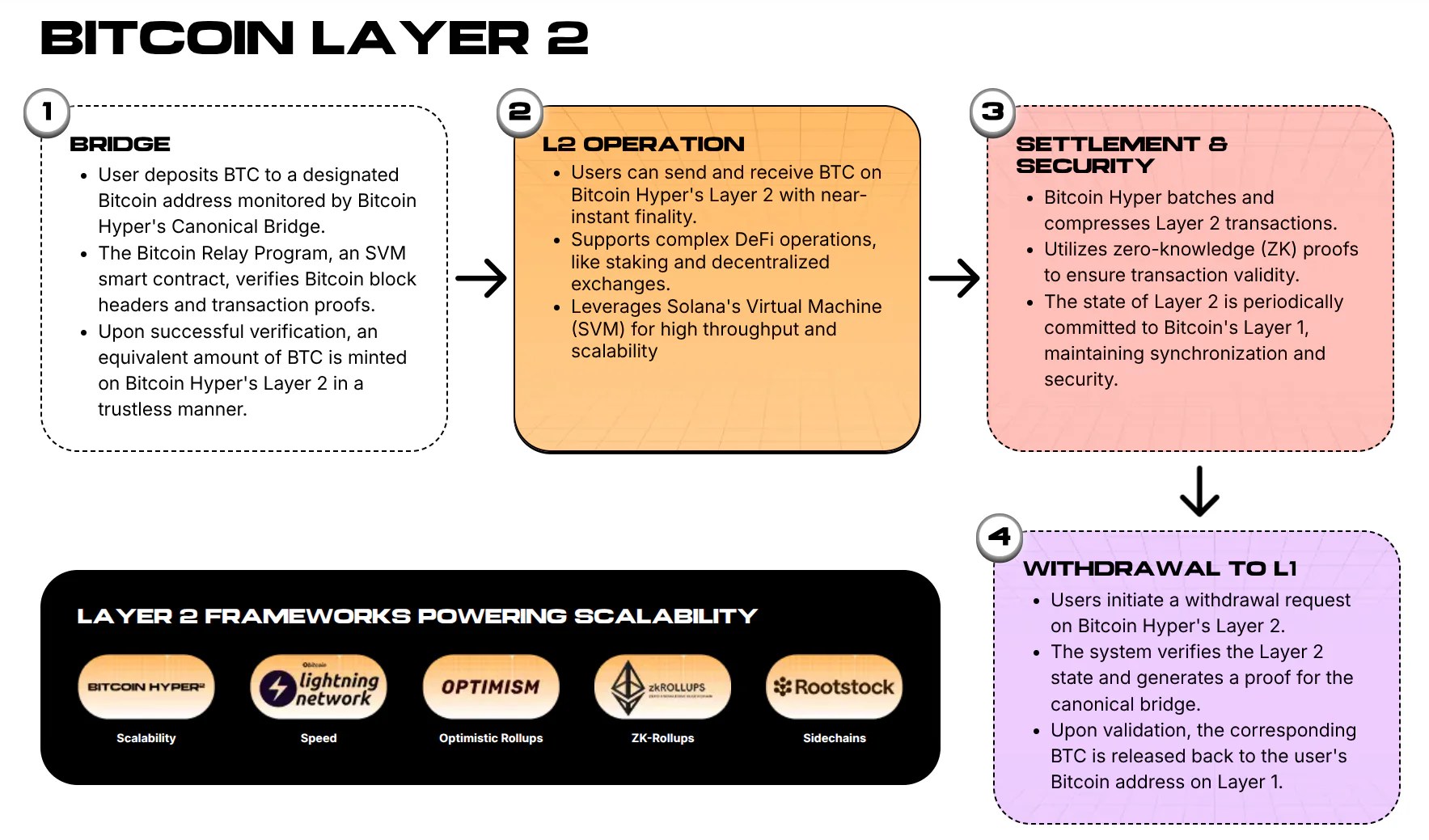

Bitcoin Hyper ($HYPER) is a $BTC-aligned Layer-2 (L2) network built for Solana-style speed.

The elevator pitch is crisp: pair Bitcoin’s world-class settlement security with a high-throughput execution environment. This finally lets $BTC power payments, perps, and DeFi at a massive scale.

- Speed: It will integrate the Solana Virtual Machine (SVM) to target sub-second finality and minimal fees, leapfrogging the slow speeds of the base Bitcoin chain.

- Security: The L2 will batch transactions and anchor its state to the Bitcoin Layer-1, meaning the speed will be Solana-like, but the final, undeniable security will be Bitcoin’s.

- Developer Funnel: Using the SVM is a smart play, as it allows existing Solana teams to port their code with fewer rewrites, giving $BTC the user experience it has lacked.

The key to all of this is the Canonical Bridge. The one true way to secure and wrap your original $BTC, and then create a 1:1 token for use on the Hyper’s Layer-2.

If the US Senate’s framework advances and removes jurisdictional fog, the venues building on top of credible L2s like $HYPER stand to benefit first.

The $HYPER Presale: Fixed Pricing, Bootstrapping Yields, and a Clear Late-Stage Tape

Bitcoin Hyper ($HYPER) is already deep into its presale and has demonstrated serious traction, raising over $26.8M, and attracting 15.6K followers on X and 6.6K on Telegram.

During the project’s bootstrapping phase, the staking APY is currently running at 43%, which, while designed as an attractive early-stage incentive, will compress over time. Meaning you need to get in early to receive higher rewards. Get in on the upgrade of the century and buy your $HYPER at today’s price $0.013255. But you’ll need to hurry, as a price increase is around the corner.

The actual thesis isn’t the yield, however; it’s the potential for a $BTC-anchored execution layer to siphon activity when Bitcoin’s narrative shifts from ‘store of value’ to ‘spendable, programmable collateral.’ Projects positioned at that intersection of performance and compliance-readiness tend to get the first look from both builders and larger wallets.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

Source: https://coindoo.com/senate-clarity-act-framework-boost-crypto-bitcoin-hyper-presale/