- Key Point 1

- Key Point 2

- Key Point 3

Reports suggest the U.S. Treasury is advancing new tax regulations for cryptocurrency and other sectors despite lacking official confirmation on November 9, 2025.

This news highlights potential shifts in tax policy that could impact cryptocurrency markets and foreign investment dynamics amidst unclear government confirmation.

Scrutiny Intensifies Amid Claims of Treasury Overreach

The alleged tax proposals reportedly offer financial advantages to private equity and cryptocurrency firms, potentially reshaping industry dynamics. However, no official government sources have substantiated these reports.

The New York Times cites claims that the U.S. Treasury proposes unexplained tax benefits for cryptocurrency entities. Reports describe IRS proposals made in August for multinational corporate tax relaxations, yet no official confirmation or detailed announcements accompany them. Overview of Tax Regulatory Process by the Treasury.

The most recent official reports from the U.S. Treasury and IRS concern specific administrative topics rather than the claims cited by PANews and The New York Times, it was noted, highlighting the absence of confirmed statements regarding these proposals.

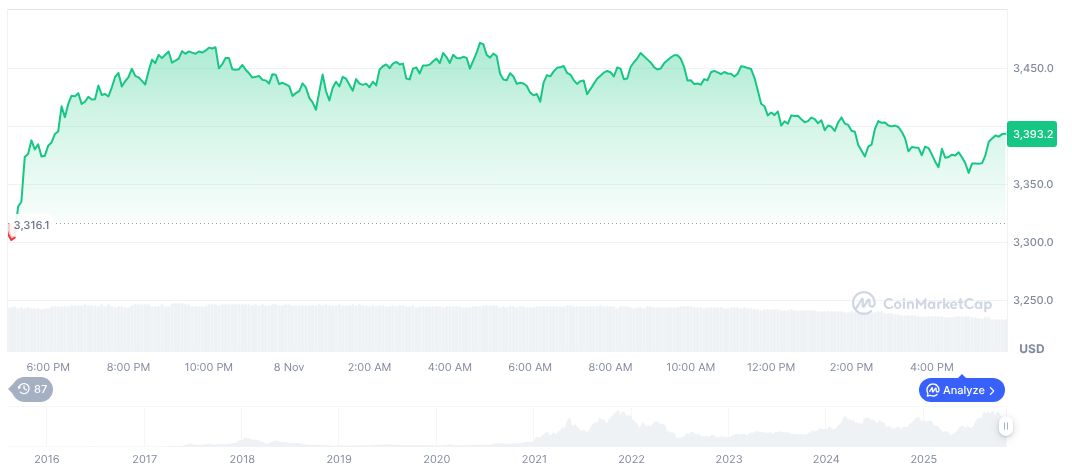

Current Market Implications

Did you know? The U.S. Treasury has historically played a significant role in shaping tax policy, often facing scrutiny for its decisions.

Current updates can be found in the IRS Newsroom: Current Month’s News Releases.

Accounting firms and consultants are reportedly keen on analyzing these proposals, yet their credibility is questioned due to the absence of solid evidence. The lack of endorsement from Treasury or IRS officials leaves markets uncertain about the true scope and effect of these policies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |