- Uniswap introduces fee switch, eliminating fraudulent pools and boosting UNI.

- Major governance decision; UNI surges over 38%.

- Uniswap targets improved market integrity through governance shifts.

Uniswap initiated its protocol fee switch on November 9, 2025, targeting fraudulent pools on the Base chain, led by Hayden Adams and Devin Walsh.

The move to activate fees aims to enhance market integrity, affecting nearly $208.07 billion in volume by eliminating almost half attributed to fraudulent activity.

Uniswap Targets Market Integrity with Fee Switch Activation

Uniswap Labs and the Uniswap Foundation have activated a protocol fee switch through governance votes as of November 9, 2025. This decision targets fraudulent pools and aligns with UNI burn mechanisms. Market integrity implications for Uniswap as half of its Base chain volume is affected.

Market reactions are generally positive. Uniswap’s official statement underlines the protocol’s strategic positioning to become the default decentralized exchange. Although key figures have not publicly reacted, community sentiment is bullish. The introduction of a “Growth Budget” and significant UNI burns contribute to this positive outlook, enhancing the governance model.

“Uniswap Labs and the Uniswap Foundation are excited to make a joint governance proposal that turns on protocol fees and aligns incentives across the Uniswap ecosystem, positioning the Uniswap protocol to win as the default decentralized exchange for tokenized value.” — Hayden Adams, Founder, Uniswap Labs

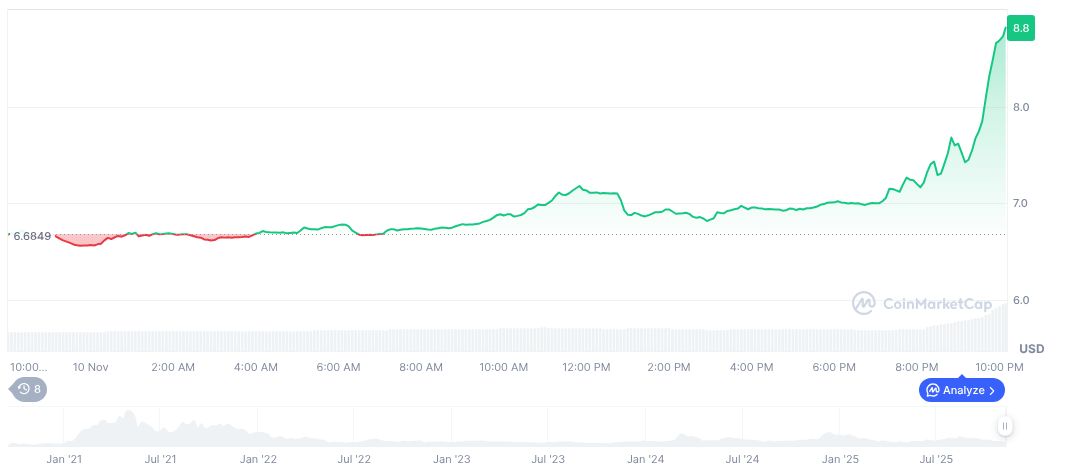

UNI Price Surge Reflects Positive Sentiment Amid Protocol Changes

Did you know? In 2025, Uniswap’s Base volume faced major scrutiny, revealing only $77.38 billion of legitimate activity versus an inflated $208.07 billion estimate, highlighting the critical need for this fee switch to improve market honesty.

As of November 11, 2025, Uniswap’s current price stands at $9.08 with a market cap of $5.72 billion according to CoinMarketCap. UNI price has seen significant changes, up 35.52% over 24 hours and 72.93% across the week, reflecting positive market sentiment amidst protocol changes.

Coincu insights suggest that Uniswap’s strategic moves can lead to more robust financial and technological outcomes in DeFi. Reducing fraudulent activities ensures better liquidity, potentially attracting institutional interest, although ongoing regulatory scrutiny remains a concern. The protocol’s adjustments indicate a stronger foundation for responsible trading within the ecosystem.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/uniswap-fee-switch-uni-jumps/